Buy-back activity among company directors at 25-year high in June as Hong Kong stocks take a hit

Insider buying particularly high among three mainland property developers – Sunac China Holdings, China SCE Property Holdings and Country Garden Holdings

A sharp fall in the Hang Seng Index over the past two weeks provided an incentive for company directors to boost their stock holdings, taking the total value of their purchases to the highest level for the month of June in 25 years, according to data from the Hong Kong stock exchange.

The HK$2.97 billion worth of insider purchases in June is more than triple the monthly average of HK$869 million in the month of June from 1993 to 2018.

A total of 1,307 purchases were made by 140 directors in 113 companies last month.

Separately, based on exchange filings from June 25 to 29, a total of 81 companies recorded 469 purchases worth HK$1.13 billion versus 10 firms with 43 disposals worth HK$68 million, sharply up from the previous week’s four-day totals of 55 firms and 338 purchases worth HK$1.15 billion.

On the negative side, the number of companies and trades were sharply up from the previous week’s seven firms and 25 disposals. The sell value, however, was down from the previous week’s HK$80.6 million.

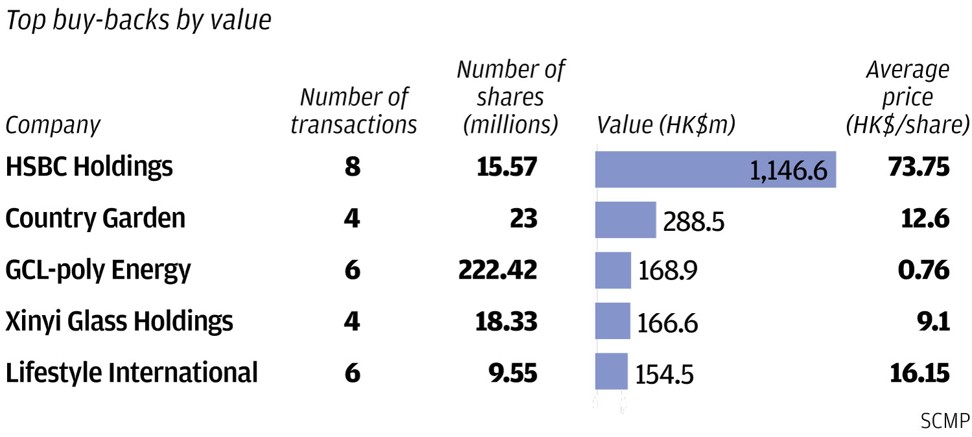

Aside from directors, the buy-back activity rose for a second straight week with 36 companies that posted 184 repurchases worth HK$2.62 billion, based on filings from June 22 to 28. The figures were sharply up from the previous four-day totals of 25 firms, 97 trades and HK$1.23 billion.

Aside from monthly totals, buyers also outnumbered sellers by a wide margin based on buy/sell ratio figures in June. The buy/sell ratio for the number of companies so far in June is 4.3, which is higher than the past six months and the average for the month of June from 1993 to 2017 of 2.4 and 2.1, respectively. Meanwhile, the buy/sell ratio for the number of transactions is 6.6 so far in June, which is higher than the past six months and the average for June from 1993 to 2017 of 4.5 and 3.6, respectively.

Heavy buying continued in property stocks, particularly in mainland property plays, with insider buys in Sunac China Holdings, China SCE Property Holdings and Country Garden Holdings.

CEO Wang Mengde and executive director Shang Yu recorded buys in Sunac China Holdings after the stock fell by as much as 25 per cent from HK$33.55 on June 13 with a combined 1.15 million shares bought from June 27 to 28 at HK$26.20 to HK$25.00 each or an average of HK$25.61 each.

Mengde resumed buying at lower than his acquisition prices earlier this year with 750,000 shares bought on June 27 at HK$25.72 each. The trade increased his holdings to 18.848 million shares or 0.43 per cent of the issued capital.

He previously acquired 450,000 shares bought from May 30 to 31 at an average of HK$29.33 each and 500,000 shares on April 4 at HK$28.80 each. Prior to his trades this year, the CEO acquired 1.35 million shares from November 1 to 6, 2017 at HK$38.00 to HK$36.27 each or an average of HK$37.05 each.

Shang, on the other hand, turned positive after selling shares in July 2014 and in January this year with 400,000 shares bought from June 27 to 28 at an average of HK$25.40 each. The trades boosted his stake to 9.150 million shares or 0.21 per cent. He previously sold 1.2 million shares on January 18 at HK$35.15 each and 4.45 million shares in July 2014 at an average of HK$5.01 each. The stock closed at HK$27.45 on Friday.

Wong Chiu Yeung, chairman and president of China SCE Property Holdings, recorded his first on-market trades in the mainland property developer since December 2017, with 2.2 million shares bought from June 27 to 28 at an average of HK$3.58 each. The trades, which accounted for 9 per cent of the stock’s trading volume, increased his holdings to 2.002 billion shares or 52.36 per cent of the issued capital. The trades were made on the back of the 22 per cent drop in the share price since March 19 from HK$4.62.

He previously acquired 16.3 million shares from November 6 to December 1, 2017 at HK$3.50 to HK$3.29 each or an average of HK$3.40 each and 12.1 million shares in March 2017 at an average of HK$3.00 each. Prior to his trades since 2017, Wong acquired 2 million shares in August 2013 at an average of HK$2.02 each and one million shares in May 2010 at HK$2.28 each. The stock closed at HK$3.72 on Friday.

Country Garden Holdings resumed buy-backs after the stock fell by as much as 22 per cent from its acquisition price in March. The mainland property developer bought 23 million shares from June 27 to 28 at HK$12.90 to HK$12.16 each or an average of HK$12.55 each. The group previously acquired two million shares on March 23 at HK$15.68 each.

Prior to the buy-backs this year, the company acquired 222 million shares from January to November 2017 at HK$4.05 to HK$12.00 each or an average of HK$6.31 each and 1.08 billion shares from January to December 2016 at HK$2.85 to HK$4.48 each or an average of HK$3.75 each.

Also positive this month is executive director Liang Guo Kun with 300,000 shares bought on June 19 at HK$15.57 each, which increased his holdings by 15 per cent to 2.327 million shares or 0.01 per cent of the issued capital. He previously acquired 52,000 shares from June to July 2017 at HK$8.81 each. The stock closed at HK$13.80 on Friday.