Hong Kong stock market slump spurs wave of insider share buying among blue chips

Hang Seng Index constituents CK Asset Holdings, Sun Hung Kai Properties, New World Development and Hopewell Holdings all recorded buying by company insiders or corporate share buy-backs for the holiday-shortened week of June 19 to 22 as Hong Kong’s stock market fell 3.2 per cent for the period

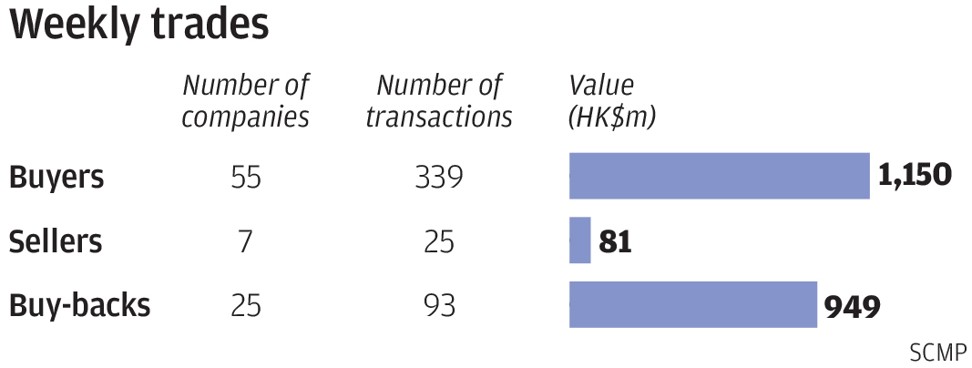

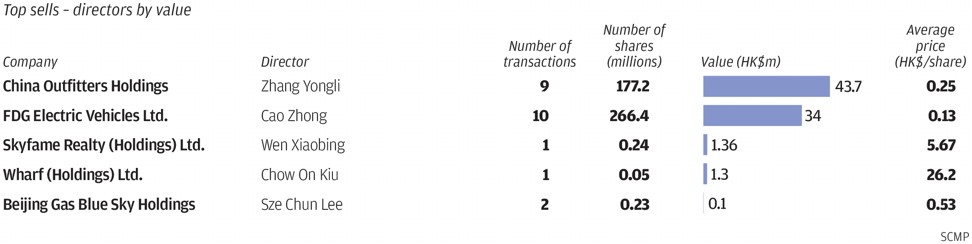

During the holiday shortened week a total of 55 companies recorded 339 purchases worth HK$1.15 billion (US$146.57 million) compared with 42 companies, 281 purchases and HK$447 million the previous week. The number of companies on the sale side, on the other hand, were sharply down from the previous week’s 14 companies, 78 disposals and HK$308 million.

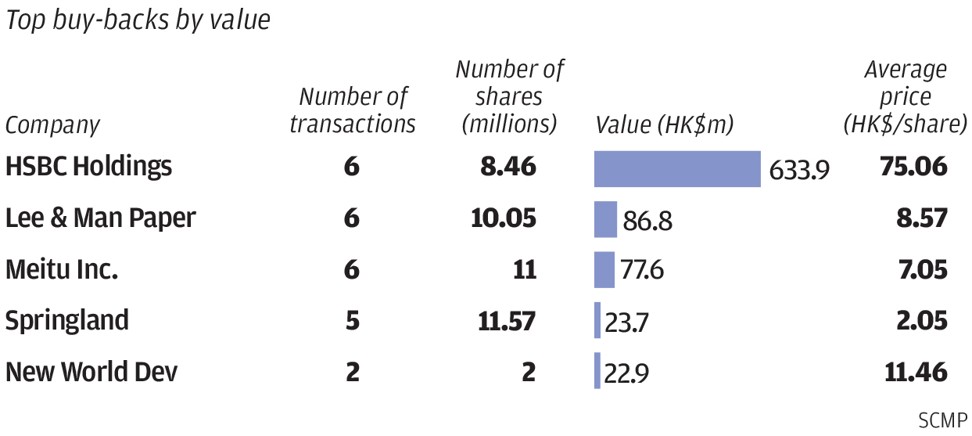

buy-back activity rose with 25 companies that posted 93 repurchases worth HK$949 million based on filings from June 15 to 21. The number of firms and trades were up from the previous five-day total of 19 companies and 75 transactions. The value, however, was sharply down from the previous week’s turnover of HK$1.384 billion.

The surge in director buying and buy-backs coincided with the 3.2 per cent drop in the Hang Seng Index last week. The market is down by nearly 7 per cent since June 7.

Whenever the market drops sharply, we are beginning to see a pattern in the activity among directors of blue chip companies. The steep fall in the market this month prompted purchases in CK Asset Holdings and Sun Hung Kai Properties and buy-backs in New World Development.

Since 1993 directors of blue chip companies have consistently bought shares following heavy market downturns. Another notable buy-back last week was by Hopewell Holdings as the group bought back for the first time since 2016.

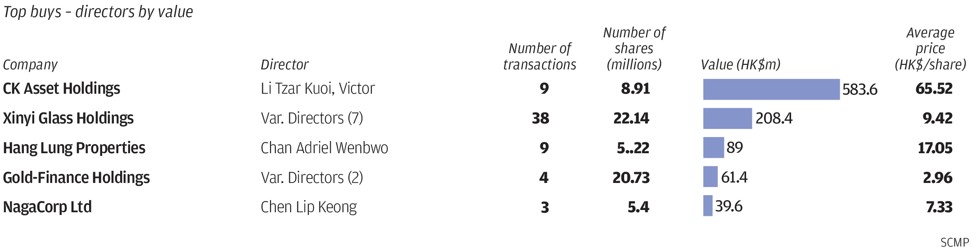

CK Asset Holdings chairman Victor Li Tzar-kuoi picked up where he left off in April with 8.9 million shares bought from June 14 to 19 at an average of HK$65.52 each. The trades, which accounted for 39 per cent of the stock’s trading volume, increased his holdings to 1.056 billion shares or 28.57 per cent of the issued capital. The purchases were made after the stock fell by as much as 7 per cent from HK$69.50 on May 14. He previously acquired 14.64 million shares from April 10 to 25 at HK$65.97 to HK$67.50 each or an average of HK$66.57 each. Before his trades this year, he acquired 1.3 million shares in June 2015 at an average of HK$67.06 each. The stock closed at HK$64.45 on Friday.

Sun Hung Kai Properties executive director Adam Kwok Kai-fai, the 34-year old nephew of chairman Raymond Kwok Ping-luen, bought 781,000 shares in the company from June 14 to 19 at an average of HK$123.94 apiece. The trades increased his holdings to 641.641 million shares or 22.15 per cent of the issued capital.

The stock closed at HK$121.90 on Friday.

New World Development bought back shares for the first time since December 2017 with two million shares bought on June 20 at an average of HK$11.46 each. The buy-back was made after the stock fell by as much as 9 per cent from HK$12.42 on June 7. The group previously acquired 9.46 million shares from September to December 2017 at an average of HK$11.38 each and 37.65 million shares from April to May 2000 atan average of HK$9.65 each. The stock closed at HK$11.30 on Friday.

Property developer and infrastructure firm Hopewell Holdings bought back for the first time since March 2016 with 462,000 shares bought from June 19 to 21 at an average of HK$27.03 apiece. The trades accounted for 37 per cent of the stock’s trading volume. The group previously acquired 7.57 million shares from June 2013 to March 2016 atan average of HK$25.59 each and 33.7 million shares from January 2005 to December 2011 at an average of HK$24.26 each. Also positive this year, Hopewell chairman Gordon Wu Ying-sheung bought 101,000 shares on April 3 at HK$29.25 each. The trade increased his holdings to 244.287 million shares or 28.08 per cent of the issued capital. The stock closed at HK$27.25 on Friday.

Robert Halili is managing director of Asia Insider