Hong Kong regains crown from New York as the No 1 market for raising funds

Eighty-four companies raise US$28.6 billion in the first nine months, up 220 per cent from a year earlier

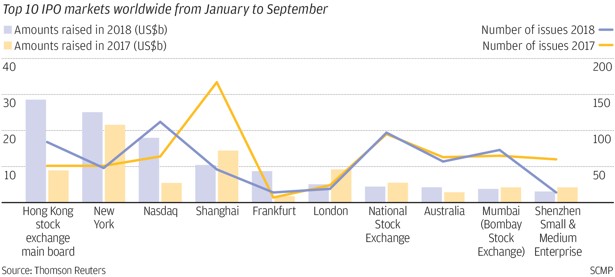

Hong Kong beat New York for the first time in 18 months to reclaim the crown as the No 1 market worldwide for IPOs in the first nine months of this year, as the listing reform led to a slew of companies raising funds in the city, according to data from Thomson Reuters.

This also marked the first time Hong Kong has risen to the top of global IPO rankings since it fell to fourth place in the first quarter of 2017 behind New York, Shanghai and Shenzhen, the quarterly data showed.

Where do blockbuster IPOs stand as the fizz goes out of Hong Kong’s stock trading debuts?

Eighty-four companies raised US$28.6 billion through IPOs on Hong Kong Exchanges and Clearing’s main board in the first nine months of the year until Wednesday, up 220 per cent from the US$8.93 billion raised a year earlier.

New York, the top IPO market worldwide since the first quarter of 2017, dropped to second place as 48 companies raised US$25.1 billion during the first nine months. Nasdaq ranked third at US$18 billion while Shanghai took fourth place at US$10.44 billion.

The driving force behind the HKEX’s IPO boom was the listing reform in April, which attracted three big technology blockbusters from July to September. About 42 per cent of IPO funds raised so far were by telecommunications firms, hi-tech firms accounted for 5 per cent, retail 19 per cent, financial 13 per cent, real estate 7 per cent and others accounted for the rest.

A year earlier 61 per cent of the funds were raised by financial firms.

The largest global IPO so far this year was telecom tower operator China Tower’s US$6.9 billion fundraising in August, the biggest since Postal Savings Bank of China’s US$7.6 billion Hong Kong listing in 2016.

Meituan Dianping rises on Hong Kong debut after US$4.2 billion IPO, pushes co-founder’s net worth to US$5.3 billion

The local bourse, which implemented its biggest listing reform in 25 years in April, allowing companies with dual shareholding structures, new economy as well as the biotech firms without profit or revenue to list here, attracted two mega dual-class shareholding structure companies.

Smartphone maker Xiaomi launched its US$5.4 billion Hong Kong IPO in July and China’s food delivery service platform Meituan Dianping raised US$4.2 billion this month.

Dual class shareholding companies allow founders and key management to own shares with more voting rights than other shareholders, which is favoured by many technology and new economy companies.

The city was the No 1 IPO market worldwide from 2009 to 2011 as well as in 2015 and 2016.

Together with main board and GEM, funds raised by 144 IPOs in Hong Kong stood at US$29.1 billion in the first nine months, up 208 per cent from a year earlier. It was also the highest amount raised in a decade, Thomson Reuters data showed.

Gordon Tsui Luen-on, managing director of Hantec Pacific, said IPOs in Hong Kong will continue to grow but warned of difficulties ahead.

“Many companies have been rushing through with their IPOs in recent months. The real reason behind the strong IPO market may be that the listing hopefuls have a bearish outlook.”

He added that many IPOs in recent months could only fix their offer price at the low end and some have seen their shares drop below the offer price on debut.

The benchmark indexes of both Hong Kong and Shanghai exchanges this year have dropped more than 20 per cent from their peak and briefly entered bear markets, as the ongoing US-China trade war has hurt investment sentiment.

Accounting and consulting firm Deloitte, however, is more positive.

It expects the strong IPO momentum in Hong Kong to continue in the coming months as the listing reform gives many tech and biotech companies more flexibility, said Edward Au, co-head of Deloitte China’s national public offering group.

Bourse chief confident Hong Kong will net world’s biggest IPO candidate Saudi Aramco

Deloitte estimates that a total of 220 new companies, including 10 unicorns, will launch their IPOs this year, up 33 per cent from last year. These companies are expected to raise about HK$300 billion (US$38.41 billion), up 134 per cent from last year.

“Hong Kong is likely to remain at the top of the IPO ranking for the rest of this year,” Au said, but he cautioned that the ongoing US-China trade war is dampening overall investment sentiment in Hong Kong and this could make investors think twice about whether to buy biotech firms that have yet to register revenue or profit.