Has Hong Kong’s stock sell-off run too far? Property directors seem to think so

Share accumulation by directors of property companies is a potential sign that the share sell-off has been overdone, with many stocks now below fair value

Directors of property companies continued to dominate insider buying this week, reflecting the fifth straight week that the real estate sector has outpaced other sectors.

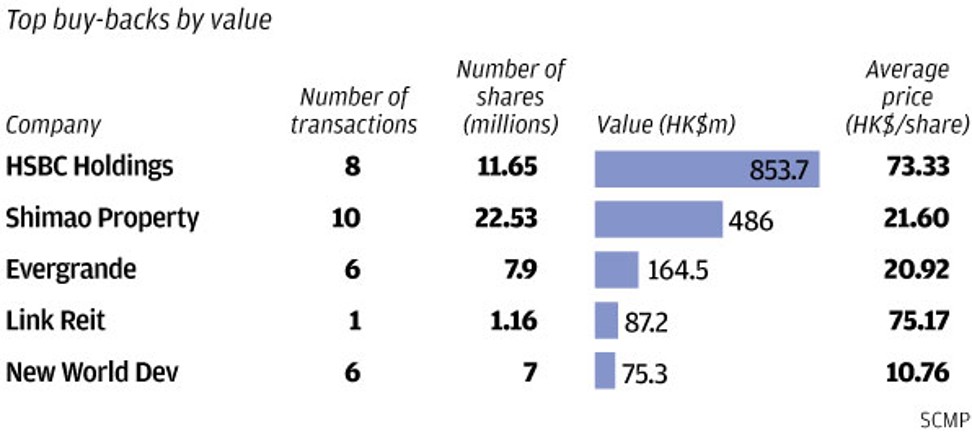

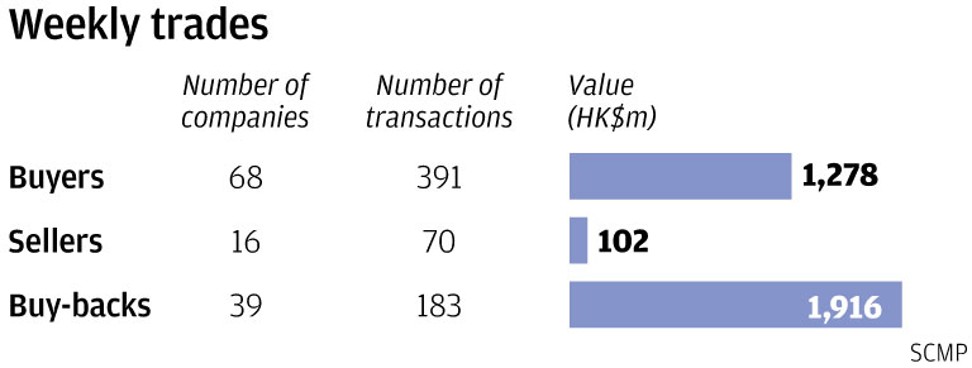

A total of 68 companies posted 391 transactions worth HK$1.278 billion (US$162.90 million) for the week ended Friday, down from the previous week’s 81 companies and 454 purchases. The buy value, however, was sharply up from the previous week’s acquisitions worth HK$840 million.

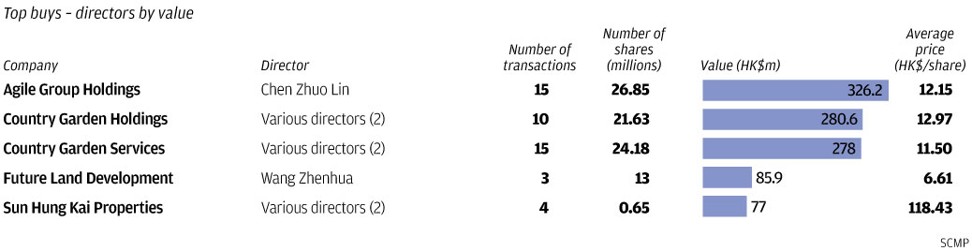

Directors of property developers and property-related companies took the top five spots in terms of insider share buying by value.

Agile Group Holdings chairman and founder, Chen Zhuolin, has been very active this month with 45.6 million shares bought from July 3 to July 18 worth HK$544 million. The purchases, which accounted for 31 per cent of the stock’s trading volume, were made at an average of HK$11.93 each.

The aggressive activity by the chairman this month indicates strongly that the stock is undervalued at current levels with a potential upside of 30 per cent based on the 950,000 shares that he acquired in April at HK$15.35 each. The chairman has a positive track record buying Agile shares since 2008 with three of his previous four buy clusters resulting in price gains within a one-year period. The stock closed at HK$11.70 on Friday.

Another mainland property-related stock in the top buyers list is Country Garden Services Holdings, with two directors picking up 28.2 million shares from July 10 to July 16 at an average of HK$11.43 each. The purchases accounted for 22 per cent of the stock’s trading volume.

Sun Hung Kai Properties is also worth mentioning this week as chairman Raymond Kwok has been buying shares in the run up to and during the sales of two large property developments this month.

St. Martin in Tai Po which generated HK$720 million last week, bringing the total sales in the development in the past two weeks to 229 units worth HK$1.87 billion. Perhaps buoyed by the strong sales, the chairman picked up a further 602,000 shares on July 13 at HK$118.42 apiece. He previously acquired 1.94 million shares from June 25 to June 29 at an average of HK$119.05 each and 856,000 shares in April at an average of HK$122.75 each. The acquisitions are his first trades in the company’s shares since December 2016. Sun Hung Kai’s shares have fallen in step with the market, easing 9 per cent since the first week of June to HK$117.00 on Friday. The purchases by the chairman this year indicate that the stock is undervalued at up to HK$123.70 per share.

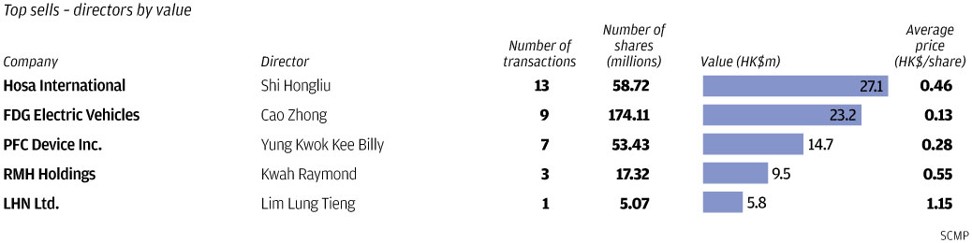

While directors of property stocks have been ramping up their purchase activities in the past month, not all insiders have been bullish. Kerry Properties chairman Wong Siu Kong sold 622,000 shares from June 26 to July 18 at an average of HK$37.74 each. The trades reduced his holdings by 12 per cent to 4.684 million shares or 0.32 per cent of the issued capital.

The disposals were made after the stock fell by as much as 16 per cent from June 20. Wong previously sold 1.2 million shares from November 16, 2017 to January 12 at an average of HK$36.03 each. Before his trades since November 2017, the Chairman acquired 48,000 shares in September 2015 at HK$22.61 each and sold 300,000 shares in January 2015 at HK$28.04 each. The chairman’s disposals will have a minimum impact on the share price with his recent sales accounting for less than 5 per cent of the stock’s trading volume. Investors should trade with caution in the near-term as the chairman’s sales indicate that the company is fairly valued at HK$40 per share. The counter closed at HK$36.40 on Friday.

Another stock that recorded sales during the steep market correction is film distributor Nine Express. The group’s CEO, Zhang Li, 29, resumed selling after the stock fell by 20 per cent from his sale price in June, with 1.62 million shares sold on July 17 at 30 Hong Kong cents each. The trade reduced his holdings by 10 per cent to 14.656 million shares or 0.41 per cent of the issued capital. He previously sold 8.43 million shares on June 28 at 37 Hong Kong cents each. Before joining the group, Zhang was an investment manager in the Mainland with four years under his belt. The counter closed at HK$0.28 on Friday.

Robert Halili is managing director of Asia Insider