Prenetics is first Hong Kong firm to take genetic test kit for cancer risk direct to consumers

- The kit will assess the user’s risk of developing eight hereditary cancers within his or her lifetime

- The nascent consumer genetic-testing market is projected to grow at 15 per cent annually to reach US$928 million by 2023

Prenetics, a Hong Kong-based biotechnology start-up, is about to become the first home-grown company to sell genetic profiling kits that test for the risk of cancer directly to the consumer.

Until now the four-year-old company, backed by Alibaba Group Holding, Ping An Insurance Group and Lippo Group, has supplied non-clinical genetic test kits to insurers, who then pass them on as gifts to their policyholders.

On Thursday, it will venture into direct sales for the first time via its online platform and health food retailer Green Common’s shops.

The kit will assess the user’s risk of developing eight hereditary cancers within his or her lifetime. It covers ovarian, colorectal, melanoma, prostate, uterine, pancreatic, breast and stomach cancers.

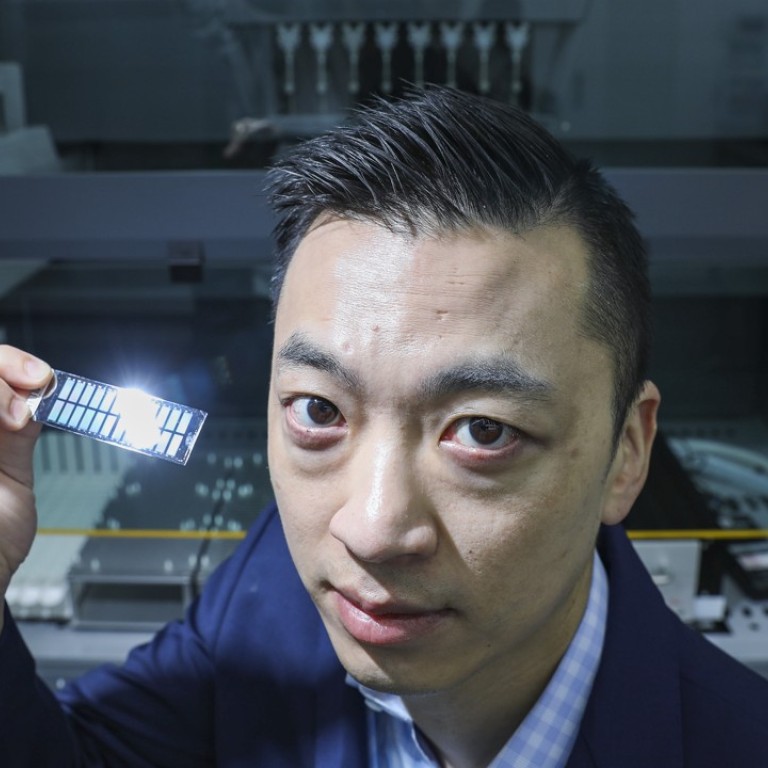

“If you have a genetic mutation associated with higher risks of cancer, the earlier you know about it, the earlier you can do something about it,” Prenetics’ chief executive Danny Yeung said in an interview, citing his own test three years ago when he was 37.

“I was the only one in the company to have the gene mutation associated with increased risk of colon cancer and I was scared. But I was happy that I had a colonoscopy much earlier than the suggested age of 50, knowing that half of the colon cancer cases were stage-two or later when first diagnosed, which could be too late.”

Lifestyle changes saw him lose 10 kilograms and cut out red meat from his diet to reduce the risk of developing.

Yeung said the risk assessment carried out by the kits is based on “a lot of validated studies and scientific research out there, and millions of well studied samples”.

Prenetics will also launch a kit on Thursday that uses saliva to profile users’ sensitivity to and needs for certain foods and nutrients, helping them achieve their health and fitness goals.

Prenetics and its overseas peers such as California-based 23andMe and Israel-based DayTwo are tapping into the nascent but fast-growing consumer genetic-testing market, valued by research firm ResearchAndMarkets at US$359 million last year. It is projected to grow at 15 per cent annually to reach US$928 million by 2023.

The test kits are directly marketed to consumers for reasons such as ascertaining genetic ancestry and assessing the risk of diseases, without consulting a doctor.

Prenetics’ cancer-risk profiling product will cost HK$2,499, while its nutrition genetics test will be priced at HK$1,499.

Yeung said such tests have become affordable thanks to a 99 per cent fall in genetic-sequencing costs in the last 15 years, made possible by new technologies.

Prenetics will provide free access to a genetic counsellor to explain the results and tell users of steps they can take to lower the risks.

Yeung said its cancer-risk products are not subject to regulatory approval in Hong Kong, since they do not involve the provision of medical advice nor diagnostics service.

In response to the Post’s queries on how such products and genetic counsellors may be regulated, Hong Kong’s Department of Health said: “Members of the public should seek medical consultation before receiving any laboratory testing services – including genetic tests – targeted at diagnosis or treatment. [They] should avoid procuring medical laboratory testing services on their own accord, as the quality and professional expertise of such services may be in doubt.”

The response did not mention scenarios where the genetic tests are produced and marketed for non-diagnosis and non-treatment purposes, such as health and wellness.

Prenetics, which acquired UK-based DNAFit in April, sources just over half its revenue from Hong Kong and Southeast Asia and the rest from the UK.

It struck an agreement this month to form a joint venture with Shenzhen-listed clinical genetic tests provider Berry Genomics to expand into mainland China, a difficult market to crack given its restrictions on human DNA exports and sensitivity to foreign firms handling mainlanders' DNA samples.

Berry said in a Shenzhen Stock Exchange filing that it will hold a 20 per cent stake, while two other mainland Chinese firms will have stakes of 35 and 45 per cent. Yeung said Prenetics will have a minority stake.

Prenetics’ investors include Ping An Ventures, the venture capital arm of Ping An Insurance Group, Venturra Capital, backed by Indonesia’s Lippo Group, and Alibaba Hong Kong Entrepreneurs Fund, a not-for-profit initiative of e-commerce giant Alibaba Group Holding, owner of the South China Morning Post.