Insider share buys hint at upside for L’Occitane International, Guangdong Investment and Shun Tak Holdings

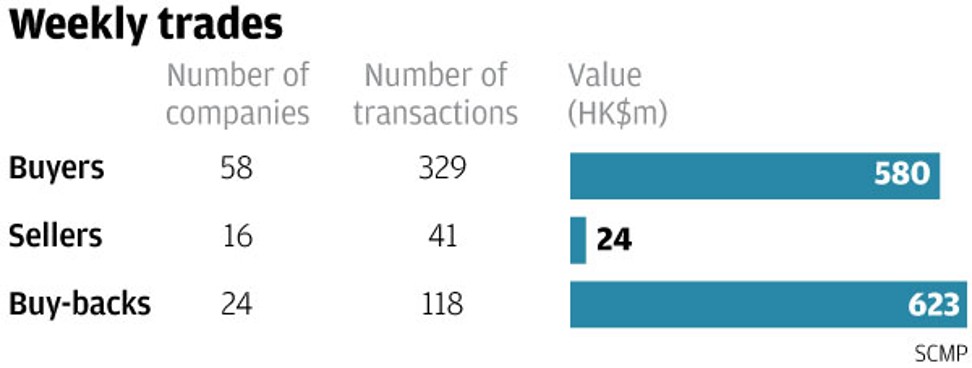

Buying rose for the third straight week as 58 companies recorded 329 purchases worth HK$580 million (US$74.29 million)

The buying rose for the third straight week while the selling among directors fell based on filings on the Hong Kong stock exchange from November 20 to 24. A total of 58 companies recorded 329 purchases worth HK$580 million (US$74.29 million) versus 16 firms with 41 disposals worth HK$24 million.

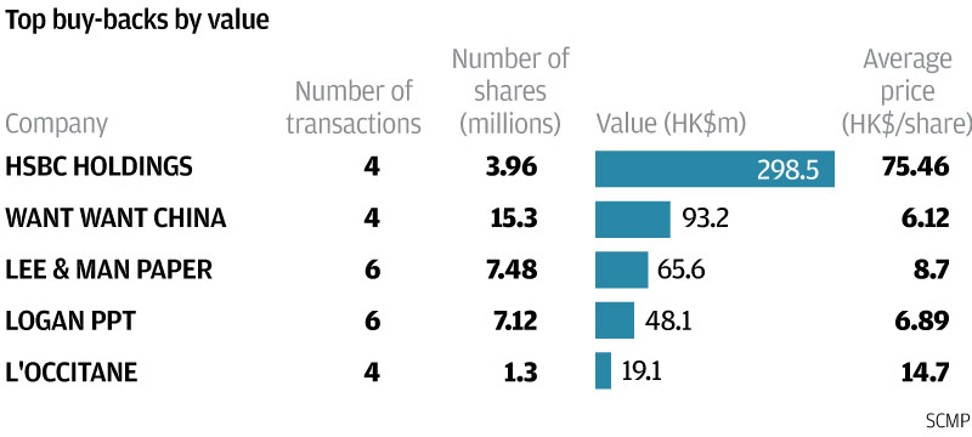

Meanwhile, the buy-back activity rose for the second straight week with 24 companies that posted 118 repurchases worth HK$623 million based on filings from November 17 to 23. The number of firms and trades were up from the previous five-day total of 22 companies and 108 repurchases. The value, however, was sharply down from the previous week’s turnover of HK$1.438 billion.

There were several significant purchases last week with buy-backs and purchases by the CEO in L’Occitane International, rare buys by the managing director of Shun Tak Holdings and purchases by BEA chairman David Li Kwok-po in Guangdong Investment.

L’Occitane International chairman and CEO Reinold Geiger added to his stake in the natural and organic cosmetics retailer with a combined 2.597 million shares bought from November 21 to 22 at an average of HK$14.70 each.

In addition, the company picked up where it left off in June with 1.299 million shares bought from November 21 to 22 at HK$14.70 each. The company previously acquired 1.29 million shares from June 13 to 15 at HK$15.85 each and 671,000 shares on January 24 at HK$15.27 each.

Before the buy-backs this year, the company acquired 1.9 million shares in December 2016 at HK$14.66 each, 6.68 million shares from January to July 2016 at an average of HK$14.56 each and 6.65 million shares from November to December 2011 at an average of HK$14.44 each. Geiger bought 1.299 million shares from November 21 to 22 at an average of HK$14.70 each, which increased his holdings to 1.086 billion shares or 73.59 per cent of the issued capital. He previously acquired 2.5 million shares from January to February last year at an average of HK$12.90 each and 337,000 shares in November 2015 at HK$15.43 each. Geiger was appointed to the board in 1996. The stock closed at HK$14.52 on Friday.

Significant Points

The company and the CEO synchronised their buying as they bought the same number of shares at the same prices each trading day from November 21 to 22

The recent purchases by the company and CEO were made on the back of the 20 per cent drop in the share price since September

The recent purchases were made after the company announced on November 20 a 59.44 per cent drop in first-half profit to HK$10.727 million

The recent purchases by Geiger are his first on-market trades since February 2016

Shun Tak Holdings managing director Pansy Catilina Ho Chiu-king bought 2.572 million shares of the property developer and jetfoil ferry services provider from November 20 to 21 at HK$2.95 each. The trades increased her holdings to 742.160 million shares or 24.39 per cent of the issued capital. She previously acquired 6.24 million shares in January 2016 at HK$2.57 each, 1.37 million shares in August 2015 at HK$3.61 each and 11.5 million shares in May 2009 at HK$3.89 each. Ho was appointed to the board in 2001. The stock closed at HK$3 on Friday.

Significant Points

The purchases by Ho reflect her first on-market trades since January 2016

The purchases accounted for 20 per cent of the stock’s trading volume

The purchases were made on the back of the 22 per cent drop in the share price since June

David Li, who holds the post of independent non-executive director at Guangdong Investment, bought 3 million shares of the water distributor and electric power supplier and property investor from November 22 to 23 at an average of HK$10.74 each. The trades increased his holdings to 15 million shares or 0.23 per cent of the issued capital. He previously acquired 1 million shares on January 24 at HK$10.08 each. Before his trades this year, Li acquired 3 million shares from January to June 2012 at an average of HK$5.18 each, 850,000 shares from September to October 2010 at an average of HK$3.97 each and 550,000 shares in April 2009 at HK$3.36 each. Li was appointed to the board in June 1998.

In another positive sign, the company’s non-executive director Li Wai-keung with 500,000 shares bought January 25 at HK$10.01 each, which boosted his stake by to 2.743 million shares or 0.04 per cent.

However, the insider sentiment is not entirely positive this year as the company’s independent non-executive director Moses Cheng Mo-chi sold 732,000 shares from May 23 to June 9 at an average of HK$11.31 each. The trades reduced his holdings by 24 per cent to 2.268 million shares or 0.03 per cent. He previously sold 150,000 shares from June to July 2016 at HK$11.48 each and 900,000 shares from January to July 2009 at an average of HK$3.58 each. The stock closed at HK$10.44 on Friday.

Significant Points

David Li, an independent non-executive director at Guangdong Investment, recently bought the company’s shares, accounting for 9 per cent of the stock’s trading volume

The recent purchases boosted the tycoon’s holdings by 25 per cent

The purchase by Li in January this year was well-timed as the stock rose by 20 per cent from his purchase price to HK$12.10 in April

Robert Halili is managing director of Asia Insider