For 8 minutes, this Hangzhou K-12 educator was six times Apple’s market value, at US$5 trillion

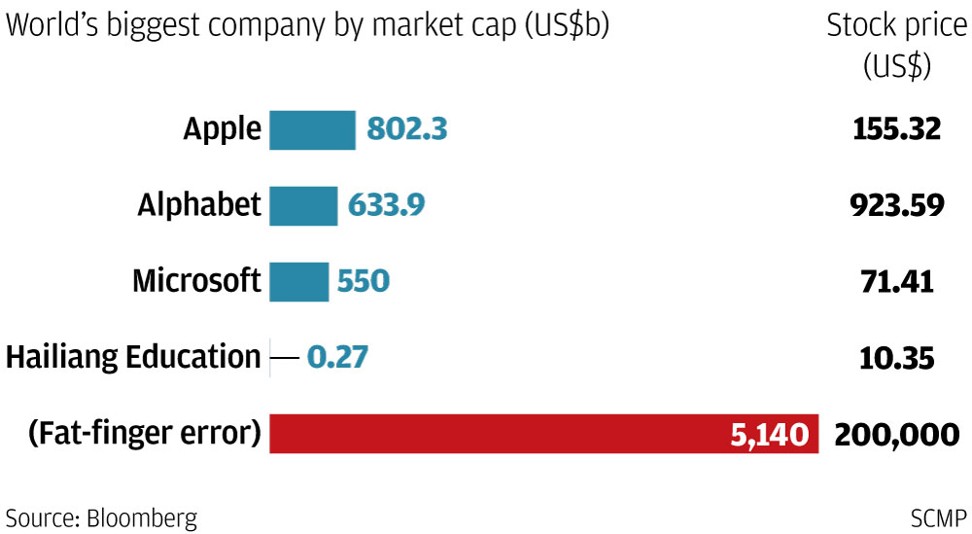

A fat-finger trading error probably gave Hailiang a US$5 trillion market capitalisation, at least for 8 minutes.

Hailiang Education Group Inc., a Hangzhou company that provides syllabuses from kindergarten to high schools, was the world’s most valuable company for eight minutes overnight, after a fat-finger trading error caused its stock price to jump 20,000-fold.

Bids for the company’s stock were received at US$200,000 at 9:35 am New York time on Thursday on the Nasdaq market. A quote recap of the transactions showed 700 shares actually changing hands at that price, before trading was halted for eight minutes.

The transaction was later annulled, after which the stock’s price dropped to US$10.26, ending the day 4.5 per cent higher at US$10.35.

Shareholders of Apple Inc need not lose sleep, for the iPhone maker is still the world’s biggest company, with a market value of US$802.3 billion at the end of Thursday trading. Alphabet Inc, the holding company of Google, was second in place with US$633.9 billion while Microsoft Inc was third place at US$550 billion, according to Bloomberg’s data.

The company, founded 22 years ago in 1995, is China’s third-largest private provider of K-12 education service, with three schools and an enrolment of 18,743 students, according to GF Securities. Listed on Nasdaq in December 2015, Hailiang reported a 2016 revenue of 4.12 billion yuan (US$617.6 million).

Its shares have surged 41 per cent this year, lagging the gains in its competitor New Oriental Education & Technology Group. Still, trading in the company’s stock has been halted no fewer than 100 times since July 2015, due to the Nasdaq’s Limit-up and Limit-Down triggers, according to Bloomberg’s data.