Hong Kong’s MPF pension fund members lose HK$6,161 each in worst first-half performance in 10 years

Falling stock markets in Hong Kong and mainland China contribute to the decline, with more market uncertainty seen for the rest of the year

The disappointing performance of the Mandatory Provident Fund (MPF) scheme – the worst first-half result in a decade – compares with a gain of HK$18,502 per member in the first half of last year when stock markets were booming, according to Convoy Financial Services, an MPG advisory firm.

“The loss in the first half of this year is the worst first half-year performance of the MPF since 2008. The loss was a result of the investment return of the MPF funds in the first half of this year dropping by 2.92 per cent, driven mainly by the stock market tumble in Hong Kong and mainland China as a result of the US-China trade disputes,” said Kenrick Chung Kin-keung, director of product management at Convoy.

Chinese equity funds were the worst performers, falling by 8.61 per cent in June and a total of 4.41 per cent in the first half, while Hong Kong equity funds lost 7.78 per cent in June and 4.55 per cent overall, according to data from Convoy.

The Shanghai Composite Index lost 14 per cent in the first half, the worst performer among the world’s major markets. Hong Kong’s benchmark Hang Seng Index was down 3.2 per cent in the first half.

Chung said at present 40 per cent of the HK$800 billion in assets held by the MPF is being invested in Hong Kong equities through pure-stock funds and mixed-asset funds. Seventy per cent of the MPF’s assets are invested in stocks worldwide, with the rest going into bonds and currencies.

“As such, when Hong Kong stocks and other stock markets are doing badly, it is bad news for the members of the MPF, and they are suffering a loss,” Chung said.

However, he urged investors to stay calm and not to rush to shift their choice of funds.

“The trade war tension may ease soon if China and the US could reach an agreement. Stock markets will be able to bounce back when that happens.

“Employees, particularly younger ones, are expected to put their money into the MPF for many years before they retire. The stock funds will outperform other investments for the long term,” Chung said.

The MPF, launched in 2000, is a compulsory retirement scheme that covers 2.8 million employees and self-employed people.

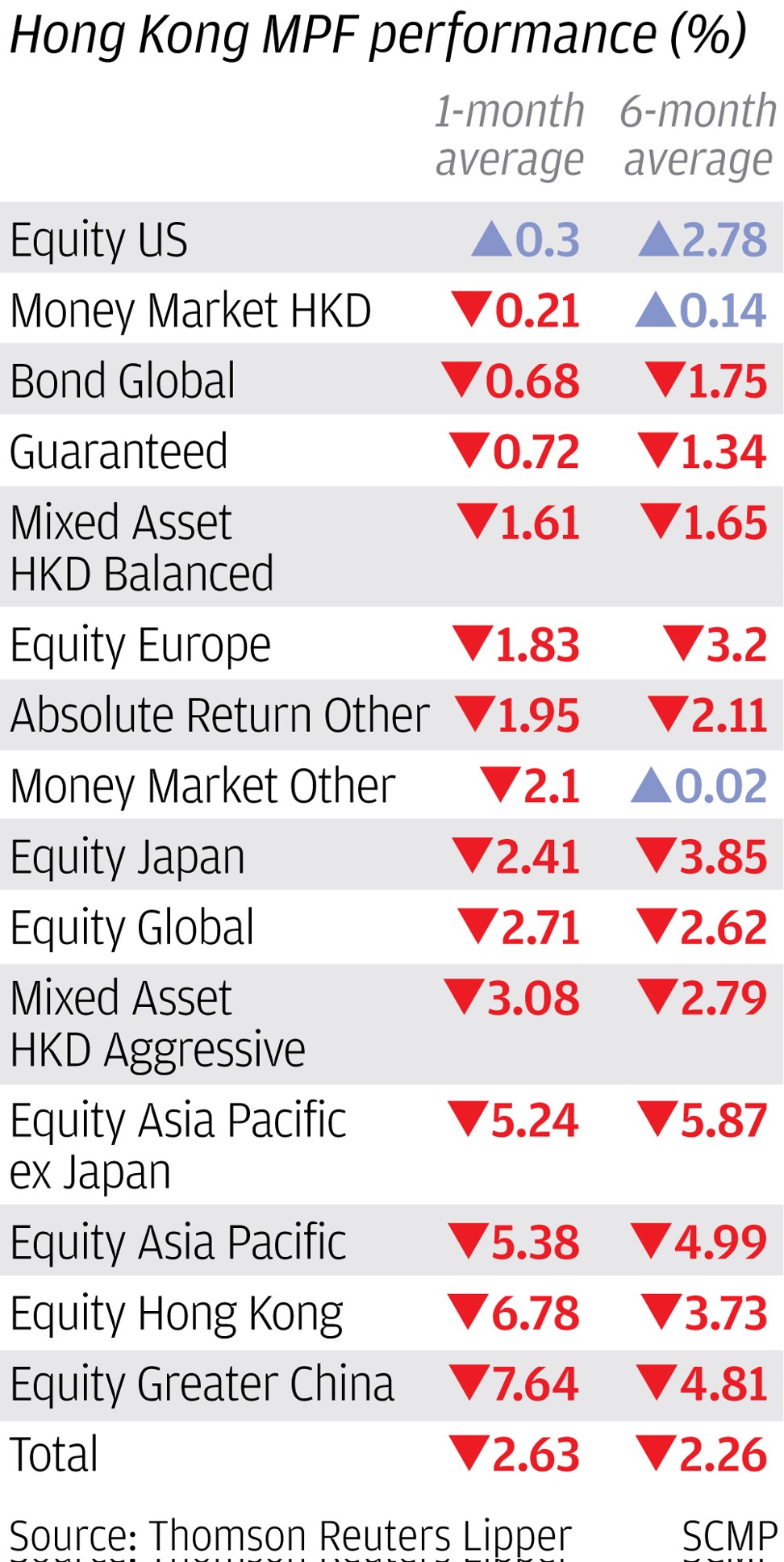

According to data tracked by Thomson Reuters Lipper, the 465 investment funds of the MPF lost 2.65 per cent in June and fell 2.26 per cent in the first half of this year.

The worst performers among individual funds were Korean stock funds, which lost 8.86 per cent in the first half, followed by Asia-Pacific excluding Japan equity funds with a 5.87 per cent loss and Hong Kong equity funds with losses of 3.37 per cent, according to Thomson Reuters Lipper.

The best performers in the first half were US stock funds, which gained 2.78 per cent, followed by US money market funds with gains of 0.93 per cent. Bond funds denominated in Chinese yuan gained 0.39 per cent, the data showed.

Elvin Yu, a principal at pension consultancy Goji Consulting, said the trade dispute between the US and China, the sharp fall in the yuan in the past few weeks and other sources of uncertainty such as US interest-rate rises and Brexit, have all hit the performance of stock markets in Hong Kong, mainland China and Asia.

“Looking ahead, the market in the second half of this year will remain full of uncertainties. We are expecting to see more volatility in the second half in stock and bond markets worldwide,” Yu said.

“Investors should also adopt a diversified approach, such as investing in global funds to spread their risks. Multi-asset funds would be a good choice but I would suggest opting for mixed asset funds which have higher weighting in stocks than in bonds. This is because the bond prices will continue to suffer negative impacts from any rises in US interest rates in the second half of this year,” Yu said.

Ben Kwong Man-bun, a director of KGI Asia, also saw volatility ahead.

“The MPF is likely to suffer from market uncertainties in the near term. However, US President Donald Trump needs to face midterm elections in November and he may introduce some policies to stimulate the economy to win the voters’ support. These measures may also benefit global stock markets worldwide, which could eventually help the MPF’s performance to improve,” Kwong said.