Hong Kong looking into tax deduction for renters, finance chief reveals on post-budget radio show

Measure not included in 2018-2019 blueprint as it requires computer system update, Financial Secretary Paul Chan says

Hong Kong residential tenants hoping for rental rebates missed out on a new tax deduction in this year’s budget because there was no time to upgrade the government’s computer system, Financial Secretary Paul Chan Mo-po revealed on Thursday.

But he said the option, which would be a significant relief measure, was still under consideration.

“We have to change the computer system of the Inland Revenue Department. We also need to consider other details of implementation.”

Chan would not disclose the potential scale of the deduction but stressed that the government had acknowledged the heavy pressure many faced from rising rents.

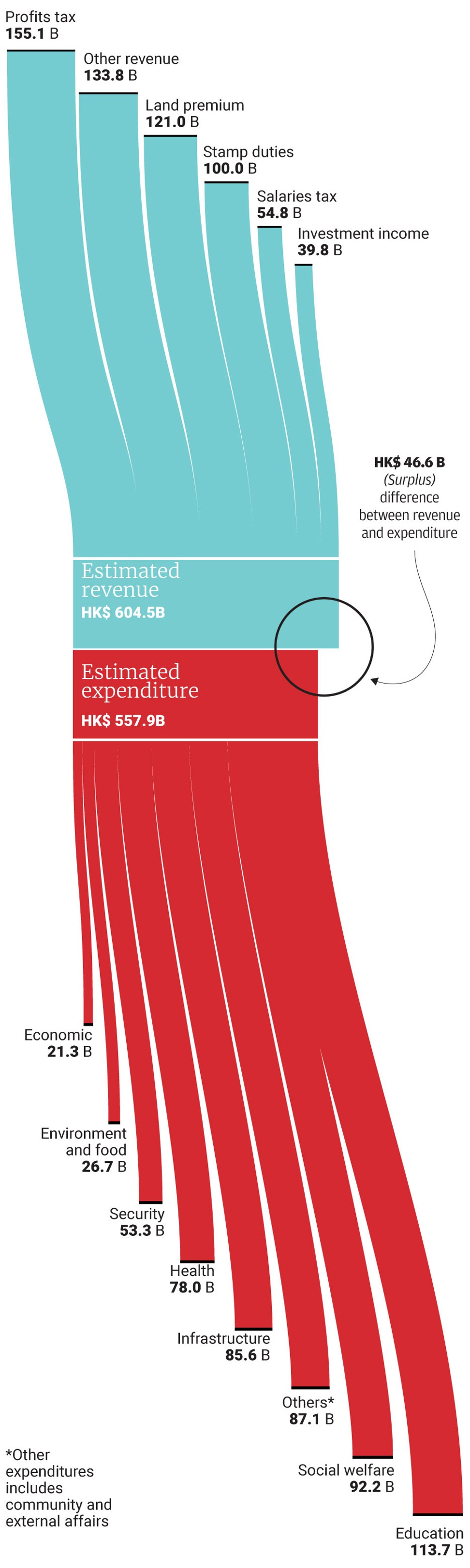

Six key Hong Kong budget takeaways you need to know: spend, spend, spend on the future

As of last December, the average rent for a private flat sized between 430 sq ft and 753 sq ft was HK$38 per square foot on Hong Kong Island, HK$33 in Kowloon and HK$24 in the New Territories, the highest since the last quarter of 2016, according to the Rating and Valuation Department.

Both profits tax and salary tax for 2017-18 will be reduced by 75 per cent, subject to a ceiling of HK$30,000. The deductions will benefit 1.88 million taxpayers and reduce tax revenue by HK$22.6 billion (US$2.9 billion).

The finance chief also widened the tax bands for the city’s salary tax from HK$45,000 to HK$50,000, increasing the number of bands from four to five.

Tax allowances for raising children and parental maintenance were increased, a move that will benefit 942,000 taxpayers and reduce tax revenue by HK$1.89 billion.

Despite the tax sweeteners, members of the public who called in during the radio show raised concerns over domestic tenants not benefiting from the tax cuts.

This came as a University of Hong Kong poll showed the dissatisfaction rate with the budget reached 41 per cent – the highest in the past four years.

One caller told Chan that the government should intervene in the market and cap rents. Chan said the government had decided against a rental ceiling because “local and foreign experiences we studied showed that rent control might not bring the best results to the market”.

Rental tax deductions might not benefit most of the “sandwich class” – those not poor enough to apply for public housing but not rich enough to buy their own homes – and could in the long run push rents to higher levels, property industry insiders and lawmakers said in response to Chan’s remarks.

“Two out of three working people in Hong Kong are not taxpayers because they earn too little – how can they be helped if rental subsidy is done through tax rebates?” Labour Party lawmaker Fernando Cheung Chiu-hung said.

Cheung, the social welfare legislator, noted that in some other countries, rental subsidies were deposited directly into citizens’ accounts by the tax authority.

Louis Chan Wing-kit, Asia-Pacific vice-chairman and residential division chief executive at Centaline Property Agency, said rental tax deductions might help relieve the burden on tenants in the short term, but “in three to four years, the rents would eventually rise to a higher level along with the increasing demand and the general property market”.

Cheung suggested the government should intervene in the leasing market through measures such as rent and utility fee caps as well as restrictions on forced removal, as “rent and property prices have gone far beyond people’s affordability and the market needs to be adjusted”.

But Chan dismissed the idea, calling rent control an “outdated regulation that can favour the tenants too much”.

How the Hong Kong budget affects you

Both Cheung and Chan suggested that Chief Executive Carrie Lam Cheng Yuet-ngor realise her campaign pledge to allow buyers of Home Ownership Scheme (HOS) flats to work with social enterprises to let their properties to increase the liquidity of the HOS rental market.

“However, we will have to study further how to properly price the rentals of these HOS units so that the owners will not be allowed to buy the flats with discounts and lease them out at market rates,” Cheung added.

The financial secretary also came under pressure at a Legislative Council Finance Committee meeting as lawmakers from across the political divide urged him to do more for the underprivileged who would not benefit from all the tax breaks.

Starry Lee Wai-king, chairwoman of the largest pro-establishment party, the Democratic Alliance for the Betterment and Progress of Hong Kong, said: “I can’t agree with you that the budget has shared with the citizens evenly … As the government has the ability, can we do more?”

Lee said many disappointed residents, including retired couples and families living in public housing, had complained to her that they would not benefit from the budget.

More than HK$50 billion will be shared with at least 2 million Hongkongers – mostly through targeted tax breaks, rate waivers and beefed-up allowances, HK$7 billion of it being dished out to the poor through an extra two months of Comprehensive Social Security Assistance, Old Age Allowance or Disability Allowance.

However, lawmakers criticised Paul Chan for the uneven distribution of the sweeteners, saying he had abandoned people who fell between the cracks as they were neither taxpayers nor receiving allowances.

“Some consortiums can save up to HK$900 million because of the rates waiver. Yet, around 1 million workers are being abandoned,” Democratic Party lawmaker James To Kun-sun said, warning that it would lead to social chaos.

But rejecting the criticism, Chan said the budget was well balanced. “Although not everyone is satisfied, we have done our best,” he told lawmakers, adding that many things had already been done for the city’s less well off.

Additional reporting by Kimmy Chung