Paris, Madrid, Berlin property markets expected to see conga line of foreign investors in 2019 amid curbs elsewhere

- Wealthy individuals will respond to curbs by turning to other markets to snap up property, says Knight Frank analyst

- Property prices could grow by 5 per cent to 10 per cent in Paris, Madrid and Berlin, analyst says

Paris, Madrid and Berlin are the next hotspots for property investors, benefiting from curbs on foreign buying elsewhere and a frisky run-up in home values expected next year, according to an analyst at real-estate consultant Knight Frank.

“There are no cooling measures in [continental] Europe,” said Liam Bailey, global head of research at Knight Frank. “We are expecting in places like Paris, Madrid, and Berlin a price growth of between five and 10 per cent next year.”

These cities are experiencing strong economic growth, healthy tenant demand and relative good value, while offering an attractive lifestyle environment, he explained.

These markets are rebounding after “being strongly hit by the financial crises” and their economies are doing relatively well, he added.

Meanwhile, restrictions on foreign buying in markets traditionally popular with foreign investors – such as New Zealand, and Toronto and Vancouver in Canada – are likely to remain in the foreseeable future. That means other spots will be seen as more favourable investment bets.

“Ultimately, it does not curtail demand. Wealthy or affluent individuals want to invest globally. They want to have diversification of their portfolio,” Bailey said.

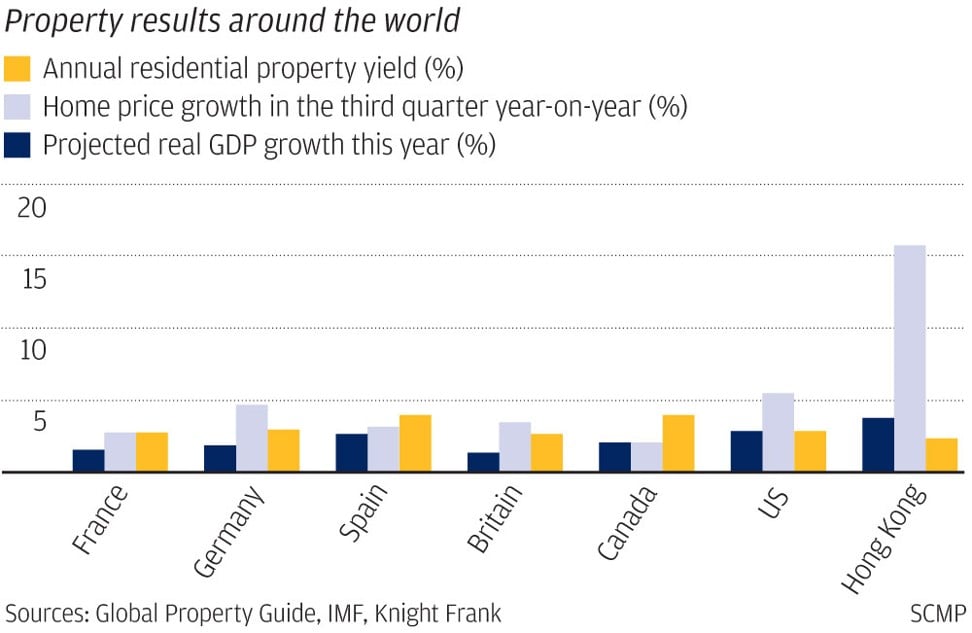

Meanwhile, some property markets that have seen big returns on investments, such as Hong Kong, are seeing prices fall.

Chinese property investors have been cited as one of the key drivers of the real estate bull run in many cities around the world. But there are questions about what’s next for this influential group of property investors.

Tom Moffat, executive managing director of capital markets at CBRE Asia, said that while Chinese investors were on a big shopping spree in the past few years, outbound activity has moderated this year.

“While interest in outbound investments still exists from many of the Chinese groups, capital controls have restricted activity, and there are no signs that these will be relaxed in the near future,” Moffat said. “We have also seen some Chinese investors selectively selling assets, though mostly in a very controlled way.”

Mainland China’s outbound real estate investment in the first six months of this year plunged by 37 per cent to US$9.9 billion, its lowest level since 2015, according to Real Capital Analytics and Cushman & Wakefield. In 2017, mainland investors deployed US$42.2 billion overseas, an increase of 10.3 per cent over 2016, despite government scrutiny and capital controls. Outbound property investment has been falling since mid-2017, but the fall intensified thanks this year due to domestic financial tightening, analysts said.

Moffat noted that other Asian investors are filling the void.

“Singaporean and Korean investors are still actively investing in the United States and Europe,” Moffat said. “While Japanese investors are investing overseas through co-mingled funds. Currency movements and hedging costs have played a bit part in which markets are most attractive.”

Concerns that foreign buyers have driven up local home prices, making home ownership beyond the reach of people in their own hometowns, has sparked a raft of curbs.

In Late September, British Prime Minister Theresa May announced her Cabinet was looking at imposing a 1 to 3 per cent tax on foreign homebuyers.

Vancouver boosted its levy on foreign homebuyers to 20 per cent in February from the 15 per cent that took effect in August 2016. Toronto and its surrounding area imposed a 15 per cent tax on foreign property investors in April 2017.

“I think we're in a world where there is more mobility of capital and there are more wealthy people,” said Bailey of Knight Frank. “And there is more money to invest and there is more desire for international purchases.”