Share buying high for fourth straight week

Several significant trades with buy-backs in SMI Holdings and NewOcean Energy Holdings following sharp falls in their share prices while two high-level board members of C&N Holdings and Clifford Modern Living Holdings have been unloading shares at progressively higher prices

Company share buying was high for the fourth straight week, while the selling among directors rose based on filings on the Hong Kong stock exchange from June 11 to 15.

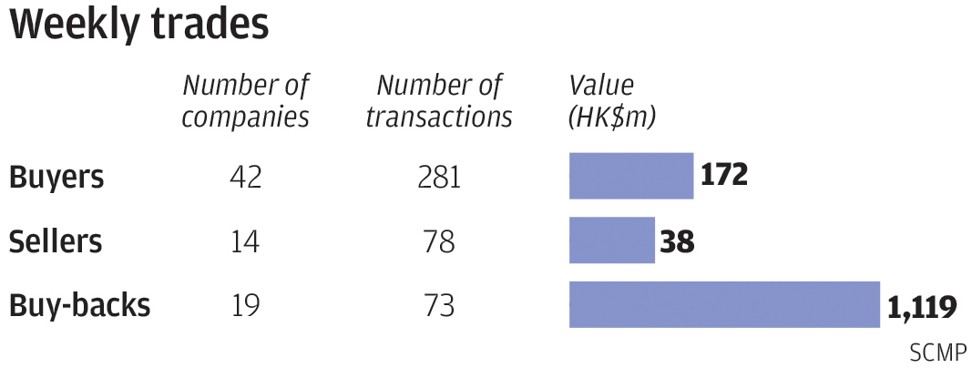

A total of 42 companies recorded 281 purchases worth HK$447 million (US$56.92 million) compared with 14 firms and 78 disposals worth HK$308 million the previous week. The number of companies and trades on the buying side were not far off from the previous week’s 44 firms and 265 purchases. The buy value, however, was down from the previous week’s acquisitions worth HK$526 million.

On the negative side, the number of companies was down from the previous week’s 18 firms while the number of trades and value were up from the previous week’s 73 disposals worth HK$177 million.

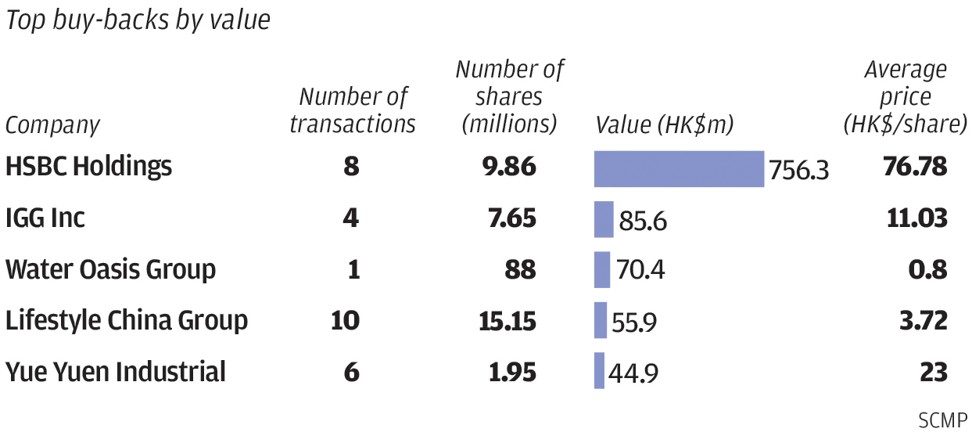

Buy-back activity fell for the third straight week with 19 companies posting 73 repurchases worth HK$1.1 billion based on filings from June 8 to 14. The number of firms was consistent with the previous 5-day totals of 18 companies while the number of trades and value were down from the previous week’s 87 repurchases worth HK$1.25 billion.

There were several significant trades last week with buy-backs in SMI Holdings and NewOcean Energy Holdings following sharp falls in their share prices.

On the directors’ side, two high-level board members of C&N Holdings and Clifford Modern Living Holdings have been unloading shares in the past few months at progressively higher prices.

On the positive side, we had a bullish alert on Anton Oilfield Services as the Chairman of the Company bought shares at above his sale price in 2016.

Movie, television, and documentary producer and distributor SMI Holdings bought back for the first time since May 2017 with 1.08 million shares bought from June 5 to 7 at HK$3.30 each.

The trades, which accounted for 21 per cent of the stock’s trading volume, were made on the back of the 24 per cent drop in the share price since October 2017 from HK$4.37.

The group previously acquired 2.2 million shares in May 2017 at an average of HK$3.55 each and 16.2 million shares from May to September 2016 at an average of HK$3.54 each.

Before the repurchases since 2016, the company acquired 8.8 million shares in July 2015 at HK$3.63 each and 8.4 million shares from March to June 2000 at HK$8.10 to HK$3.15 each or an average of HK$5.60 each. The stock closed at HK$3.29 on Friday.

Liquefied petroleum gas distributor NewOcean Energy Holdings bought back for the first time since April 2017 with 4.9 million shares bought on June 5 at HK$1.58 each.

The buy-back was made after the stock fell by as much as 37 per cent from the company’s acquisition prices last year. The group previously acquired 6.1 million shares from March to April 2017 at HK$2.49 to HK$2.32 each or an average of HK$2.39 each, 3 million shares in September 2014 at HK$3.85 each and 2 million shares from June to July 1994 at HK$0.88 to HK$0.79 each or an average of HK$0.836 each. The stock closed at HK$1.51 on Friday.

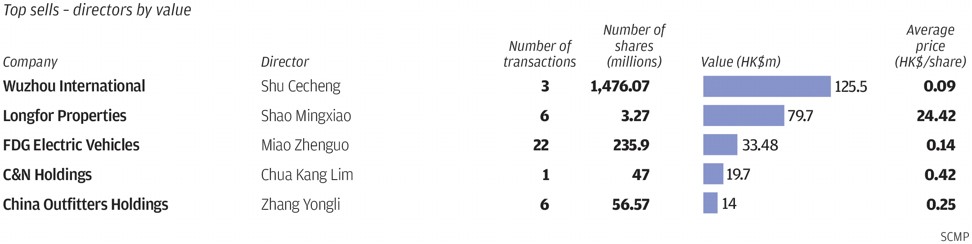

Founder, chairman and CEO Chua Kang Lim recorded the first trades by a director of transport and storage services provider C&N Holdings. He has been unloading shares since May with 100.2 million shares sold from May 21 to June 12 at HK$0.42 to HK$0.52 each or an average of HK$0.42 each.

The disposals, which accounted for 57 per cent of the stock’s trading volume, reduced his holdings by 21 per cent to 379.800 million shares or 59.34 per cent of the issued capital.

The disposals were made after the stock rebounded by as much as 73 per cent from HK$0.30 on May 9. The purchases by the CEO since May are his first on-market trades by a director of the company since the stock was listed in October 2017. The CEO’s sale prices were near the initial public offering (IPO) price of HK$0.44. The counter closed at HK$0.405 on Friday.

Non-Executive chairwoman Man Lai Hung has been unloading shares in the property management and retail firm Clifford Modern Living Holdings at progressively higher prices since the last week of March with 14.16 million shares sold from March 27 to June 13 at HK$0.72 to HK$1.03 each or an average of HK$0.95 each.

The disposals, which accounted for 6 per cent of the stock’s trading volume, reduced her holdings to 740.840 million shares or 73.81 per cent of the issued capital. She recorded sales on 16 out of the 52 trading days during that period. Her sales since March are the first corporate shareholder trades in the company since the stock was listed in November 2016. Her sale prices were higher than the IPO price of HK$0.46. The counter closed at HK$0.79 on Friday.

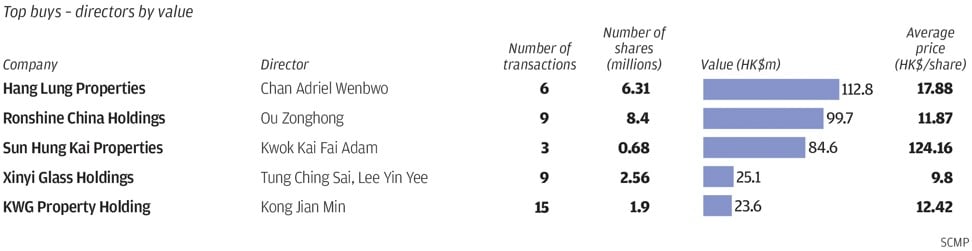

Founder and chairman Luo Lin bought shares in oilfield products and services provider Anton Oilfield Services at higher than his sale price in December 2016 with 2 million shares bought on June 11 at HK$1.20 each. The trade increased his holdings to 618.089 million shares or 23.19 per cent of the issued capital.

The purchase was made, however, after the stock fell by 15 per cent from HK$1.41 on May 24. He previously sold 106.4 million shares in December 2016 at HK$1.01 each. Before that disposal, the chairman acquired 28 million shares from May to July 2015 at HK$1.95 to HK$1.05 each or an average of HK$1.73 each and 22.9 million shares from May to June 2014 at an average of HK$5.61 each. Before those purchases, Luo sold 2.1 million shares in January 2014 at HK$5.85 each and 2 million shares in April 2013 at HK$5.52 each. Before his trades since 2013, the chairman acquired nearly 26 million shares from September 2011 to April 2012 at an average of HK$1.08 each. The stock closed at HK$1.10 on Friday.

Robert Halili is managing director of Asia Insider