Lee & Man, SmarTone, Great Eagle and China New Higher Education to the fore in strong week of share buying

Sixteen firms record 69 purchases worth HK$121 million (US$15.4m) versus eight firms with 29 disposals worth HK$58 million

Share buying among directors rose for the first time in the past three weeks while selling rebounded sharply, based on filings on the Hong Kong stock exchange from March 5 to 9.

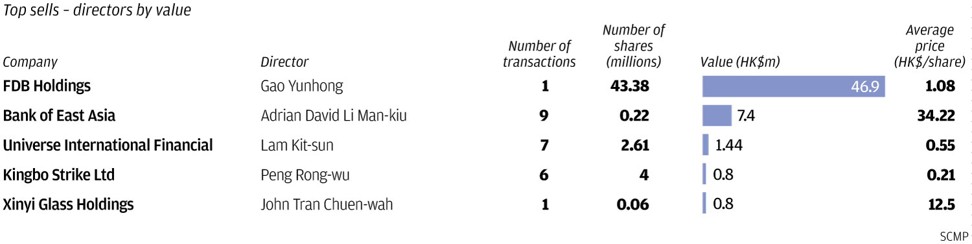

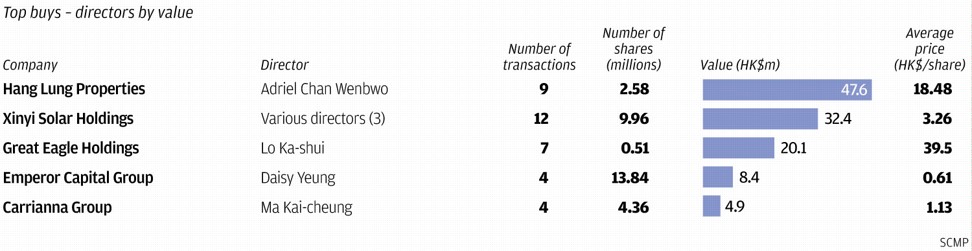

Sixteen companies recorded 69 purchases worth HK$121 million (US$15.4 million) versus eight firms with 29 disposals worth HK$58 million.

The number of companies and trades on the buying side were sharply up from the previous week’s 12 firms and 49 purchases. The buy value, however, was consistent with the previous week’s purchases worth HK$122 million. Sales were sharply up from the previous week’s five companies making 15 disposals worth HK$28 million.

Aside from directors, buy-back activity rose for the first time in three weeks with eight firms posting 36 repurchases worth HK$132 million, based on filings from March 2 to 8.

The number involved was unchanged while the number of trades and value were sharply up from the previous five-day totals of 24 trades worth HK$65 million.

There were only a few significant transactions last week due to the busy reporting season with notable buy-backs by Lee & Man Paper Manufacturing and SmarTone Telecommunications, and insider buys in Great Eagle Holdings and China New Higher Education Group.

● Lee & Man Paper Manufacturing picked up where it left off in January with 14.8 million shares bought from March 1 to 8 at HK$9.00 to HK$8.70 each or an average of HK$8.89 each. The group previously acquired 472,000 shares on January 22 at HK$9.17 each and 4.93 million shares from January 4 to 5 at HK$8.96 to HK$9.17 each or an average of HK$9.05 each.

Before the buy-backs, the company acquired 33.2 million shares from March 16 to December 7, 2017 at HK$5.86 to HK$8.99 each or an average of HK$7.03 each and 217.7 million shares from January 2013 to December 2016 at HK$3.61 to HK$5.99 each or an average of HK$4.72 each. The stock closed at HK$9.00 on Friday.

Significantly, the group recorded buys on five out of the six trading days from March 1 to 8, accounting for 21 per cent of the stock’s trading volume. They were made after the stock rebounded by as much as 13 per cent from HK$7.98 on February, and after the company announced on February 28 a 76 per cent rise in annual profit to HK$5.04 billion.

It previously acquired 17.57 million shares from March to November 2017 at HK$10.20 to HK$9.09 or an average of HK$9.62, and 1.5 million shares in December 2016 at HK$10.29 each and 1.89 million shares from August to September 2016, at an average of HK$12.54.

Before the buy-backs, since 2016 it had acquired 6.9 million shares from January to May 2014 at HK$9.00 to HK$7.90 each, an average of HK$8.22 each, 75.7 million shares from November 2006 to November 2010 at HK$4.44 to HK$10.68 each (average HK$7.13) and 26.9 million shares from December 1997 to June 2004 at HK$20.00 to HK$7.55 (average HK$9.48). The stock closed at HK$8.65 on Friday.

The buy-backs from February 14 to March 8 were its first repurchases since November 2017, and it recorded buys on seven out of the 15 trading days from February 14 to March 8. Combined they accounted for 37 per cent of the stock’s trading volume.

They were made after the stock fell by as much as 13 per cent from HK$9.49 on January 10, and on February 13, a 16.7 per cent drop in interim profit to HK$324.31 million.

● Great Eagle Holdings’ chairman and managing director Lo Ka-Shui bought 508,000 shares in the property developer and investor from March 2 to 6 at an average of HK$39.50, which increased his holdings to 416.798 million shares or 60.53 per cent of the issued capital.

The chairman previously acquired 222,0000 shares from September to October 2017 at an average of HK$41.30 and 2.75 million shares in March 2017 at HK$36.62.

Before his latest trades, since 2017 he had bought a net 4.1 million shares from November to December 2016 at an average of HK$35.34, sold 80,000 shares in September 2016 at an average of HK$34.74 and a net 11.8 million shares from March to June 2016 at HK$24.92 to HK$31.98 (average HK$28.66). The stock closed at HK$41.70 on Friday.

Lo’s recent purchases accounted for 35 per cent of the stock’s trading volume, and were made on the back of the 11 per cent drop in the share price since November 2017 from HK$44.15. They were completed after Great Eagle announced a 201.6 per cent gain in annual profit to HK$8.96 billion on February 28.

● China New Higher Education Group independent non-executive director, Francis Wong Man Chung bought 207,000 shares in the business on March 2 at HK$5.44. The trade increased his holdings to 321,000 shares or 0.02 per cent of the issued capital.

Investors should note that CEO Zhao Shuai acquired an initial 71,000 million shares from December 15 to 18, 2017 at an average of HK$4.03. The stock closed at HK$5.67 on Friday.

Wong’s purchase is his first on-market trade since the stock was listed in April 2017, and the purchase price of HK$5.44 was higher than the IPO price of HK$2.78, increasing his holdings by 181 per cent. It was made after the stock rebounded 19 per cent from HK$4.56 on February 9, and the stock is now up from HK$2.60 since August 2017.

The purchase was made after the company announced a 107.9 per cent gain in annual profit to 233.32 million yuan on February 28.