Ascletis Pharma, Asia’s first pre-profit listed biotech, plunges in Hong Kong three days after debut

Analysts warn the fall in drug makers bodes ill for the other unprofitable biotechs queuing up to list

Shares of Ascletis Pharma, the first early-stage biotechnology company to list in Hong Kong under new rules, tumbled on Friday, their third day of trading.

Other pharmaceuticals fell too, a trend that bodes ill for a slew of biotech firms lining up to go public, according to analysts.

The Chinese pre-profit drug maker plunged 15.5 per cent to close at HK$10.02 on Friday, bringing the total loss since the shares’ debut on Wednesday to 32 per cent. The shares finished their first day of trading unchanged from the initial public offering price of HK$14 but have slumped over the last two days.

People are not even buying drug firms that have profits, not to mention these biotech firms that are not making money

The decline came as market sentiment continued to deteriorate on the back of escalating trade tensions between the US and China. The Hang Seng Index has sunk 3.9 per cent this week, the worst performance since early February.

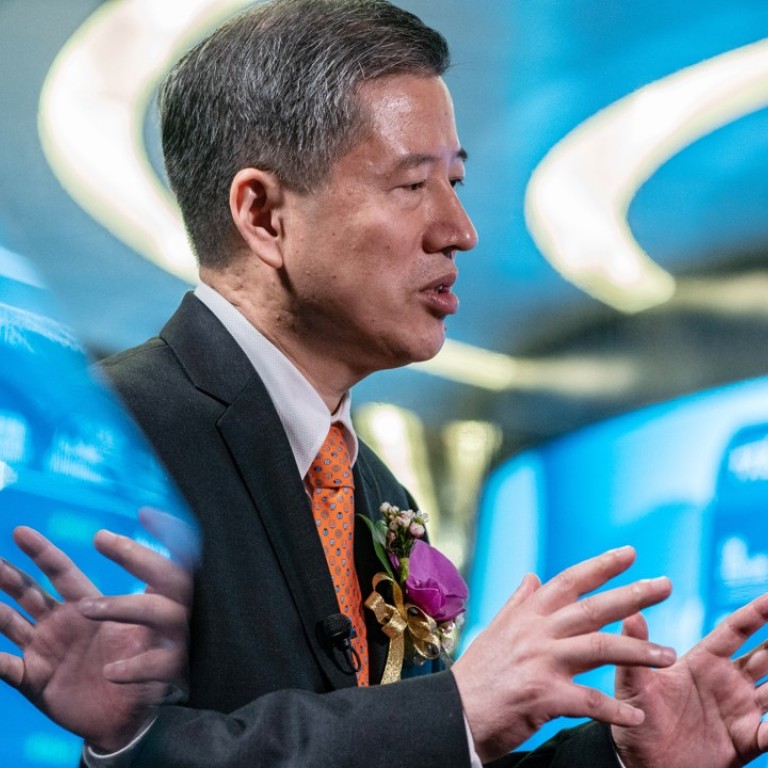

“People are not even buying drug firms that have profits, not to mention these biotech firms that are not making money,” said Kingston Lin King-ham, a director at AMTD securities brokerage.

“It’ll be very hard to attract investors for the biotech firms to be listed.”

A recent safety scandal over vaccines in China also weighed on the pharmaceutical sector, as it involved several companies listed in the mainland.

At least seven biotech firms are applying to go public in Hong Kong, after new listing rules took effect on April 30 allowing them to list even if they are yet to generate revenue or profit. The rule changes are an effort by Hong Kong Exchanges and Clearing, operator of the city’s bourses, to turn it into a hub for early-stage biotech listings.

Ascletis, which develops antivirus, cancer and liver disease drugs, raised over HK$3.1 billion (US$395 million) of funds in its initial public offering before its shares went live on Wednesday.

BeiGene, a Nasdaq-listed cancer drug maker seeking a dual listing in Hong Kong, was also met with a lukewarm response from retail investors. Brokers estimate the retail tranche of its IPO is likely to only just sell out, with combined margin lending for investors standing at only HK$250 million.

Lin said investors would favour large listed pharmaceuticals rather than new shares, because the valuation of the former fell with the broader stock market.

Blue-chip stock Shijiazhuang Pharma Group, for example, which has a HK$123 billion market cap, fell 4.1 per cent to HK$19.66 on Friday. And cancer treatment developer Genscript Biotech plunged 14 per cent to HK$16.2.