Chinese stock traders find small is beautiful as top leaders pledge support for private firms

- The ChiNext gauge is set to beat the Shanghai Composite Index in November for the first time since June

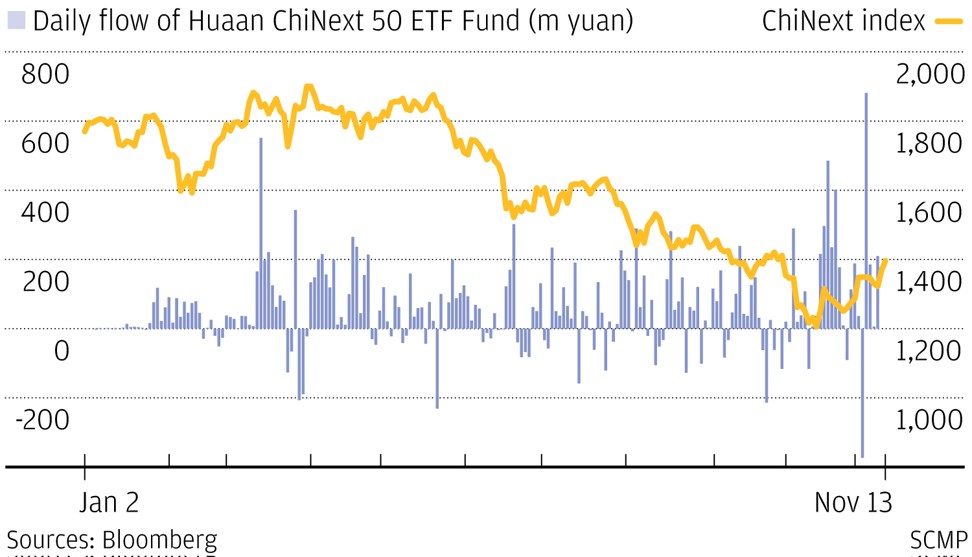

- Traders bought record 681.3 million yuan of Huaan ChiNext ETF fund last Tuesday

Buying has resumed in earnest in Chinese small caps after a barrage of unprecedented moves by China’s top leadership to support smaller and private companies that have been struggling because of a credit crunch.

The ChiNext index, which at one point was the nation’s worst-performing stock gauge this year, has rebounded 9.1 per cent so far this month, compared with a 2 per cent gain for the Shanghai Composite Index and is on track to beat the benchmark in five months.

Traders poured 681.3 million yuan (US$98 million) into an exchange-traded fund linked to the small-cap measure last Tuesday, the biggest one-day inflow on record, according to Bloomberg data.

President Xi Jinping said in a meeting with entrepreneurs early this month that the government will “unswervingly” support growth of the private sector.

The central bank too said it will encourage re-lending and debt issuances to aid private companies, while the banking regulator aims to extend at least 50 per cent of new loans to the private sector in three years.

And a recent meeting of the State Council, China’s cabinet, also said it will crackdown on defaults on debt repayments to smaller firms.

“The government policy is now heavily tilted towards smaller companies and that has made the sector the biggest investment theme in the market now,” said Wu Kan, an investment manager at Soochow Securities in Shanghai. “They will outperform companies on the main board, say, in the following month.”

The ChiNext index rose 1.7 per cent to 1,392.05 on Tuesday in Shenzhen after surging 3.5 per cent a day earlier. It has trailed the performance of the Shanghai Composite every month since June and had been down as much as 31 per cent in 2018, as smaller companies were battered by a liquidity squeeze and margin calls arising from falling shares pledged as collateral for loans.

The ChiNext companies are still on the way of recovering from a boom-to-bust cycle. The index remains down 65 per cent from its all-time high in 2015 after speculators ramped up its valuation to 134 times earnings. The multiple now stands at 37.9 times, Bloomberg data showed.

Policy support from top leaders and falling valuations have gripped traders’ attention to small-caps. They have spent a total of 12.2 billion yuan buying Huaan ChiNext 50 ETF Fund this year, whose size has grown almost 38 fold this year.

Sungrow Power Supply, China’s biggest maker of solar inverters, has led the rebound on ChiNext companies this month, with the stock rising 40 per cent. It was followed by Xingyuan Environment Technology and Shenwu Environmental Technology, whose shares have gained at least 24 per cent.