Hongkongers’ MPF funds should not be used to buy property, says OECD pensions chief

-

Singaporeans can use their pension pots to buy homes, but Pablo Antolin says Hong Kong’s MPF cannot afford such withdrawals, given the current contribution rates

-

Head of OECD’s private pensions unit is in Hong Kong along with hundreds of pension experts to give suggestions on how to improve city’s public pension provisions

Hong Kong should follow Singapore and other markets in allowing people to pay more into their Mandatory Provident Funds (MPF).

But it should not allow employees to take money out their pension pools to buy their own homes, according to an Organisation for Economic Co-operation and Development (OECD) pension expert.

Pablo Antolin, principal economic and head of OECD Private Pension Unit, said if Hongkongers were allowed to withdraw money from the pension system as initial down payments on first homes or for their children’s education, it would further reduce the scheme’s ability to cover future liabilities, given it’s already among the lowest worldwide.

“Money in a retirement plan should be used for retirement only,” he said in Hong Kong on Tuesday, adding the OECD does support withdrawals for those suffering serious illness or bankruptcy.

Hong Kong’s Mandatory Provident Fund Schemes Authority revealed earlier this year it had been assessing whether to allow first-time buyers to use their accrued funds as down payment – as Singapore already does. But it scrapped the plan in May because of worries that would only fuel the red hot property market further.

Antolin is in Hong Kong along with hundreds of pension experts to give suggestions on how to improve local pension provisions.

Elvin Yu, a principal at pension consultancy Goji Consulting, also advocates no withdrawals for housing purposes.

“The MPF itself is already inadequate for retirement saving. Singapore can allow employees to take money out of the CPF to buy property, due its much higher contribution rate,” he said.

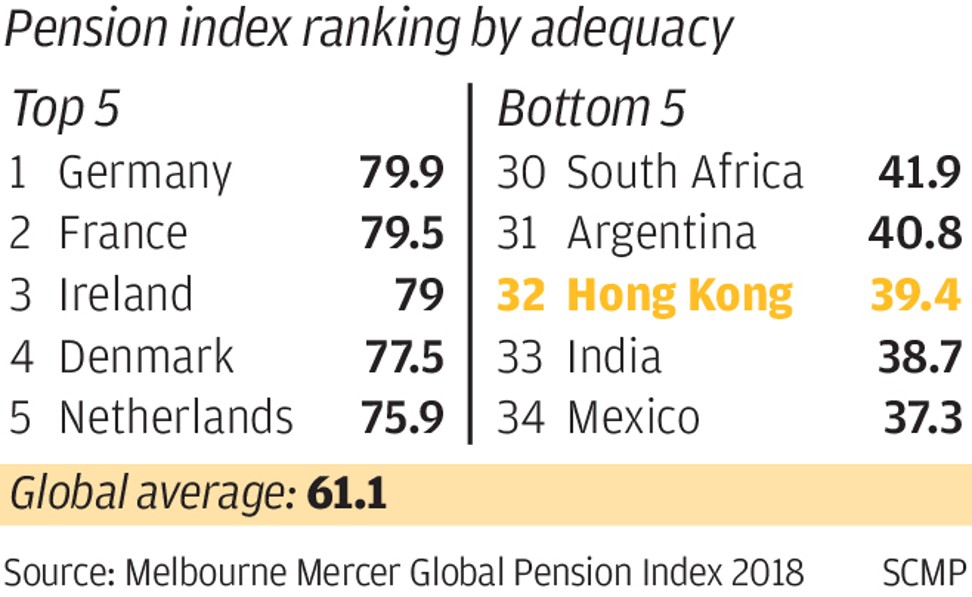

Hong Kong is now in the world's bottom three in terms of pension adequacy for its population, ahead only of India and Mexico, according to 2018 Melbourne Mercer Global Pension Index released last week.

The MPF is compulsory for 2.8 million Hongkongers and their employers to contribute 5 per cent of monthly salaries, capped at a combined HK$3,000 (US$382).

Antolin said that’s far lower than Asian neighbour Singapore’s Central Provident Fund (CPF) where both contribute a combined 37 per cent of salary without a cap.

In The Netherlands and Denmark too, for instance, staff contribute 18-20 per cent of salaries into their schemes, which were recently ranked top in terms of adequacy, according to Mercer.

“With the MPF only contributing 10 per cent of staff salaries with a cap, you cannot expect the savings to be as high,” Antolin said. “To improve the situation, Hong Kong should increase contributions over a longer period of time.”

Antolin also said Hong Kong should consider allowing retirees to buy annuity products, which provide lifelong monthly payments, with part of their pensions pots.

“An annuity scheme would hedge longevity risks if an employee lives up to 100 years, or older,” he said.

Goji Yu said increased contributions would, however, face a lot of opposition.

“A more feasible way is to remove or lessen the HK$3,000 contribution cap, to allow those who earn more to contribute more,” Yu said.