BMW becomes first global brand to take control of Chinese venture

German car giant spends US$4.1 billion to increase its stake in Brilliance China Automotive by a quarter to 75pc

BMW is spending €3.6 billion (US$4.1 billion) to control its Chinese joint venture, a deal that will give it more power over the German car giant’s business in the world’s biggest car market.

The agreement with Brilliance China Automotive Holding makes BMW the first carmaker to take advantage of China’s policy to let foreign companies take majority control of their local partnerships. The car maker said on Thursday it is increasing its stake in the venture with Brilliance to 75 per cent from the current 50 per cent.

We are now embarking on a new era. China is quickly becoming an important development and production base for BMW new energy vehicles

The move gives BMW a bigger say over its business in China, and allows it to retain a larger proportion of the earnings it generates in the massive market.

China is a key focus for all major car companies, but sales of luxury vehicles have been coming off as the trade war with the US damps consumer demand.

The deal will help BMW lessen the impact of higher tariffs imposed in the trade fight, as it now plans to boost manufacturing capacity in China and expand local production of models including electric cars.

“We are now embarking on a new era,” said BMW chief executive officer Harald Krueger. “China is quickly becoming an important development and production base for BMW new energy vehicles.”

The pact shows China’s government is following through on its pledge to open up the economy to foreign ownership after the 50:50 joint-venture rule that has restricted global brands’ access to the market for decades.

The policy shift also gives carmakers such as Daimler, Volkswagen and General Motors a chance to obtain a bigger control over their businesses in China.

“BMW’s move is a signal that China may be giving a green light for foreign carmakers to lift their stakes in local joint ventures ahead of the original timeline,” said Tian Yang, an analyst with China Securities International in Hong Kong.

Until now, foreign carmakers’ ownership in Chinese joint ventures has been capped at 50 per cent. China said in April it was scrapping the limit for electric-car ventures as soon as this year. For commercial vehicles, the cap will be eliminated in 2020 and the one for passenger vehicles will end in 2022, the government said at the time. BMW said on Thursday its deal will be completed in 2022.

The agreement proved a drag on Brilliance shares, however. Other Chinese car stocks have also slumped amid investor concerns that companies will be left with a smaller share of their ventures’ future earnings should global partners increase control.

While Brilliance is getting a hefty payment from BMW for the added quarter stake, it is reducing its holding in a partnership that accounted for most of its profit last year.

The shares, the second-worst performer this year among Chinese car stocks traded in Hong Kong, were halted early on Thursday. Brilliance has a market capitalisation of about US$7 billion.

Shares in BAIC Motor, a partner of Daimler, fell as much as 18 per cent while SAIC Motor Corp, Volkswagen’s local companion, declined 4.6 per cent.

Investors are now looking to Mercedes-Benz to see when it might raise the stake in its joint venture with BAIC Motor. If that happens, it will definitely cut contribution to the Chinese carmaker and hurt their profits

“Investors are now looking to Mercedes-Benz to see when it might raise the stake in its joint venture with BAIC Motor,” China Securities’ Tian said. “If that happens, it will definitely cut contribution to the Chinese carmaker and hurt their profits.”

All global car companies in China are now approaching their Chinese partners over their joint-venture stakes, Brilliance CEO Qi Yumin said at the Shenyang event.

“Being the first usually means we have to face a lot of questioning,” Qi said. “But we’d rather do it earlier rather than waiting till 2022 to sit down and start the negotiations.”

BMW is the biggest exporter of vehicles from the US to China, putting it among major companies most exposed to a trade war. BMW has warned that trade tensions could drag on profits in coming months. Last year, the carmaker shipped more than 100,000 sport utility vehicles to China from its Spartanburg plant in South Carolina in the US.

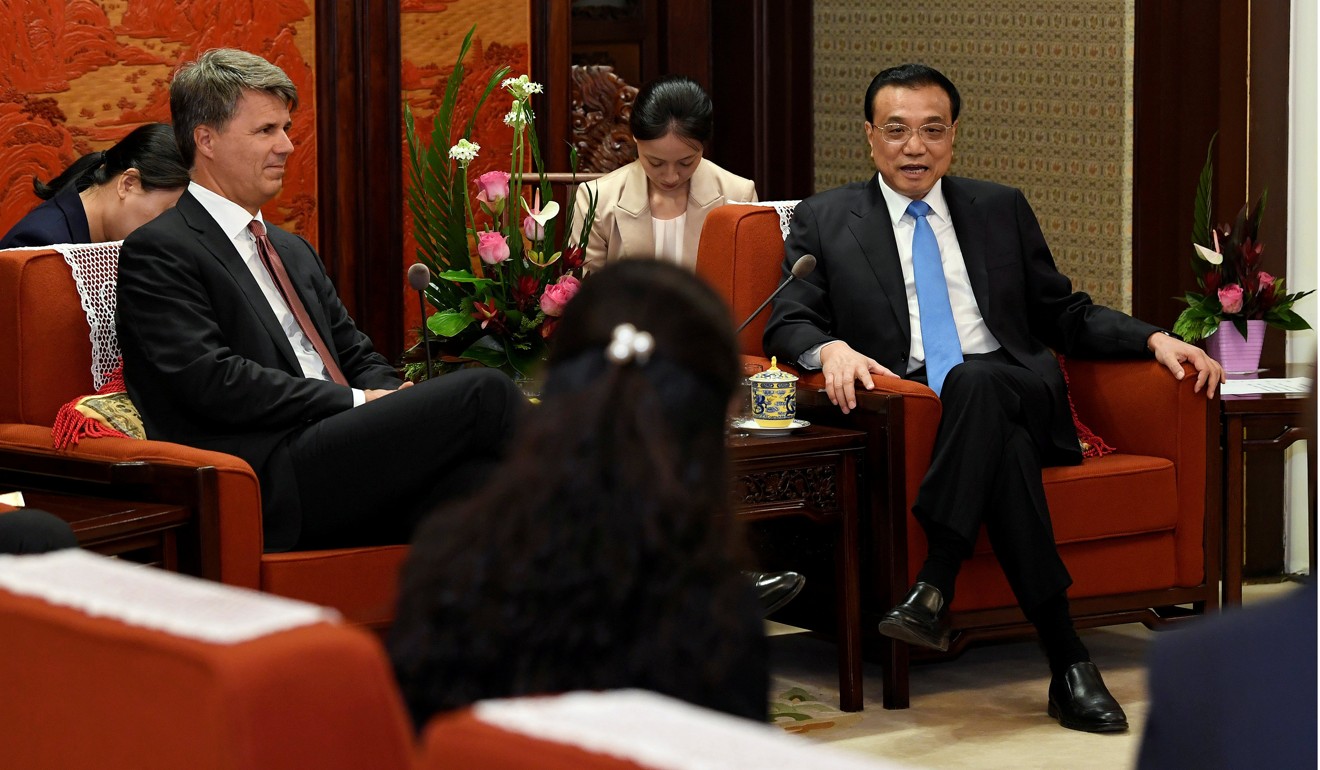

Krueger met Chinese Premier Li Keqiang on Wednesday in Beijing. He said China will not only become BMW’s biggest market but also an important manufacturing hub to make cars for export to other markets, according to a Chinese government website.

The BMW-Brilliance joint venture will invest about €3 billion to expand its plant structure, doubling its annual manufacturing capacity to more than 650,000 vehicles from the early 2020s on, Krueger told reporters in Shenyang.

BMW will start making its first pure-electric vehicle in China under the joint venture with Brilliance by 2020. The model will be sold in China and also exported.

China and Germany are forging closer ties with each other as trade relations worsen with the US. Krueger was in Berlin in July during a summit between Li and German Chancellor Angela Merkel. Among discussions were opportunities to open up China more to foreign investment.