October stock market slump puts Hong Kong’s MPF on track for worst year since 2011

- In October alone, the 430 MPF investment funds lost an average of 5.63 per cent, the worst monthly return since August 2015

The Mandatory Provident Fund, the retirement scheme that covers 2.8 million people in Hong Kong, is on track to report its worst year since 2011.

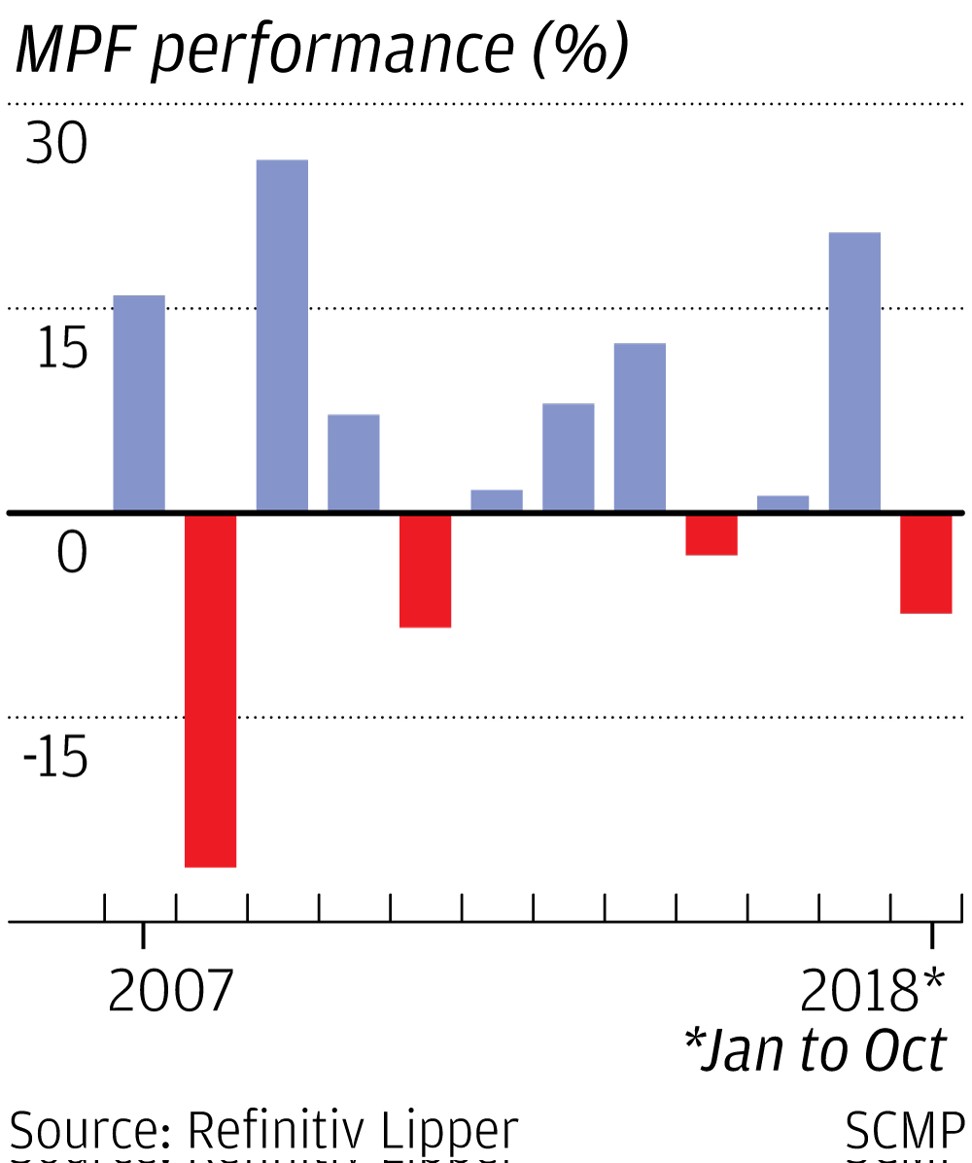

It suffered a 7.38 per cent loss in the first 10 months of the year, according to data from Refinitiv Lipper, the bulk of that coming in the last month as stock markets around the world took a hammering.

In October alone, the 430 MPF investment funds tracked by Lipper – formerly Thomson Reuters Lipper – lost an average of 5.63 per cent, the worst monthly return since August 2015.

According to a calculation by another MPF consultant, Convoy, employees covered by the scheme on average lost HK$19,661 (US$2,509) in the first 10 months of 2018 – HK$14,046 of that in October.

If the performance continues to be affected by the stock market slump, the MPF is likely to report the worst year since 2011, when it lost 8.41 per cent.

While the 2011 loss was because of the European debt crisis, this year’s is mainly down to the stock market slump made worse by the US-China trade war and rising interest rates. Hong Kong’s benchmark Hang Seng Index has dropped about 13 per cent this year, in contrast to a 36 per cent increase in 2017. The Shanghai Composite Index, mainland China’s benchmark, is down by a fifth.

“This has been a very difficult year to achieve positive returns from investment, due to the volatility of markets,” said Stewart Aldcroft, chairman of Cititrust.

“Emerging markets, which include a large part of the Asian region, have been heavily sold by global investors. Europe has also had significant levels of volatility, and also shown negative returns for the year to date.

“In the bonds markets, with interest rates starting to be increased in the US, this is leading many investors to rethink the level of their commitment to this market as inevitably, when interest rates rise, capital values of bonds will decline.”

Aldcroft however believes now is a good time for long-term investors to buy.

“Members with a longer-term memory will recall that on previous occasions when the average returns from MPF have been so poor, there has been a good and positive recovery in the following year,” he said.

The biggest loser is a fund investing in South Korea which is down 23 per cent in the first 10 months, and 16 per cent in October alone.

Greater China funds were the second-worst, losing 17 per cent in the first 10 months and 12 per cent in October.

The performance of Asia-Pacific stock funds was exactly the same.

The mixed-asset funds – a popular choice with their mixture of bonds and stocks – lost 9 per cent in the first 10 months and 7 per cent in October.

US equity funds are the only category of stock funds that generated a positive return, although they too took a huge hit last month. They gained 0.89 per cent in the first 10 months this year, falling 8 per cent in October.

The money market funds, which invest in bank deposits, were the only funds that gained in October, rising 0.35 per cent and 1.34 per cent in the 10-month period.

Elvin Yu, a principal at pension advisers Goji Consulting, said MPF investors need to adopt a diversified approach to fend off the market downturn.

“MPF members should not panic because the MPF is a long-term investment with regular contributions,” Yu said.

“While the global market outlook might not be so positive in light of various uncertainties such as the US-China trade war, the US midterm election this month and Brexit next year, investors should still stay with equities for long-term investment, but diversified across global markets.”