Applications to Hong Kong’s financial industry soar to record high as traders look beyond slump to Greater Bay Area opportunities

- A record 46,063 individuals are licensed as analysts, stockbrokers, fund managers and futures traders in Hong Kong

- Stockbroking reached saturation point long ago, with the top 100 brokers controlling 95 per cent of transactions. What applicants are looking forward to is the opportunity for growth in the Greater Bay Area

A record number of people are seeking to become stockbrokers, futures traders, analysts or fund managers in Hong Kong, as they look beyond the local market’s slump to the day when their licenses can let them serve a market with 10 times the local population in the Greater Bay Area.

Individual licence applications rose by 15 per cent to 2,354 in the third quarter from last year, while the number of firms increased 6 per cent over the same period, according to the quarterly data compiled by the Securities and Futures Commission (SFC).

That has brought the number of SFC-licensed individuals to a record 46,063 at the end of September, while the number of firms increased to a record 2,844, according to the SFC’s data.

“The increasing number of people joining the financial industry reflects the demand for wealth management, especially by mainland Chinese investors who want to invest through Hong Kong brokers and fund management firms because of the greater variety of services”, said Gordon Tsui Luen-on, managing director of Hantec Pacific in Hong Kong.

Hong Kong’s stockbroking industry reached saturation point long ago, with too many brokers competing for a dwindling pie of daily transactions.

To make a tough business harder, stockbroking has always been concentrated in the hands of the largest brokers, with Hong Kong’s top 20 brokers controlling two-thirds of the local market’s trading volume, while the top 100 brokers make up close to 95 per cent of daily transactions.

That leaves more than 500 brokers fighting for the remaining 5 per cent of the market, valued at HK$110.4 billion (US$14 billion) everyday on average as at the end of November.

At an average commission of 25 basis points, the average daily fee income amounts to HK$552 million. Still, transactions have risen 27 per cent this year, compared with 2017, which raises the commission for brokers.

To be sure, some investors prefer to deal with smaller brokers because they appreciate the tips and rumours that flow readily from a more personalised form of relationship broking.

“While the big firms offer research to help customers trade, our traders give them stock tips,” said Jasper Lo, chief investment strategist at Eddid Securities & Futures in Hong Kong, with 40 employees on staff. “Even in the digital age, many customers still like to talk to humans than robot advisers.”

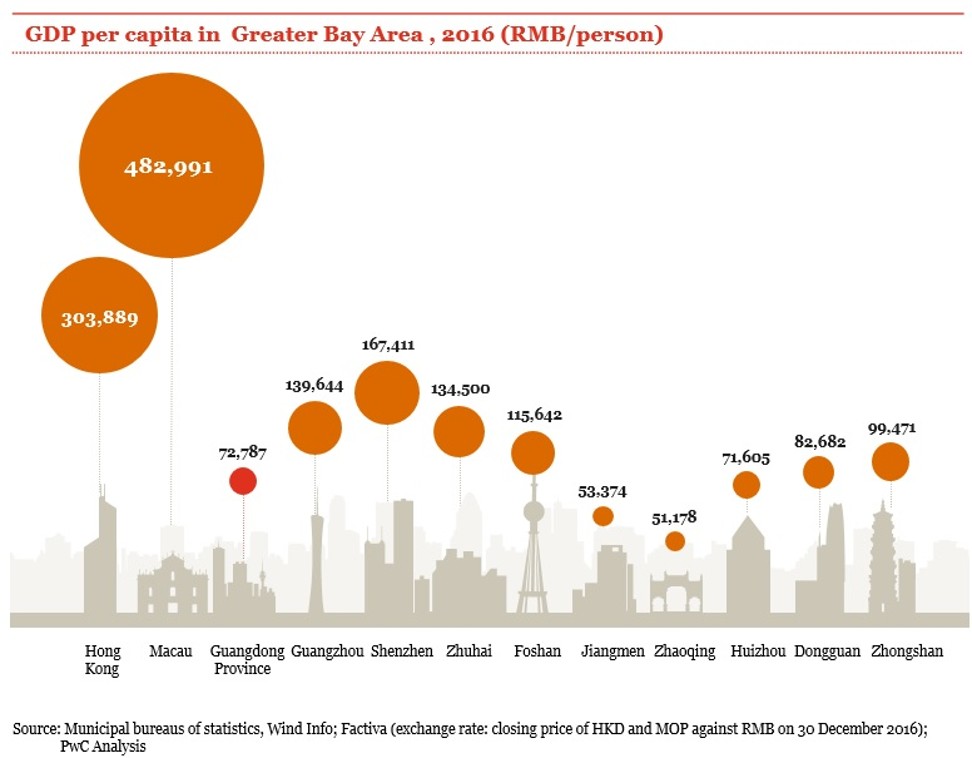

Still, new entrants to the financial market are placing their hopes on the Chinese government’s creation of a Greater Bay Area, which would bring together the economic resources of 11 cities including Zhuhai, Dongguan, Macau and Hong Kong.

The area will have a population of 66 million people, with a combined economic output of US$1.5 trillion.

Despite the Greater Bay Area still being in the planning stage, a high-speed railway and a newly constructed bridge have shortened the travelling time from mainland China to Hong Kong, making it more convenient for Chinese customers to take their business to the city.

Local brokers are preparing for the growth. Bright Smart Securities expanded its headcount by 20 per cent this year to cater to 270,000 customers in Hong Kong.

“We like to recruit during the market downturn as it is easier to hire talent,” said the mid-tier broker’s chief executive Edmond Hui. “With 22 branches in Hong Kong, we need enough people to serve our customers with research and other services. We will continue to hire more next year as we believe the market will bounce back in the longer term.”

Restrictions on brokerage ownership has also drawn many would-be brokers to Hong Kong.

“These mainland players came to buy Hong Kong brokers, or to apply for new licences from the SFC,” said Tsui. “They want to use Hong Kong as a platform to expand overseas, or to return to China when the mainland financial markets open up for global competition.”

Everbright Securities, China's eighth-largest brokerage, paid HK$4.1 billion (US$524 million) for 70 per cent of Sun Hung Kai & Co. in 2015.