These property companies are flashing buy signals based on insider stock purchases

Insider buying activity hints at better times ahead for property developers Country Garden, Future Land Development, and Sunac China

The buying rebounded sharply while the selling among directors plunged for the second straight week based on filings on the exchange from November 6 to 10.

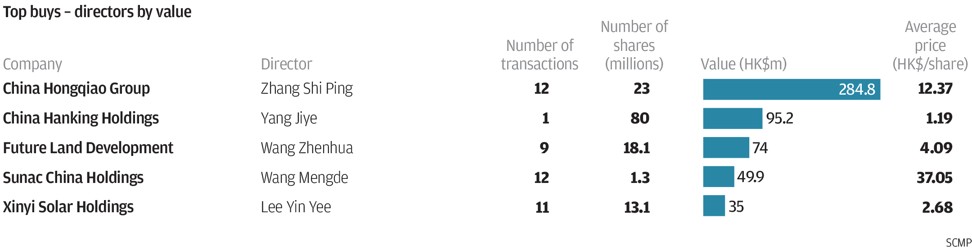

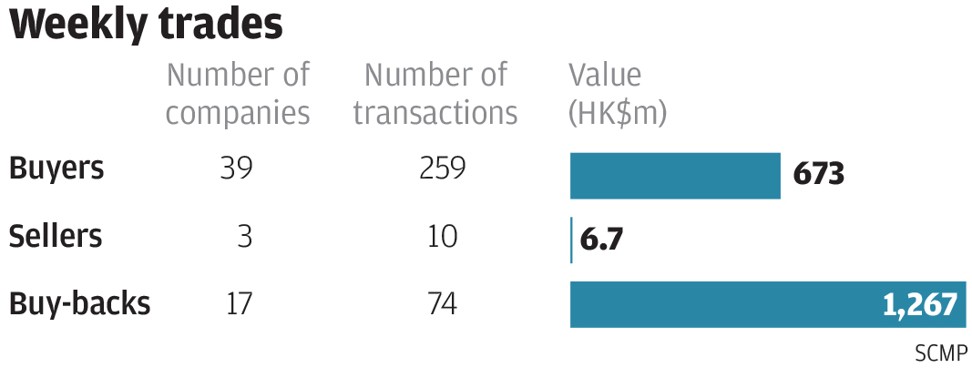

Buyers outweighed sellers with 39 companies that recorded 259 purchases worth HK$673 million versus a paltry three companies with 10 disposals worth HK$6.7 million. The number of companies and trades on the buying side were up from the previous week’s 34 companies and 173 purchases. The buy value, however, was down from the previous week’s acquisitions worth HK$858 million. The sales, on the other hand, were sharply down from the previous week’s nine companies, 23 disposals and HK$60 million.

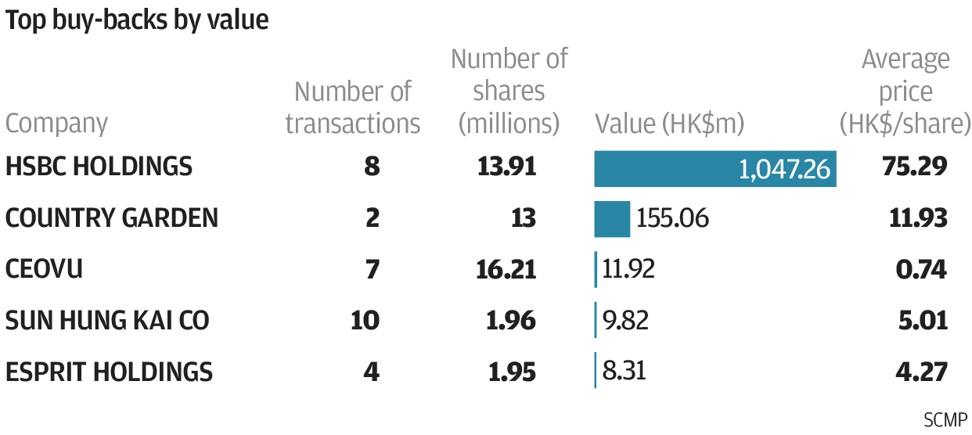

Meanwhile, the buy-back activity was flat for the second straight week with 17 companies that posted 74 repurchases worth HK$1.27 billion based on filings from November 3 to 9. The number of companies and trades were not far off from the previous week’s five-day totals of 18 companies and 80 repurchases. The value, however, was sharply down from the previous week’s turnover of HK$1.8 billion.

There was heavy buying in mainland property stocks last week with buy-backs in Country Garden Holdings and insider buys in Future Land Development and Sunac China Holdings. The most significant purchases were in Country Garden as the buy-backs were made in the run-up to the group becoming an Hang Seng Index constituent on December 4. Sunac China is also worth noting as its CEO recorded his first purchases since he joined the group in 2006.

Mainland property developer Country Garden bought back 376,000 shares on October 30 and a further 13 million shares on November 6 at an average of HK$11.94 each. The group previously acquired 47.35 million shares from August 30 to September 26 at HK$9.88 to HK$12 each or an average of HK$11.03 each and 161.3 million shares from January 5 to April 3 at HK$4.05 to HK$6.98 each or an average of HK$4.46 each. Prior to the buy-backs this year, the company acquired 1.08 billion shares from January to December 2016 at HK$2.85 to HK$4.48 each or an average of HK$3.75 each. The repurchases since January 2016 are the company’s first buy-backs since listing in April 2007. The stock closed at HK$12.28 on Friday.

Significant Points:

Country Garden resumed buying back after the stock fell by 11 per cent

Four executive directors bought shares earlier this year.

In August, the company announced a 39.2 per cent gain in first-half profit to 7.50 billion yuan (US$1.13 billion)

Country Garden will make its blue-chip debut on December 4

Future Land Development chairman Wang Zhenhua bought 18.1 million shares of the Hong Kong-listed property developer from November 7 to 9 at HK$4.09 each. The trades increased his holdings to 4.123 billion shares or 72.88 per cent of the issued capital. He previously acquired 994,000 shares on September 1, 2015 at 98 HK cents each and 5.4 million shares from May to August 2015 at HK$1.70 to 99 HK cents each or an average of HK$1.36 each. The insider sentiment is not entirely positive this year as executive director Chan Wai-kin sold 200,000 shares on April 7 at HK$2.40 each, which reduced his holdings by 67 per cent to 100,000 shares. The stock closed at HK$4.20 on Friday.

Significant Points:

Chairman Wang Zhenhua recorded his first on-market trades since 2015

The recent purchases accounted for 36 per cent of the stock’s trading volume

The recent purchases were made after the stock rose by as much as 329 per cent from his acquisition price in September 2015

The recent purchases by the chairman were made at higher than the stock’s IPO price in November 2012 of HK$1.79

Sunac China CEO Wang Mengde bought 1.35 million shares of the real estate developer from November 1 to 6 at an average of HK$37.05 each. The trades increased his holdings to 14.348 million shares or 0.35 per cent of the issued capital. Wang was appointed as CFO in 2006, president in 2011 and CEO in 2015. Also positive this quarter is executive president Jing Hong with 915,000 shares bought from October 6 to 10 at an average of HK$40.17 each. The trades increased his holdings to 10.515 million shares or 0.25 per cent of the issued capital. He previously sold 2.2 million shares in July 2014 at an average of HK$4.75 each.

The insider sentiment is not entirely positive this year as executive directors Tian Qiang, Li Shaozhong and Chi Xun sold a combined 6.9 million shares from January to June at an average of HK$11.15 each. The stock closed at HK$36.90 on Friday.

Significant Points:

CEO Wang Mengde and president Jing Hong recorded their first purchases since they joined the company in 2006 and 2012, respectively

The recent purchases by these two directors were made on the back of the rise in the share price since February 2016 from HK$4.44

The purchases by these two directors increased their respective holdings by 10 per cent

Chairman Sun Hong Bin bought 14.6 million shares in January at HK$6.82 each

Robert Halili is managing director of Asia Insider