Property companies prominent as Hong Kong directors, firms trade own shares

Greenland Hong Kong, Shimao Property and China Evergrande among those involved in director buying or buy-backs even as the stock indices fall

Hong Kong directors’ trading of their own companies’ shares remained high in the latest week, while buy-back activity surged, with property firms to the fore amid a decline in the overall stock market.

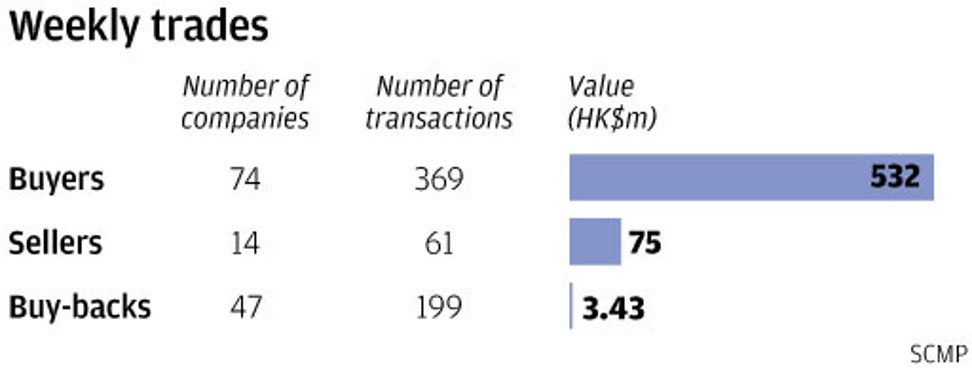

Buyers outweighed sellers with 74 companies recording 369 purchases worth HK$532 million (US$67.8 million) versus 14 firms with 61 disposals worth HK$75 million, based on filings to the stock exchange during the holiday-shortened week of July 3 to 6.

The number of companies and trades on the buying side were consistent with the previous week’s five-day totals of 81 firms and 472 purchases. The buying value, however, was sharply down from the previous week’s HK$1.13 billion. Sales were up from the previous week’s 10 companies, 43 disposals and HK$68 million.

Meanwhile, company buy-back activity surged for the third straight week, with 47 companies posting 199 repurchases worth HK$3.43 billion, based on filings from June 29 to July 5. The four-day figures were up from the previous five-day totals of 36 firms, 186 trades and HK$2.94 billion

Director trading and company buy-back activity has been heavy since the market started falling after the first week of June, with the Hang Seng Index dropping from 31,512 points to a low of 28,182 points last week.

The buying support has been strong in the past three weeks with 83 companies recording director and or buy-back trades that accounted for between 10 per cent and 89 per cent of each respective stock’s trading volume in the market.

In contrast, only six companies recorded insider sales that accounted for 15 per cent to as high as 84 per cent of each respective stock’s trading volume.

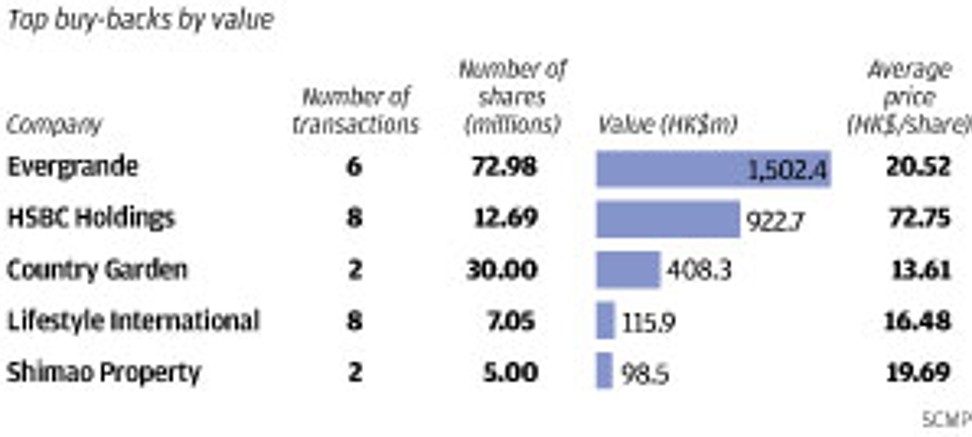

The trading focus was once again on property stocks, with rare buy-backs in Greenland Hong Kong Holdings, Shimao Property Holding and China Evergrande Group. The repurchases were made following sharp falls in their share prices.

There were rare acquisitions by Greenland’s honorary chairman, Wang Weixian, who recorded his first on-market trades since 2010 with 4 million shares purchased from June 27 to July 4 at an average of HK$2.91 each. The trades were made after the stock fell by as much as 41 per cent from HK$4.67 in the last week of January.

The trades increased his holdings to 405.259 million shares, or 14.51 per cent of the issued capital. He had previously acquired 1.64 million shares from June to July 2010 at an average of HK$3.24 each, 4.05 million shares in October 2008 at HK$1.12 each and 875,000 shares from January to April 2008 at an average of HK$3.34 each. The stock closed at HK$2.87 on Friday.

The Greenland Group bought back for the first time since October 2015, with 1.8 million shares purchased from June 29 to July 5 at an average of HK$2.92 each. The company had previously acquired 62 million shares from July to October 2015 at HK$5.40 to HK$3.08 each, or an average of HK$3.98 each, 4.6 million shares in June 2009 at HK$2.63 each and 7.5 million shares from October to November 2008 at HK$0.42 to HK$0.80 each, or an average of HK$0.62 each.

Mainland property developer Shimao Property Holdings meanwhile bought back for the first time since December 2016, with 5 million shares purchased on July 5 at HK$19.69 each. The trade was made after the stock plunged by 24 per cent from HK$26 on June 15. Despite the fall in the share price, the company resumed buying back at a sharply higher price than its previous acquisitions.

It had previously acquired 85.5 million shares from July to December 2016 at an average of HK$10.20 each, 84.1 million shares from September to October 2011 at HK$7.24 to HK$5.39 each, or an average of HK$6.12 each, and 56.2 million shares from October to November 2008 at HK$3.05 to HK$4.74 each, or an average of HK$3.76 each. The stock closed at HK$19.86 on Friday.

Also among property firms, China Evergrande Group bought back for the first time since April 2017, with nearly 73 million shares purchased from July 3 to 5 at HK$20.80 to HK$19.32 each, or an average of HK$20.59 each.

The trades, which accounted for 34 per cent of the stock’s trading volume, were made after the stock fell by as much as 39 per cent from HK$31.55 in October 2017. Despite the fall in the share price, the company resumed buying back at sharply higher prices than its previous acquisitions.

It had previously acquired 723 million shares from March to April 2017 at HK$6.21 to HK$9.31 each, or an average of HK$8.70 each, 2.05 billion shares from July 2015 to January 2016 at HK$3.31 to HK$6.81 each, or an average of HK$5.42 each, and 1.76 billion shares from January to July 2014 at HK$2.80 to HK$3.46 each, or an average of HK$3.32 each.

Before the buy-backs since 2014, Evergrande acquired 110.63 million shares in July 2011 at HK$5.93 each. The stock closed at HK$20.65 on Friday.