Hong Kong company directors’ selling of shares increases in latest week

Lee Shau-kee unloads HK$261 million worth of shares in his Henderson Land Development, while Country Garden vice-chairwoman Yang Huiyan buys 26.3 million shares in her firm

Hong Kong company directors sold more shares in their own firms in the week of December 11 to 15 while buying activity was little changed from the previous week, according to filings to the Hong Kong stock exchange.

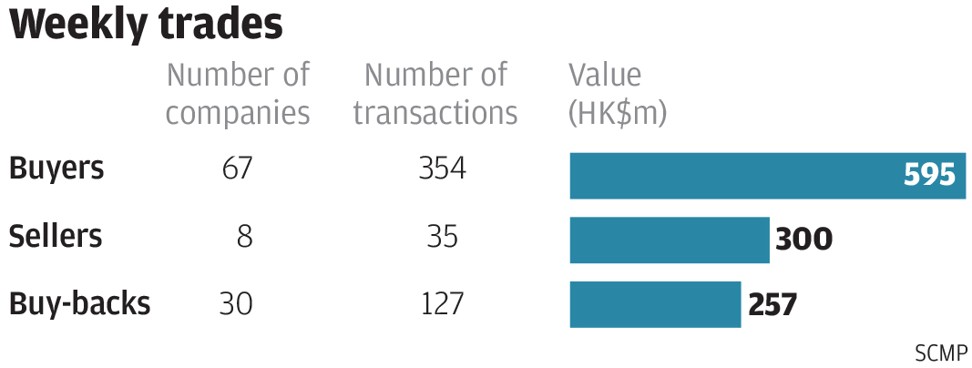

A total 67 companies recorded 354 purchases worth HK$595 million (US$76.2 million) in the week, not far off from the previous week’s 70 firms and HK$561 million, but the number of purchases was down from the previous week’s 413.

In comparison, eight firms recorded 35 share disposals worth HK$300 million, up from the previous week’s 28 disposals worth HK$248 million, although the number of companies reporting sales was down from the previous week’s 12.

Meanwhile, buy-back activity fell, with 30 companies seeing 127 repurchases worth HK$257 million, based on filings from December 8 to 14. The figures were down from the previous five-day totals of 39 firms, 172 trades and HK$518 million in value.

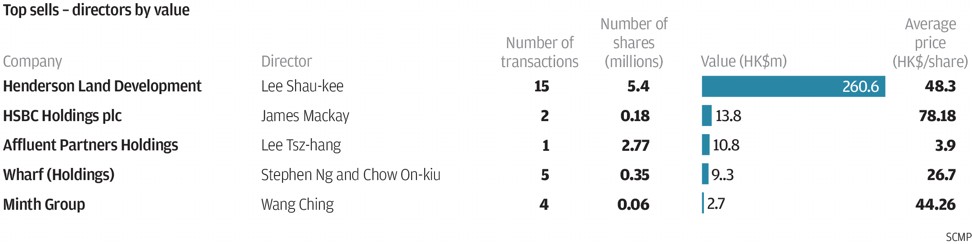

The rise in the selling value last week was mainly due to tycoon Lee Shau-kee, who unloaded a further HK$261 million worth of shares in his Henderson Land Development. That brought his total disposals this month to 9 million shares worth HK$442 million at an average of HK$49 per share. They were Lee’s first disposals in Henderson Land since 1993, according to filings. Henderson Land shares closed at HK$49.85 on Friday.

Among other significant trades last week, PC gaming hardware and accessories maker Razer Inc’s independent non-executive director, Kevin Chau Kwok-fun, acquired 600,000 shares from December 12 to 13 at an average of HK$3.86 each. The stock closed at HK$3.78 on Friday. The purchase was the first corporate shareholder trade in Razer since it listed on November 13, and came after an 18 per cent drop in the share price since a November 14 price of HK$4.69. Chau bought the shares at near the IPO price of HK$3.88.

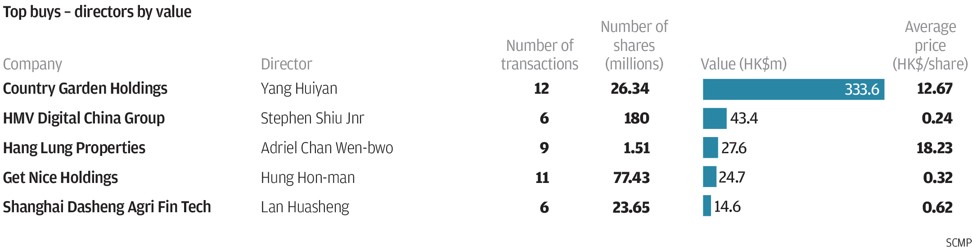

Elsewhere, property developer Country Garden Holdings’ vice-chairwoman, Yang Huiyan, bought 26.3 million shares in the firm between December 6 and 11 at HK$12.26 to HK$12.98 each, or an average of HK$12.67 each, increasing her holdings to 12.312 billion shares, or 57.82 per cent of the issued capital.

She recorded buys on every trading day from December 6 to 11 and the purchases accounted for 12 per cent of the stock’s trading volume.

Yang, 36, was appointed executive director in December 2006 and vice-chairwoman in March 2012. Among her previous purchases, she had bought 2 million shares in October 2008 at HK$1.78 each, 546,000 shares in May 2009 at HK$3.69 each, 87.5 million shares from June to December 2013 at average of HK$4.32 each, 6 million shares in March 2014 at HK$3.11 each and 129.9 million shares from January to October 2016 at an average of HK$3.52 each.

Other directors to buy shares in Country Garden this year were the vice-president, Liang Guokun, who purchased 352,000 shares from June 26 to July 7 at HK$8.76 to HK$9 each, or an average of HK$8.81 each. The purchases increased his holdings to 2.027 million shares, for a 0.01 per cent stake. Executive director Yang Ziying, Yang Huiyan’s sister, bought one million shares on June 6 at HK$9.99 each, which boosted her stake to 6.750 million shares, or a 0.03 per cent stake.

Company president Mo Bin acquired 4.32 million shares between May 16 and 22 at HK$7.59 to HK$8.22 each, or an average of HK$7.65 each, which increased his holdings by 40 per cent to 15.030 million shares or a stake of 0.07 per cent. Country Garden stock closed at HK$13.04 on Friday.

Country Garden bought back 222 million shares between January 5 and November 6 at HK$4.05 to HK$12 each, or an average of HK$6.31 each. Prior to the buy-backs this year, the company bought 1.08 billion of its own shares from January to December 2016 at HK$2.85 to HK$4.48 each, or an average of HK$3.75 each. The repurchases since January 2016 were the company’s first buy-backs since it listed in April 2007.

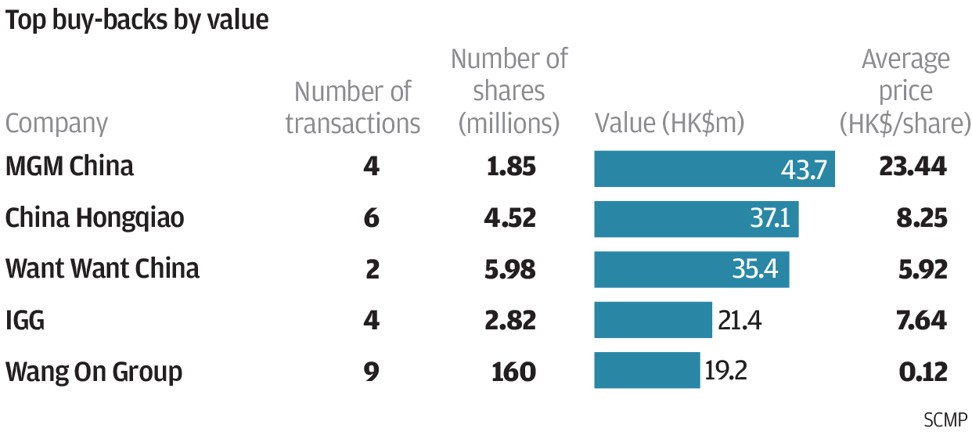

Aluminium products manufacturer China Hongqiao Group bought back 4.5 million shares between December 8 and 12 at HK$7.90 to HK$8.45 each, or an average of HK$8.21 each, its first buy-backs since listing in March 2011. The buy-backs accounted for 15 per cent of the stock’s trading volume and were made after the stock rose by as much as 133 per cent from HK$3.63 in September 2015.

The company’s chairman, Zhang Shiping, bought 79 million shares from October 30 to November 8 at HK$9.29 to HK$12.72 each, or an average price of HK$10.79 each. The trades increased his holdings to 5.968 billion shares, or 73.99 per cent of the issued capital.

The purchases were made after the stock rose by as much as 236 per cent from his previous acquisition of 2 million shares in November 2015 at HK$3.79 each.

Prior to those purchases, he had sold 2.2 million shares in October 2015 at HK$4.19 each after buying 9.07 million shares in September 2015 at HK$3.47 each. Zhang was appointed to his post in 2011. The stock closed at HK$9.05 on Friday.

Robert Halili is managing director of Asia Insider