China’s slowdown is not looking good. The

trade war with America is dragging on exports, new investment intentions remain sluggish and consumer demand is looking more lacklustre. Beijing has its work cut out breathing new life back into the flagging economy. Unless there is a breakthrough in the

trade dispute pretty soon, Beijing will have to stump up much more monetary and fiscal stimulus to speed things along. With the global picture looking shakier, China must stay focused on domestic reflation to prevent

a deeper slowdown next year.

China’s economy is definitely losing momentum.

Gross domestic product growth should hit Beijing’s target of

around 6.5 per cent for this year, but what happens next is critical given the growing global gloom. Consensus forecasts show economists looking for a further mild deceleration, to 6.3 per cent expansion next year, well down on what China has been used to in the past, but with rising risks the outcome could be much worse. The trade dispute with the

United States is taking its toll and Beijing needs some answers pretty quick.

Pessimists say growth could even be closer to 5 per cent next year if the government is not careful. The solutions are clear. Either Beijing buries the hatchet with Washington and fast-tracks its way to a compromise in the trade war, or refocuses its energies on ramping up home demand. This means massive fiscal regeneration, cranking up deficit spending on key

infrastructure projects and pump-priming consumer confidence so China’s households feel much more encouraged to go out and spend. Reinforcing consumer demand could be the quicker, more effective route short-term.

Just like in the US, the consumer has become the backbone of China’s economy, accounting for up to two-thirds of GDP growth. But China’s consumers are being hamstrung by flagging confidence, a less robust

housing market, falling

stock market prices,

soft car sales, indifferent employment conditions and an extremely weak

yuan. The growing uncertainty has hit retail spending sentiment pretty hard as consumers have fretted about the weaker economic picture.

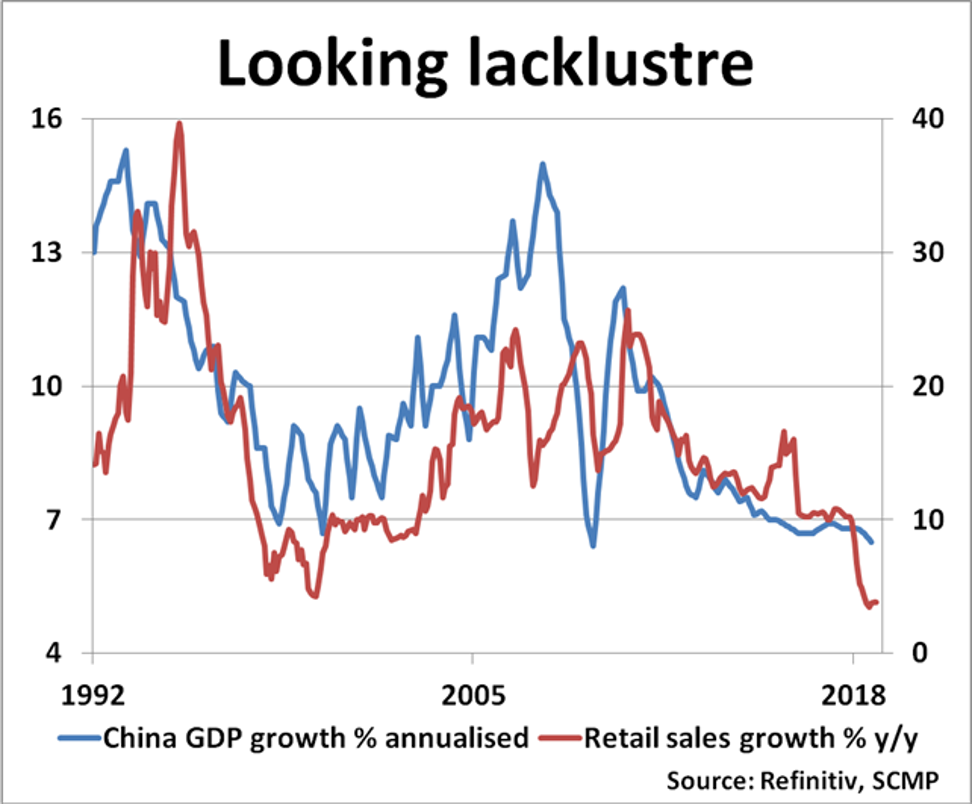

What is worrying is that the downturn in consumer demand is setting the trend to a weaker growth path across the whole economy. According to the National Bureau of Statistics, recent underlying retail sales growth has slowed dramatically to around 4 per cent, well down from levels running upwards of 20 per cent as recently as 2011. Beijing has an uphill struggle on its hands and must intervene soon to stop the rot.

This last year, US consumers enjoyed a huge fiscal boost from tax cuts, with booming job prospects and consumer confidence on the up. US consumers have also had the added advantage of easy access to cheap credit to help underpin demand. The contrast with China could hardly be more marked, where tax cuts have

done little so far,

interest rates are close to bottoming out and the authorities are trying to rein in disorderly credit expansion.

Looking ahead, Beijing has to strike the right policy balance. Cutting too loose at this stage would smack of panic, the last thing China’s stock markets need to see right now. But if it is left to tinkering at the margin with minimal fiscal and monetary measures, the economy will underperform and stock market confidence will tank. Beijing is stuck between a rock and a hard place.

If Beijing can hit consumers’ sweet spot with the right mix of tax cuts, spending incentives and easy credit, the government has a much better chance of saving GDP growth from sliding towards the 5 per cent mark over the next year. China needs a quick-acting Goldilocks solution in which future economic stimulus is neither running too hot nor too cold. Beijing’s conundrum is that there is no easy fix.

It’s the reason why China’s authorities are probably pinning their hopes on an early breakthrough on trade. Would a querulous US President

Donald Trump come to Beijing’s rescue in time? It’s probably not advisable to hold your breath too long on that score. There is no alternative – Beijing must reflate now or else suffer the consequences of a deeper growth slump ahead.

David Brown is the chief executive of New View Economics

This article appeared in the South China Morning Post print edition as: Consumers need confidence as US-China trade war rages