China’s push for technology self-reliance faces reality check, says economist

- Large number of key component suppliers to Chinese tech companies are foreign, says Shaun Roache, Asia-Pacific chief economist at S&P Global Ratings

Foreign companies in Asia are deeply embedded in China’s industry supply chains, making the self-reliance call from Chinese President Xi Jinping both difficult and costly, according to Shaun Roache, Asia-Pacific chief economist for S&P Global Ratings.

The problem is that a large proportion of suppliers in China’s technology industry are foreign based, often with headquarters in Taiwan, South Korea, Japan, and the United States.

Thus far, according to Roache, the push for self reliance has come up against the reality that the tech industry is heavily dependent on global component suppliers.

Of “Level 1” suppliers in China’s supply chain, about 42 per cent, or 323 companies, have overseas headquarters, while 446 are based domestically in China.

The biggest proportion are companies headquartered in Asia-Pacific, excluding China, followed by those headquartered in Europe, and the US.

Of “Level 2” suppliers in China’s supply chain, 47 per cent, or 362 companies have overseas headquarters, versus 405 companies which are based domestically. Among those companies based overseas, 215 are from the Asia-Pacific, while 84 are from the Euro zone and 63 from the US.

A closer look into China’s import basket by Harvard World Trade Atlas shows China’s biggest imports are electronics, industrial machinery, and information and communication services.

China imported US$260 billion worth of semiconductors in 2017, more than its US$162 billion imports of crude oil.

Roache, a former top IMF official who spoke this week at Standard & Poor’s annual financial forum, cited investment restrictions and export controls as among the multiple “supply chain vulnerabilities” affecting China.

Investment restrictions will make it increasingly hard for a Chinese tech producer to bring in foreign technology to improve their own production process, he said.

Meanwhile, export controls will make it harder for some Chinese companies to gain necessary components.

“Export controls can be put on not just US based exporters. It could be exporters from third countries if they have subsidiaries in the US,” Roache said.

He said the combination of trade tariffs, investment restrictions, and export controls will embolden China’s efforts to domesticate its supply chain.

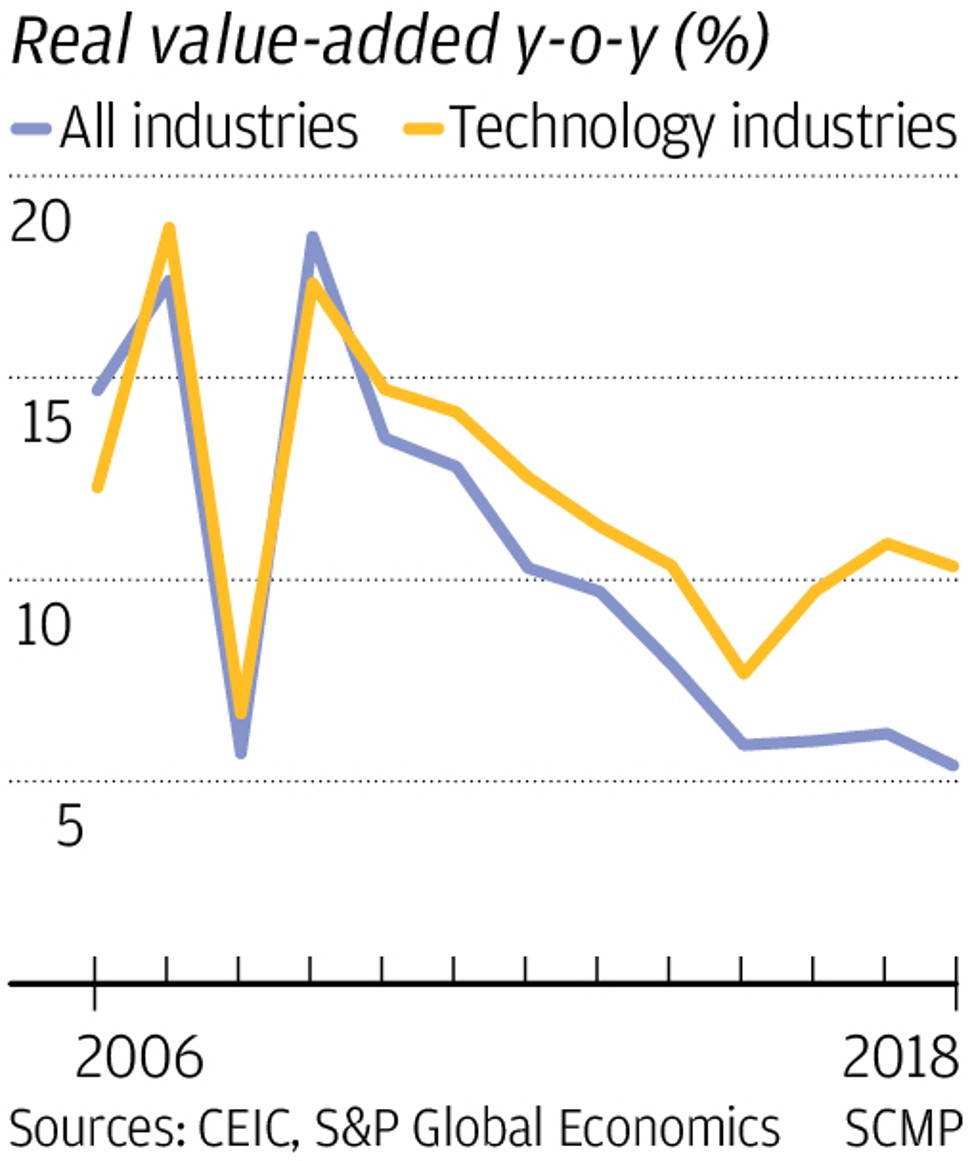

“China is big enough for that to be sustainable. But the growth is probably to become much slower,” he said.

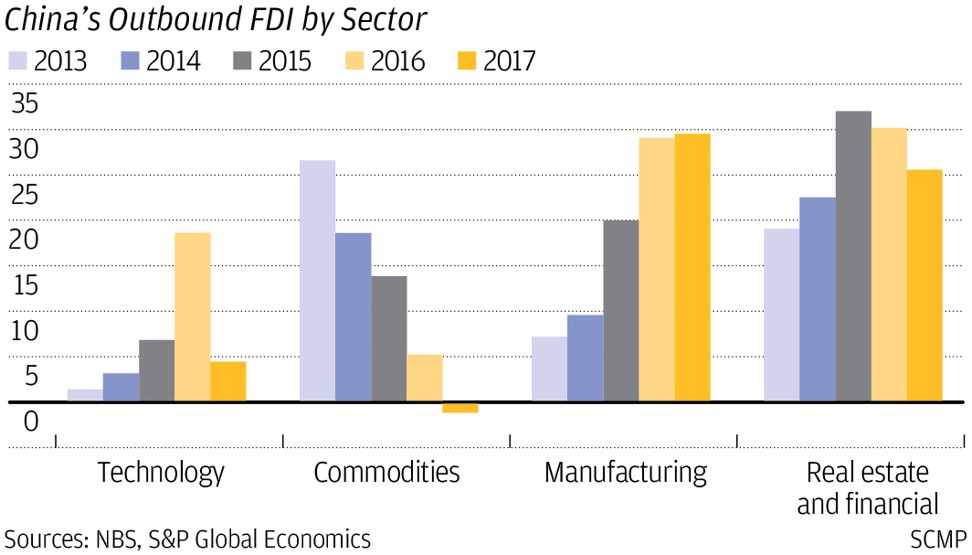

Since the China-US trade war started in 2018, Xi has reiterated several times in public speeches that China should play a stronger role in technology research and development.

In May, during an address to the opening of the joint annual conference of the Chinese Academy of Sciences and Chinese Academy of Engineering, he urged researchers to push ahead in developing core technologies.

The speech came after ZTE was fined US$1.3 billion by US authorities over breaches of trade sanctions on Iran and North Korea.

In his annual New Year’s Eve address, Xi reiterated his appeal for greater self-reliance.

“Consider it from China’s perspective,” Roache said. “Trade partners, particularly the US, are becoming less reliable with a high degree of policy uncertainty.”