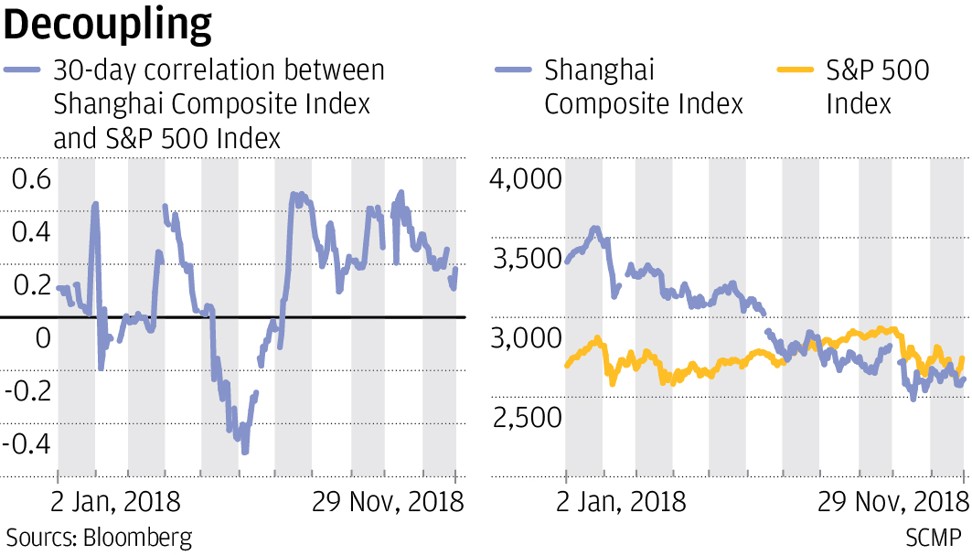

US stocks lose sway over Chinese equities as two markets show sign of decoupling

- The 30-day correlation between the stock benchmarks of the two markets drops to a three-month low this week

When Chinese President Xi Jinping meets his US counterpart Donald Trump this weekend to resolve the trade dispute, he will have one other bargaining chip: the decoupling between the two nation’s stock markets.

The influence US stocks can wield over Chinese equities has been waning. The 30-day correlation between the Shanghai Composite Index and the Standard & Poor’s 500 Index dropped to a three-month low this week, according to Bloomberg data. Only in October, the correlation between the two hit its highest level this year.

The divergence further strengthened on Thursday trade. The Shanghai Composite slumped 1.3 per cent, ignoring the 2.3 per cent rally on the S&P 500 Index on Wednesday after the dovish comment by Federal Reserve chairman Jerome Powell on the outlook of interest rate increases. Hong Kong’s Hang Seng Index, where a barrage of offshore Chinese equities trade, also dropped 0.9 per cent.

While US traders cheered a possible pause in increases in borrowing costs going forward, Chinese investors will probably endure an array of weak economic data in coming weeks. China’s industrial production growth may stay sluggish in November and gains in producer prices will probably weaken on waning aggregate demand, according to China International Capital Corp. The data is due to be released by the statistics bureau on December 14.

Equities in China and the US – the world’s largest by market capitalisation – began to move in opposite directions in October. The pledge by Chinese policymakers to alleviate the funding strain facing smaller listed companies temporarily put a floor under equities, while routs in US stocks were rattling global markets on jitters about rising borrowing costs.

US equities are also losing their influence over Hong Kong stocks, which now have a higher correlation with the mainland’s markets based on Bloomberg data. The city’s stocks are more swayed by news flows linked to China’s fundamentals, with increasing buying from mainland traders through the exchange link programmes.

Goldman Sachs estimated southbound buying of Hong Kong stocks through the link to reach US$20 billion in 2019, compared with US$11 billion so far this year.