Brilliance Auto shares plunge by almost a third as BMW plans to buy control of Chinese joint venture

Carmaker’s Hong Kong-listed shares tank as investors fear the stake sale will reduce future profits

BMW’s key Chinese partner, Brilliance Automotive, plummeted by almost a third on Friday morning in Hong Kong, after it announced the German car giant will pay €3.6 billion (US$4.2 billion) to take control of their joint venture.

The deal will see BMW increase its stake in the partnership to 75 per cent from 50 per cent and makes it the first company in China’s vehicle sector to take advantage of Beijing’s removal of foreign-ownership limits.

News of the deal has alarmed investors, who fear Brilliance Auto will be left with a smaller share of future earnings from the joint venture.

Several investment banks cut their ratings or target prices for Brilliance Auto, including Bank of America Merrill Lynch and Nomura, while UBS said the sale of the stake could cost Brilliance Auto’s least half its profits.

Brilliance Auto, a state-owned car company headquartered in Shenyang, briefly dropped 30 per cent to HK$7.51 on Friday morning before recovering slightly to close 27 per cent lower at HK¥7.90.

Brilliance Auto said in a filing to the stock exchange on Thursday evening that it had agreed to the deal in which BMW will spend €3.6 billion to acquire a 25 per cent stake in BMW Brilliance Automotive (BBA) from Shenyang Jinbei Auto, a wholly owned subsidiary of Brilliance Auto.

The deal will not be completed until 2022, when a law that prevents foreign car makers owning more than a 50 per cent stake in a joint venture ends.

BMW said it will extend its partnership term with Brilliance Auto to 2040.

Brilliance Auto is not the only Chinese partner of BMW. In 2017, the famed German brand formed another joint venture with Great Wall Auto to produce electric BMW Mini vehicles.

BMW’s request to take control of BBA came after the Chinese central government announced in April it would scrap foreign-ownership limits on local car firms and open up the market by 2022.

The filing on Thursday said the new agreement has received support from the Chinese government.

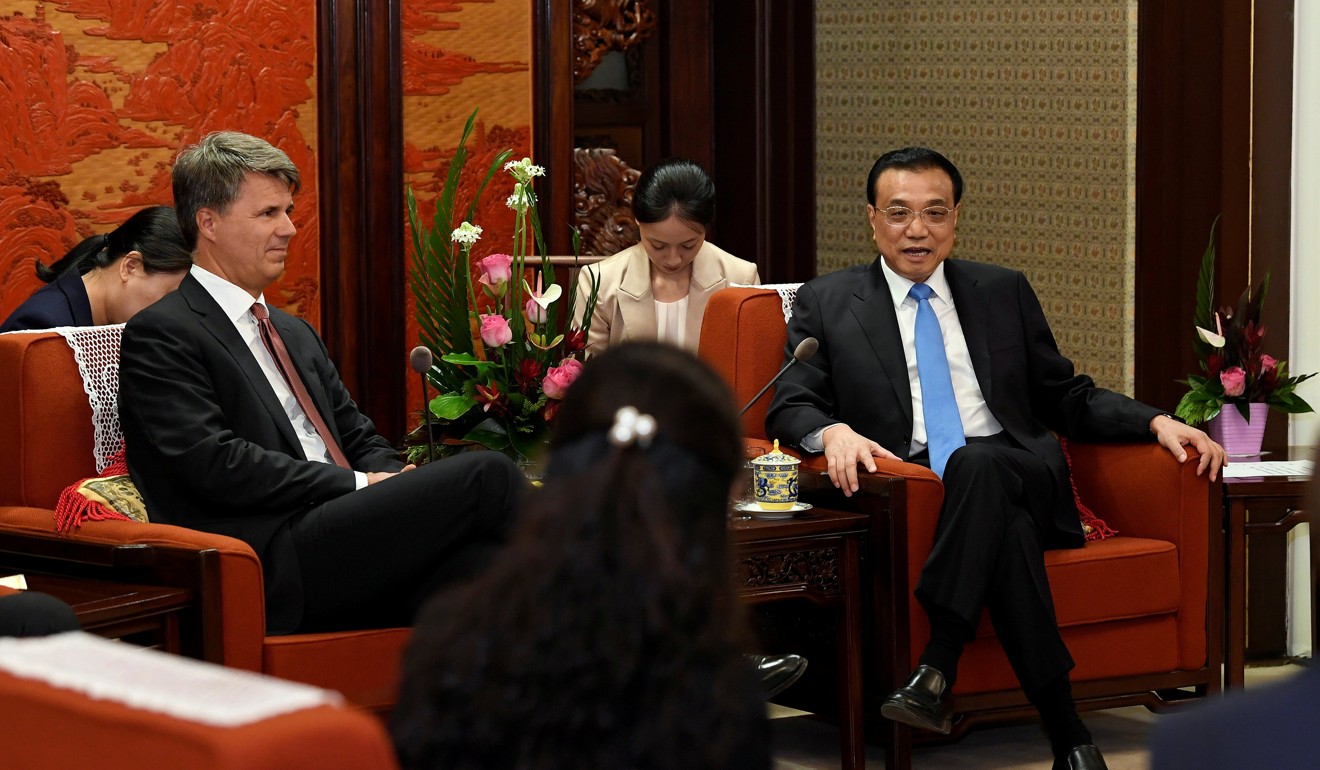

On Wednesday, Premier Li Keqiang said during a meeting with BMW’s chief executive officer Harald Krueger that the deal showed “China will not change its opening-up policy, and instead will open up further and deeper”, according to a story posted on the central government’s website.

In 2017, BMW sold 560,000 vehicles in China, two thirds of which were manufactured in its Shenyang factories. In the next three to five years, the annual production capacity of BBA will increase to 650,000, according to the company.

Starting in 2020, BMW will launch its all-electric BMW iX3, which will be assembled at the Dadong factory in Shenyang for delivery to Chinese customers or export to the rest of the world.

In August, BMW posted a 6 per cent drop in its second-quarter, pre-tax profit, attributing it to a sales slowdown in the Chinese market, as consumers postponed car purchases on the back of higher tariffs. The company said it will expand its local manufacturing and sales network to reduce the cost and mitigate impact of increasing trade tariffs.