As buy-backs head for a historical high in July, will we see a repeat of the 1997 crash?

Mainland property firms top repurchases this month

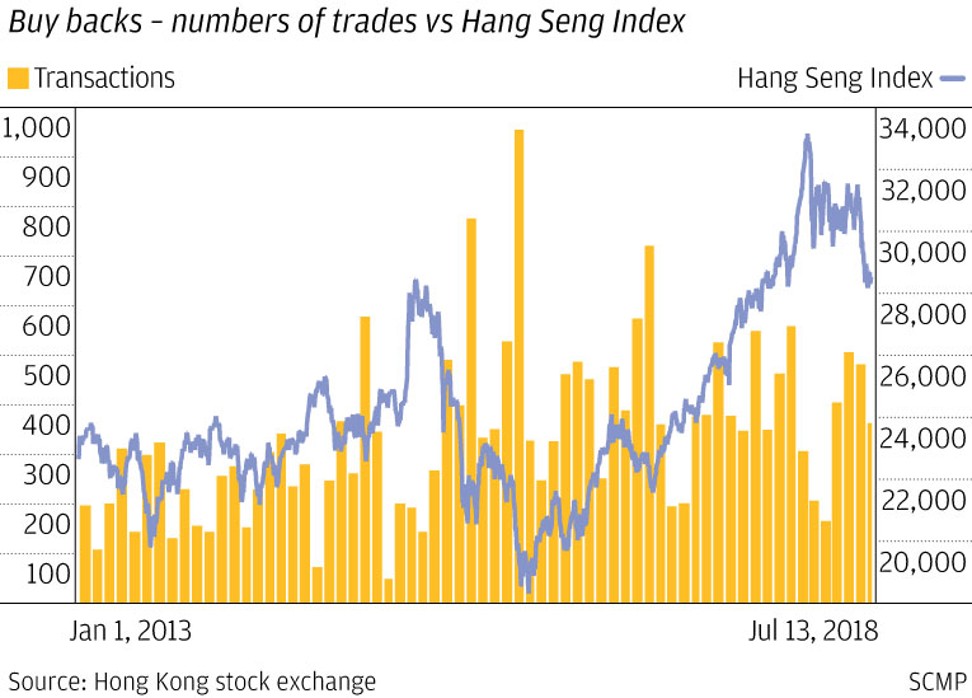

Buy-back activity on Hong Kong exchange is heading for a historical high this month as the repurchase activity has intensified following the steep drop in the market since June.

A total of 52 companies posted 363 transactions worth a whopping HK$6.73 billion (US$857 million) in the first eight trading days of July. The buy-back figures so far this month are already more than the averages for July from 1992 to 2017 of 24 companies, 211 trades and HK$761 million.

Although the correction in the market started in the second week of June, it took until July for listed firms to ramp up their buy-back activity with an average of 22.3 companies, 40.3 trades and HK$748 million recorded per day from July 3 to 12.

The daily average figures so far this month are sharply higher than the daily average of 13.9 companies, 24.7 trades and HK$391 million from June 8 to 29 and significantly more than the daily averages of 9.9 companies, 16.8 trades and HK$147 million from January to June of this year.

With 13 trading days remaining this month, the buy-back total in July 2018 is fast approaching the record high of HK$8.19 billion in July 2015.

If the heavy buy-backs continue, will record highs in July translate into a sustained rebound in the Hong Kong market in the medium-term?

Not likely as the buy-backs so far this month are far below the record highs of 127 companies and 1,783 transactions in October 2008. The buy-backs then were preceded by a sharp drop in the market from 31,492 points in November 2007 to 11,015 points in October 2008.

The market rebounded sharply following the record buy-backs in October 2008 to 22,914 points in November 2009, an increase of 108 per cent.

Comparatively, the fall in the market in the past month of 11 per cent is small compared to the 65 per cent drop from the fourth quarter of 2007 to the fourth quarter of 2008.

The surge in the buy-back activity in the past month is reminiscent of the heavy buy-backs at the beginning of the Asian Currency Crisis in the fourth quarter of 1997, where the market went on a bull run from 7,500 points in the mid-1990s to 16,000 points in 1997.

A total of 94 companies jumped in and posted a then record 583 repurchases worth HK$2.72 billion when the market started falling in October 1997 followed by 52 companies, 539 transactions and HK$1.2 billion in November 1997.

Listed firms reined in their repurchases amid the prolonged market slump. Buy-back activity fell in the ensuing months with an average of 46 companies, 351 trades and HK$320 million from January up until the government stock market intervention in September 1998.

The sector with the heaviest buy-backs in July is property. Eight mainland-based developers have posted 74 repurchases worth HK$3.31 billion. The number of trades and value of repurchases in the property sector represent 20 per cent and 49 per cent of the overall totals.

The list contains several mainland-based or mainland-focused developers such as China Evergrande Group, Shimao Property Holdings, Logan Property Holdings, China Jinmao Holdings and Greenland Hong Kong Holdings.

These five developers have recorded 46 repurchases worth HK$3.25 billion. Aside from the heavy repurchases, the buy-backs by these five firms have accounted for 4 per cent to as high as 33 per cent of their respective trading volumes this month.

What made it more significant was that most of the buy-backs in the property sector were rare – some for the first-time buys since listing.

For retail investors, the stocks with the heaviest purchases and the highest trading volumes are the ones to watch, as the buy-backs will provide strong support in this very volatile market.

The stocks that meet this criteria are China Evergrande, Shimao Property and Greenland Hong Kong. The rarity of their buy-backs also adds significance to their trades, particularly Shimao Property, with the group’s previous buy-backs in December 2016. The shares of Shimao Property, incidentally, rose from its buy-back price of HK$10.20 in December 2016 to a high of HK$26.00 in June 2018.