Exclusive | Generali CEO: Insurer on the hunt for acquisition opportunities in Asia

- After years of restructuring, insurer looking to grow organically, through acquisitions

- Italian insurer announced a new strategic plan in November

Philippe Donnet is in a buying mood.

After years of restructuring and selling unprofitable businesses at Assicurazioni Generali, Donnet, the Italian insurer’s group chief executive, believes the company is finally in a healthy position to expand its business both organically and through external acquisitions, particularly in “high potential” markets in Asia and in Latin America.

The company unveiled a three-year strategic plan in November designed to improve shareholder returns and increase profitability across its insurance and asset management business. It includes a target of a 6 per cent to 8 per cent compound annual growth rate for earnings per share.

“Definitely, we are now a buyer because we have the money and because this is a good way to grow the group,” the 58-year-old French executive told the Post.

“We are looking at anything that is consistent with our strategy and anything that is consistent with our financial discipline,” he said.

Generali, based in Trieste, Italy, was founded in 1831 and opened its first Asian offices in Hong Kong and in Japan in 1975.

But, much of its premium revenue – more than 70 per cent – comes from just three countries: France, Germany and Italy.

We are growing fast, but we will be very opportunistic in capturing all of the growth opportunities we can capture at reasonable prices

Philippe Donnet, CEO of Generali Group

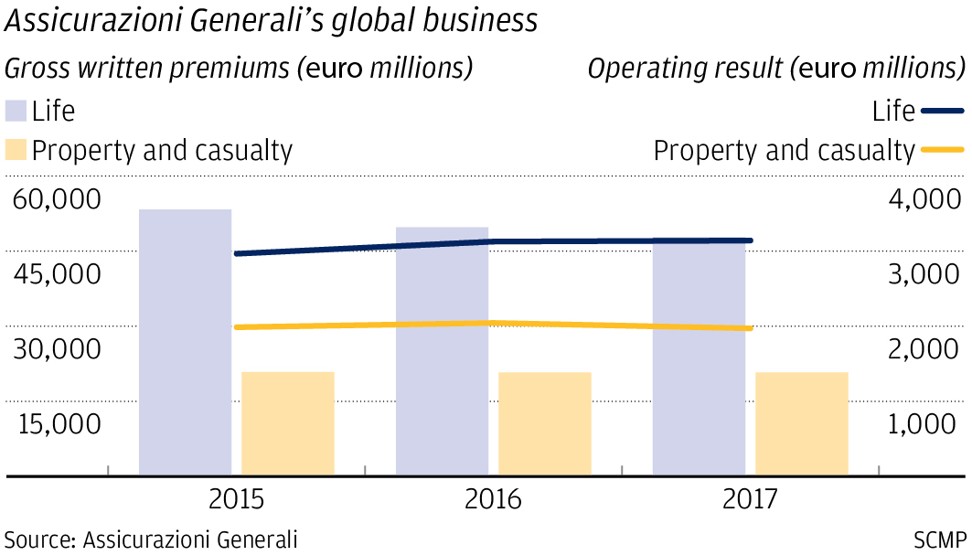

The company had gross written premiums of 49.7 billion euros (HK$444 billion) in the first nine months of 2018. It has nearly 71,000 employees and a presence in almost 60 countries.

Donnet said the group was open to a number of potential acquisitions, including a bancassurance provider in Asia, a property and casualty insurer in Central and Eastern Europe, or even a global health insurer.

Donnet said that acquiring a major health insurance asset would only take place “at a good price”.

“I’m just dreaming, but it’s important to dream,” he said.

In Asia, the insurer is based in 10 markets. These include China, Hong Kong, India, Indonesia, Japan, Malaysia, Philippines, Singapore, Thailand and Vietnam.

“We are growing fast, but we will be very opportunistic in capturing all of the growth opportunities we can capture at reasonable prices because we are disciplined people and we don’t want to pay stupid prices,” said Donnet, who previously served as AXA Group’s regional CEO for Asia-Pacific. He joined Generali in 2013 and became its global CEO in 2016.

“It’s too easy [to pay too much], but the end of the story is always wrong when you do so,” Donnet said. “We are working for the future. We are working for the next generation, but all we do has to be sustainable.”

Generali has operated a joint venture with China National Petroleum Corporation since 2002, when it became the first foreign joint venture that was granted permission to operate in the Chinese general insurance market.

In November, Chinese authorities granted German insurer Allianz the go-ahead to set up the first wholly-owned insurance holding company in Shanghai later this year in an acceleration of the opening up of the country’s banking and insurance sector.

Rather than exploring its own wholly-owned insurer, Donnet said that Generali was pleased with its joint venture partner in China.

“For me what is important is to grow. I prefer to have 50 per cent of a growing and performing company than to have 100 per cent of a small, non-growing and not performing company,” Donnet said.

Part of Generali’s growth strategy is built around capturing clients through partnerships it has with non-insurers, such the retailer Future Group in India; the Thai retail and food conglomerate Central Group; and California Fitness & Yoga Centers in Vietnam.

“We see, together with the Future Group, massive opportunities through digital to maximise and capture customers through that ecosystem,” Rob Leonardi, Generali’s regional officer for Asia-Pacific, said.

In Hong Kong, Generali has a similar partnership with Centaline Property Agency, one of the city’s two largest real estate agencies.

As part of its growth strategy, the company is looking to increase its network of agents, rather than through direct sales to consumers.

Generali has targeted increasing the number of active agents in Asia from 13,000 to 23,000 in the next three years. That said, improving the customer experience through the use of technology is an important part of its strategy, Leonardi said.

Generali can fully service customers through WhatsApp in several markets, including India, he said.

In China, customers can use the popular digital payment systems, such as Tencent Holdings’ WePay and Alibaba Group Holding’s Alipay to pay for coverage, he said. Alibaba is the owner of the South China Morning Post.

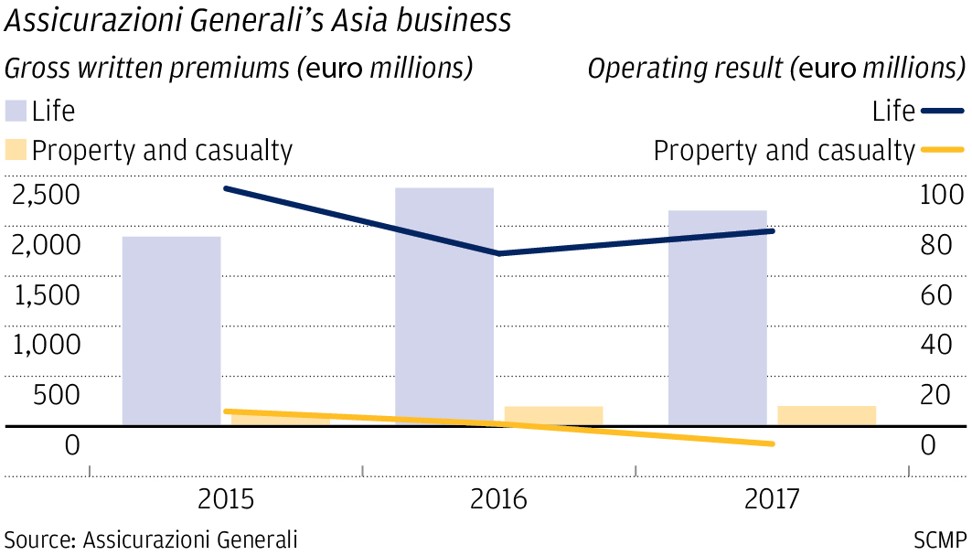

In the first half of 2018, Generali’s life insurance business in Asia had gross written premiums of 1.42 billion euros, or about 6 per cent of its overall life business.

On a premium basis, the property and casualty business in Asia accounted for less than 1 per cent of Generali’s overall property and casualty business and was a money loser in the first half of 2018.

As part of the restructuring, Generali exited a number of countries and sold about a dozen businesses where it did not have enough scale to be competitive, gaining more than 1.5 billion euros from the disposal of those businesses.

The company also agreed to sell 89.9 per cent of Generali Leben in Germany last year and is expected to gain another 1 billion euros for its war chest.

“Thanks to this industrial turnaround plan we are more focused in terms of geography. We are stronger focused in less markets,” Donnet said. “We have a strong capital position and a strong cash position.”

Generali’s business is centred around insurance and asset management products for consumers, professionals and small and medium-sized businesses, with asset management becoming a much bigger part of the business in the coming years, Donnet said.

“For us, asset management is a global business,” he said. “We will look for growth opportunities, not only in Europe, but in Asia and in the US as well.”

Even though he is exuberant about the company’s growth potential, Donnet said the company will remain disciplined in its acquisition strategy.

“It’s not a matter of ego,” Donnet said. “If we don’t find the right opportunities, we’ll find another way.”