Mobile software provider Meitu makes first buy-backs since listing in 2016

Kohei Sato, CEO of pachinko operator Dynam Japan Holdings, also sells his shares for the time since listing in August 2012

Buying by Hong Kong directors remained high for a second straight week even as selling rose, based on filings to the city’s stock exchange from May 28 to June 1.

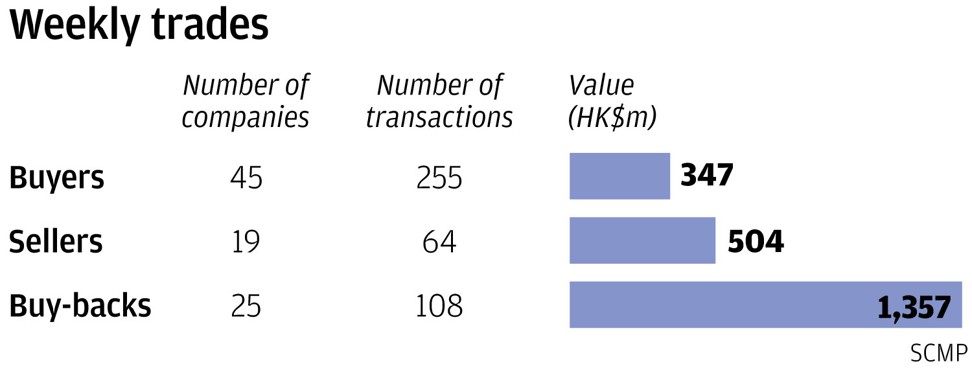

A total of 45 companies recorded 255 purchases by directors worth HK$347 million (US$44.2 million) versus 19 firms with 64 disposals worth HK$504 million. The figures were sharply up from the previous week’s four-day totals of 38 companies, 178 purchases and HK$199 million on the buying side and 11 firms, 34 disposals and HK$142 million on the selling side.

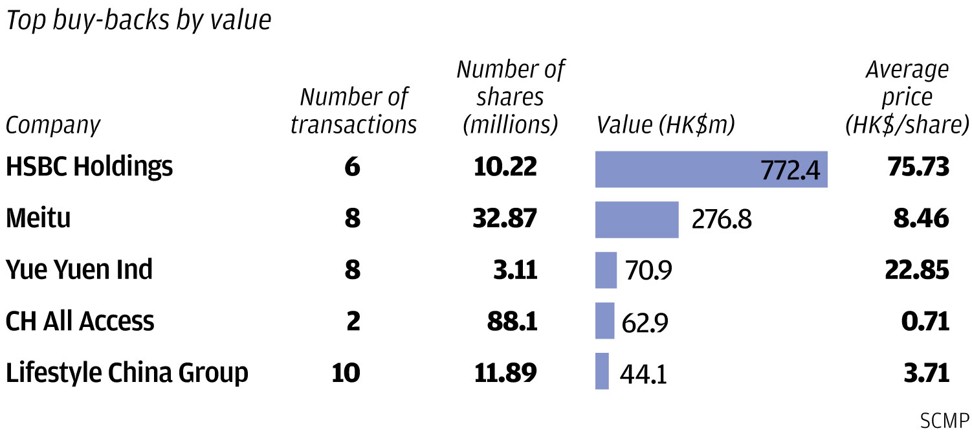

While the buying by directors surged last week, the buy-back activity fell with 25 companies recording 108 repurchases worth HK$1.35 billion, based on filings from May 25 to 31. The figures were not far off from the previous four-day totals of 28 firms, 103 trades and HK$1.31 billion.

There were significant trades in technology stock Meitu, property developers Sunac China Holdings and Guangdong Land and home building materials manufacturer China Lesso Group. On the selling side, there was a first-time sale by the founder of pachinko halls provider and operator Dynam Japan Holdings.

Meitu, for the first time since listing in December 2016, bought 32.86 million shares from May 25 to 30 at HK$7.98 to HK$8.78 each or an average of HK$8.42 each. It had announced a voluntary buy-back plan to acquire US$100 million worth of shares from the open market on May 25. The trades, which accounted for 28 per cent of the stock’s trading volume, were made after the price fell by as much as 37 per cent from HK$12.72 in January. The company’s buy-back prices were near the IPO price of HK$8.50.

Meitu’s chairman and founder Cai Wensheng bought 1.28 million shares acquired on May 10 at HK$8.36 each, which increased his holdings to 1.68 billion shares or 39.5 per cent of the issued capital. He previously acquired 15.1 million shares from April 13 to 27 at HK$8.96 to HK$8.14 each or an average of HK$8.35 each.

Before his trades this year, Cai had acquired 6.5 million shares on December 21 and 22, 2017 at an average of HK$10.18 each – the first trades by a company director since then. The stock closed at HK$8.48 on Friday.

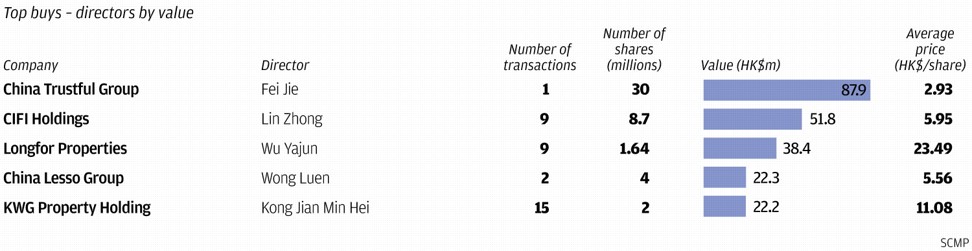

Sunac CEO Wang Mengde resumed buying shares of the company after the stock fell by 19 per cent from HK$36 on April 13, acquiring 450,000 shares on May 30 and 31 at an average of HK$29.33 each. The trades increased Wang’s holdings to 18.09 million shares or 0.41 per cent of the issued capital. He previously acquired 500,000 shares on April 4 at HK$28.80 each. Before his trades this year, he acquired 1.35 million shares in November 2017 at an average of HK$37.05 each. The stock closed at HK$30.60 on Friday.

Lee Vincent Marshall Kwan Ho, independent non-executive director at Guangdong Land Holdings, recorded his first on-market trades in the property developer, buying one million shares from May 21 to 28 at HK$1.81 to HK$2.02 each or an average of HK$1.89 each. The shares bought represented 0.06 per cent of the issued capital. The trades, which accounted for 26 per cent of the stock’s volume, were made after the stock rebounded by as much as 30 per cent from HK$1.55 in November 2017. Despite the rebound, the counter is still down from its five-year high of HK$3.44 seen in September 2013. The stock closed at HK$2.00 on Friday.

Wong Luen Hei, founder and chairman of China Lesso Group recorded his first on-market trades in the home buildings materials manufacturer since 2014, acquiring four million shares on May 29 and 30 at HK$5.68 to HK$5.44 each or an average of HK$5.56 each. The trades, which accounted for 20 per cent of the stock’s volume, increased his holdings to 2.12 billion shares or 68.49 per cent of the issued capital. The purchases were made after the stock fell by as much as 14 per cent from HK$6.33 on May 16. Before his trades this month, Luen had acquired 1.9 million shares from March to April 2014 at an average of HK$4.27 each and 16.6 million shares from August 2011 to June 2013 at HK$4.22 to HK$3.28 each or an average of HK$3.55 each. His last buying price was sharply higher than the IPO price in June 2010 of HK$2.60. The stock closed at HK$5.61 on Friday.

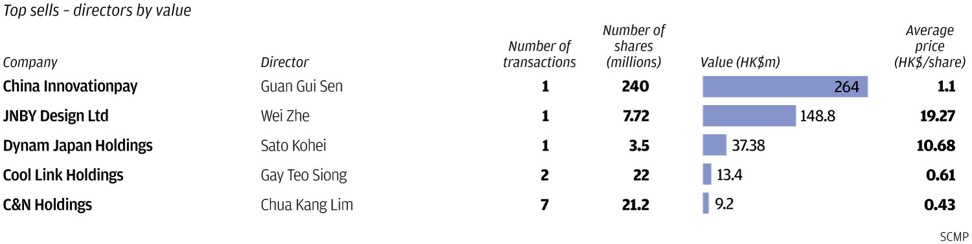

Kohei Sato, chairman, president and CEO of Dynam Japan Holdings, recorded his first on-market trade in the pachinko halls provider and operator since listing in August 2012. He sold 3.5 million shares on May 30 at HK$10.68 each, which reduced his holdings to 452.4 million shares or 59.06 per cent of the issued capital. The CEO’s sale price was lower than the IPO price of HK$16.00. The disposal was made after the company announced on May 23 a 16.1 per cent gain in annual profit to HK$803 million. The stock closed at HK$10.54 on Friday.