Hong Kong company earnings results spur buying of own company shares by directors

More companies also bought back their own shares in the latest period

Buying of shares in their own companies by Hong Kong directors rebounded sharply in the March 19 to March 23 week, according to filings to the stock exchange, while selling rose for a third straight week.

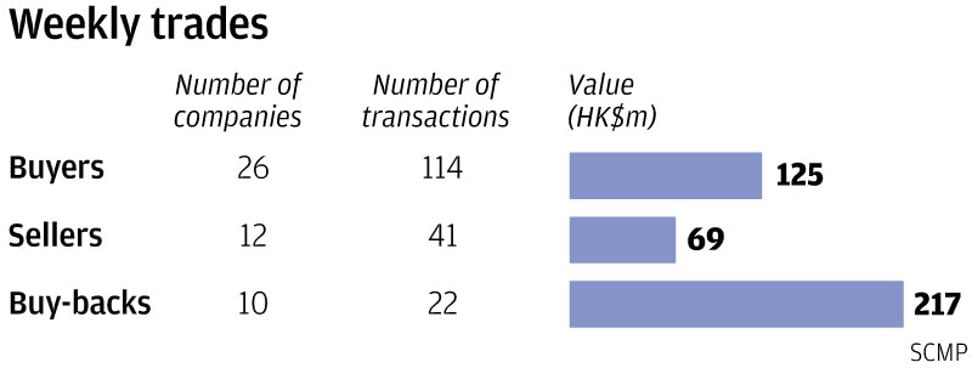

A total of 26 companies recorded 114 purchases by directors worth HK$125 million (US$15.9 million) versus 12 firms with 41 disposals worth HK$69 million. The buy figures were sharply up from the previous week’s 13 companies, 56 purchases and HK$39 million while sales were slightly up from the previous week’s nine firms, 34 disposals and HK$60 million.

More companies bought back their own shares in the March 16 to March 22 period, with 10 companies posting 22 repurchases worth HK$217 million, up from the previous five days’ seven companies buying back HK$152 million. The number of trades, however, was down from the previous period’s 26 repurchases.

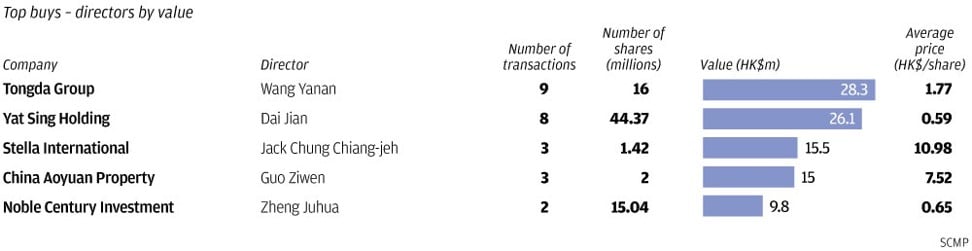

The bulk of the director and buy-back transactions last week were made following announcements of companies’ earnings results. There were also several rare transactions last week, with a buy-back in real estate trust Link Reit and buybacks and a purchase by the CEO of electronics maker Techtronic Industries. On the selling side, two non-executive directors of conglomerate NWS Holdings recorded rare disposals following a sharp gain in the company’s share price.

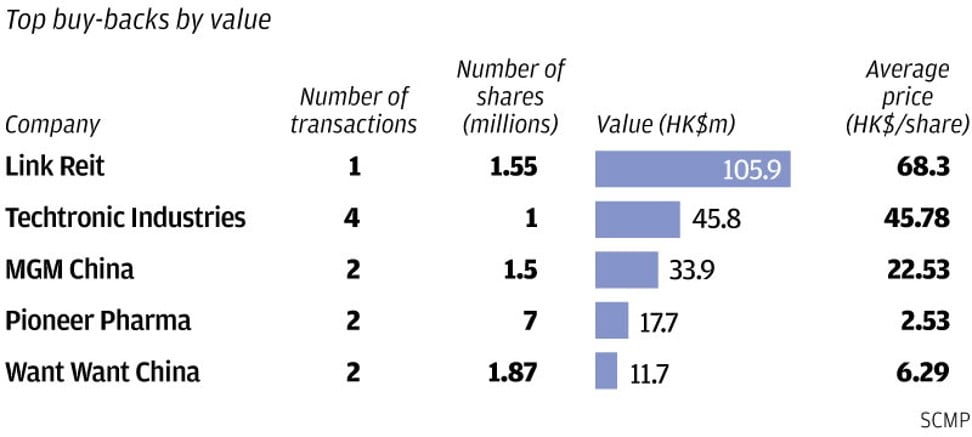

Retail and car park operator Link Reit bought back 1.55 million units on March 21 at HK$68.30 each, its first buy-back since December 2016. It previously acquired an initial 2.09 million units from November 30 to December 1, 2016 at an average of HK$52.84 each.

The latest buy-back was made on the back of an 8 per cent drop in the unit price since January from HK$74.25. Link Reit resumed buy-backs this month at sharply higher than the price it paid in 2016.

In addition, independent non-executive director Tan Poh Lee bought 1,200 units on January 30 at HK$69 each. The trade increased her holdings by 73 per cent to 29,000 units. That is her first on-market trade since her appointment in November 2015. The unit trust closed at HK$67.80 on Friday.

Rechargeable tools manufacturer Techtronic Industries bought back a combined 1.05 million shares from March 16 to 22 at HK$46.65 to HK$45 each, or an average of HK$45.82 each. It bought back one million shares from March 16 to 22 at an average of HK$45.78 each.

It had previously acquired 3 million shares from November to December 2016 at an average of HK$27.90 each, 14 million shares from September 2011 to December 2014 at HK$4.62 to HK$24.15 each, or an average of HK$10.56 each, and 4.36 million shares from September to November 2007 at HK$9.25 to HK$6.48 each, or an average of HK$8.03 each.

The company’s CEO, Joseph Galli Jnr, bought 50,000 shares on March 19 at HK$46.64 each. Following that purchase, he received 514,000 shares via a share award scheme on March 21, which boosted his stake to 4.747 million shares or 0.26 per cent of the issued capital. He had previously acquired 4,000 shares in June 2015 and 12,000 shares in January 2015 at an average of HK$25.41 each, 18,000 shares in August 2013 at HK$17.73 each and 35,000 shares in May 2012 at HK$9.13 each.

The stock closed at HK$43.60 on Friday.

The recent trades are the company’s first buybacks since December 2016 and the CEO’s first purchase since June 2015. They were made after the company announced on March 13 a 15 per cent rise in full-year profit to US$470 million and after the stock fell by as much as 14 per cent from HK$52.50 in the first week of January. The shares however are up since February 2017’s HK$25.85.

The purchase prices this month were sharply higher than previous acquisition prices.

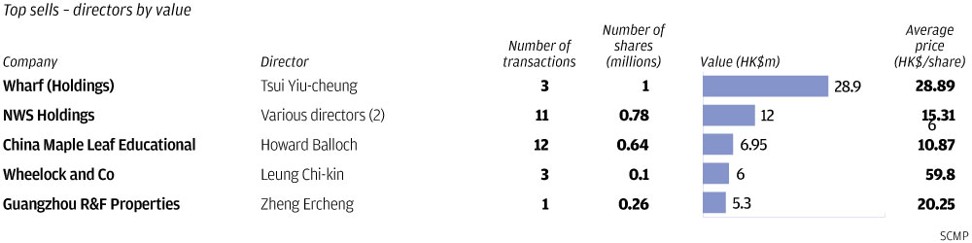

Conglomerate NWS Holdings’ independent non-executive director Alan Lee Yiu-kwong and non-executive director Patrick Lam Wai-hon sold a combined 884,000 shares from March 13 to 20 at HK$15.60 to HK$15.18 each, or an average of HK$15.33 each.

Lee sold 514,000 shares from March 19 to 20 at an average of HK$15.18 each, which lowered his stake by 37 per cent to 890,000 shares or 0.02 per cent of the issued capital. It was his first disposal since his appointment in October 2012.

Lam sold 370,000 shares from March 13 to 16 at an average of HK$15.54 each, which reduced his holdings by 8 per cent to 4.194 million shares or 0.11 per cent. It was his first sale since July 2017.

He previously sold 470,000 shares from June to July 2017 at HK$15.32 each, 2.14 million shares from March to November 2012 at HK$13 to HK$11.57 each, or an average of HK$12.49 each, and 832,000 shares from April to June 2005 at an average of HK$11.16 each.

Lam was appointed executive director in January 2003 but became a non-executive director in January 2016.

The sales by both directors were made after the stock rose by as much as 14 per cent from HK$13.64 in December 2017.

The stock closed at HK$14.62 on Friday.