Executives of Midland Realty, Landsea and Elec & Eltek disclose rare buy-backs of own stocks

Transactions by company insiders rose for the fourth consecutive week in Hong Kong

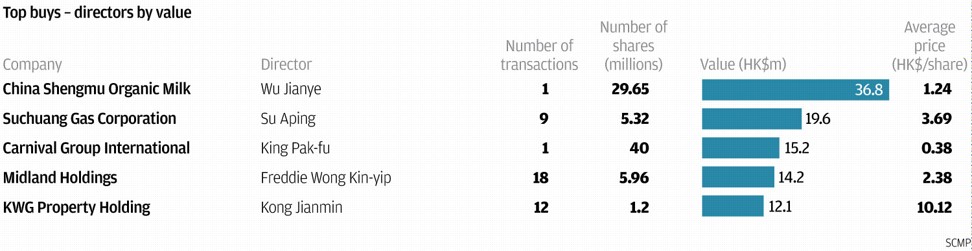

The chairmen of Midland Realty, Landsea Green Properties and Elec & Eltek International disclosed rare buy-backs last week during the holiday shortened trading period, according to disclosures to the Hong Kong stock exchange.

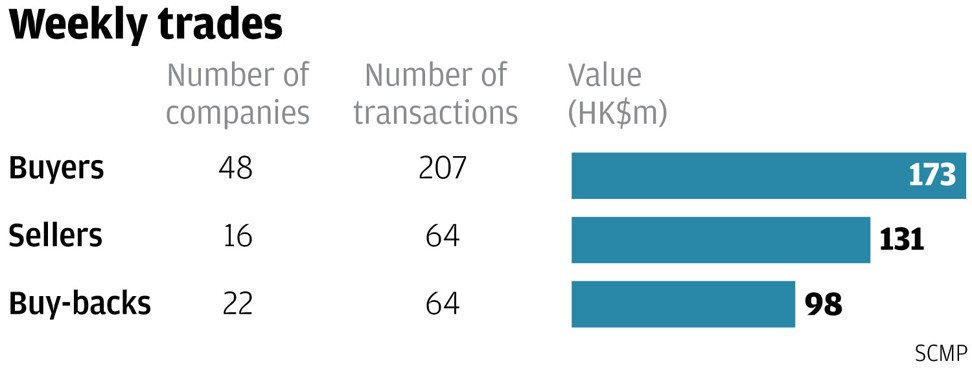

The buy-backs came as transactions by company insiders rose for the fourth consecutive week in Hong Kong. Up to 48 companies disclosed 207 purchases worth HK$173 million (US$22 million) while 16 companies reported 64 disposals valued at HK$131 million.

The company issued a positive profit alert on December 22, citing rising property transactions, growth in its market share and effective cost controls. Midland had swung to an interim profit of HK$115.67 million in the first six months of last year, from a loss of HK$137.07 million in 2016.

The stock closed at HK$2.40 on Friday. Wong’s purchases were his third since January 2014, when he paid an average of HK$4.68 per share for 90.56 million shares.

Significant Points:

- Wong’s purchases accounted for 46 per cent of the stock’s trading volume during the transaction period.

- Wong bought his stock after its price rebound by as much as 23 per cent from HK$2.00 on December 6.

Significant Points:

- Tian’s purchases were his first on-market trades since July 2017, accounting for 43 per cent of trading volume during his transaction dates.

- The purchases were made after the stock fell by as much as 16 per cent from 98 HK cents in August 2017.

Significant Points:

- The recent purchase by Cheung was his first on-market trade since September 2011

- The recent purchase was made on the back of the 157 per cent rebound in the share price since February 2016 from HK$4.91

Chairman Alan Chuang Shaw-swee bought 23 million shares of his own company from July 10 to December 22 at an average price of HK$1.80. The company’s interim profit rose 21.2 per cent to HK$537.978 million.

Significant points:

- The buy-backs were the first repurchase by Chuang’s Consortium since September 2016, making up 31 per cent of the stock’s trading volume during the purchase period.

- The stock had risen 27 per cent since December 2016, from HK$1.45