China's financial sector tipped to open further as authorities reaffirm support for Shanghai free trade zone

Central bank says zone will spearhead the move to make the yuan convertible, signalling freer cross-border capital flows are imminent

Beijing on Friday reaffirmed the role of the Shanghai free-trade zone (FTZ) as a pioneering area for bold liberalisations including the full convertibility of the yuan, a fresh sign that freer cross-border capital flows are imminent.

The People's Bank of China said that reforms, including the launch of a pilot scheme allowing individual investors to directly trade overseas stocks, were being studied to reinforce Shanghai's transformation into a global financial centre.

The central bank said the FTZ in Shanghai would spearhead the move to make yuan convertible under the capital account - a move to facilitate cross-border investments in equities, properties and production facilities.

It did not give a clear timeframe, saying the liberalisation would happen with a "step-by-step" approach.

The bank said the launch of the qualified domestic institutional investor (QDII2) scheme was being reviewed and would take place at an "appropriate time", a sign the long-heralded reform is in the pipeline.

The statement, jointly published by other ministry-level authorities such as the Ministry of Commerce, also mentioned that qualified investors would be allowed to trade equities and futures across the border while facilitating two-way commodity trading and direct investments to support the real economy.

"It is a clear message that the authorities are determined to deepen the financial reforms despite worries about China's hesitation to fully open its financial sector," said a Shanghai official. "The Shanghai FTZ will be further used as an important experimental ground for planned reforms."

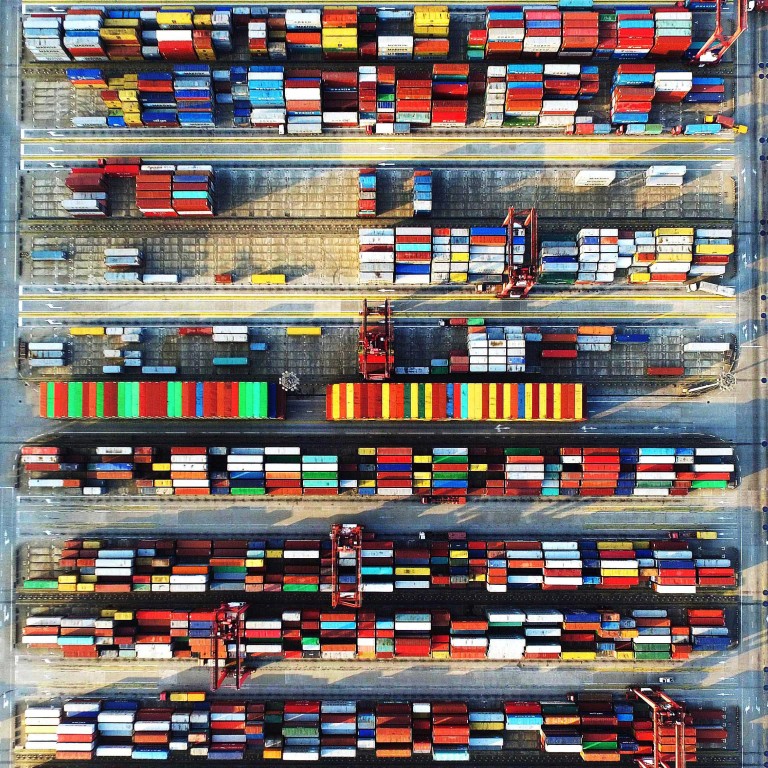

Shanghai FTZ, the first of its kind on the mainland and planned as a Hong Kong-style free port, was launched in late 2013. But slow progress in conducting reforms inside the zone kept foreign investors away.

A one-off devaluation in yuan and a recent stock market rout in China deepened worries that the reforms, including the QDII2, would be put on hold.

The QDII2, on top of the Shanghai-Hong Kong Stock Connect programme, could technically direct a larger capital outflow owing to a crisis of confidence in the A-share market.

Beijing approved three more FTZs, in Tianjin, Guangdong and Fujian, early this year while allowing Shanghai to expand its FTZ by four times, which now covers more than 120 sq km.

"Shanghai remains a promising international metropolis with expectations for a further financial liberalisation," said Albert Lau, managing director for China at property consultancy Savills.

"If Shanghai were to implement free capital flows across the border, foreign institutions and capital will gravitate to the city to make it one of the world's most important financial centres."

Guan Tao, a former head with the balance of payments department at the State Administration of Foreign Exchange, said more detailed plans were needed.

A primary concern among the key financial policymakers is rampant hot money flows amid eased regulatory oversight.