8 per cent of Hong Kong retirees used MPF funds to help their children buy property, finds survey

HKIFA study also shows retirees were too conservative with investments made once they had encashed their MPF

Some Hong Kong retirees are using their Mandatory Provident Fund savings to help their children buy property, according to a survey conducted by the Hong Kong Investment Funds Association.

A poll of 600 retired people conducted between July and September last year found that 8 per cent had used their MPF to either help their children buy property, or support them with other needs such as education.

“We cannot fault parents for caring, but they should pay attention to the potential risks that arise when they neglect to prepare for their own retirement,” says Stephen Fung, the chief executive of the MPF at insurance company AIA.

The MPF is a compulsory retirement scheme, with more than HK$843 billion (US$107.45 billion) in assets, that covers 2.8 million employees in Hong Kong. Employers and employees each pay 5 per cent of the staff member’s salary into different investment funds run by providers. The employees can get their contribution and investment returns at the age of 65.

Separate surveys conducted by HSBC and AIA last year also show that while Hong Kong retirees could not expect their children to support their retirement, it was the children’s property dreams or other financial needs that were eroding their parents’ retirement savings.

Home prices in Hong Kong are among the most expensive globally, which has resulted in many youngsters not being able to afford to buy their own homes without their parents’ help.

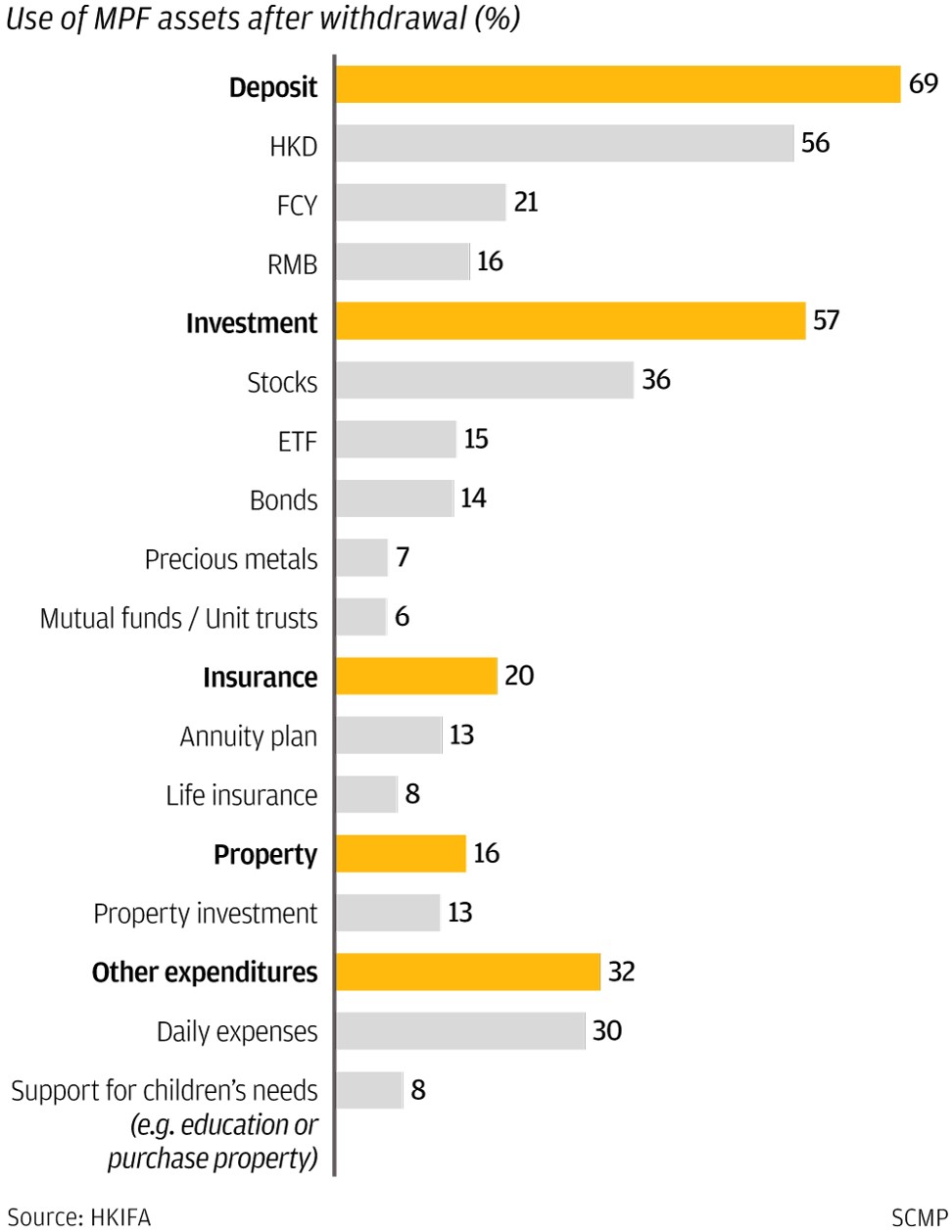

The HKIFA survey also shows that retirees were too conservative with their investments after withdrawing their MPF amounts, with 69 per cent having put some money in bank deposits, 36 per cent in stocks, 20 per cent in insurance products including annuity, and 8 per cent using their MPF to help their children. The respondents could choose more than one option.

And while they were not willing to take too high a risk, the retirees expected a return of about 11 per cent.

“It is not just Hong Kong – overseas experience also shows that globally most retirees are investing in a very conservative way,” said Chris Durack, chairman of the pensions subcommittee at HKIFA.

“Such an approach, however, may led to very low returns, which would not be able to support their retirement life. People are living longer nowadays, and it is important for retirees to seek professional advice on their investments after they withdraw their money from the MPF,” he said. “The retirees should invest relatively more in stocks, or other higher return products, after their retirement to get a reasonable return.”

To expect an annual return of 11 per cent from the investment of the sum withdrawn from the MPF is not realistic. “They should target for a return of between 4 per cent and 5 per cent every year, which is good enough to beat the inflation in Hong Kong, which now stands at about 1.7 per cent,” said Durack.

The survey also shows retirees want to see more principal guaranteed investment products that could provide them with regular interest payments.

Durack said the annuity products provided by insurance companies and the public annuity to be launched by the Hong Kong Mortgage Corporation would fit such needs. The government’s proposal to give tax benefits to people who buy annuity would also help promote the products, he said.