Hong Kong company directors’ buying of own shares falls for second week; HSBC buys back

HSBC repurchases 3.945 million of its own shares, the first buy-back since November 2017

Buying by Hong Kong company directors of shares in their own companies fell for a second straight week while selling rose for the first time in three weeks, based on filings to the city’s stock exchange between May 7 and 11.

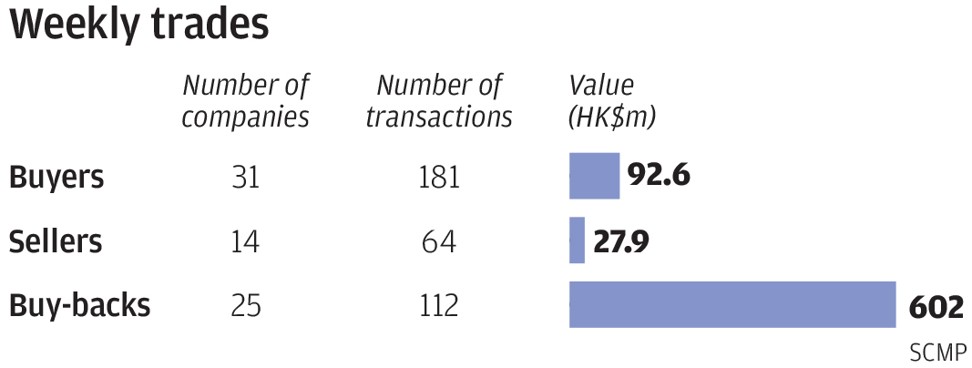

A total of 31 companies recorded 181 purchases by directors worth HK$93 million (US$11.9 million) versus 14 firms with 64 disposals worth HK$28 million. The number of trades on the buying side was consistent with the previous week’s four-day total of 152 purchases, but the number of companies and buying value were sharply down from the previous week’s 38 firms and HK$613 million.

Buy-back activity picked up, with 25 companies – including global banking giant HSBC Holdings – recording a total of 112 repurchases of their own shares worth HK$602 million, based on filings from May 4 to 10. The number of firms buying back shares was unchanged from the previous four-day total, but the number of trades and value were sharply up from 63 repurchases worth HK$107 million.

Among directors selling shares, the CEO of men’s casual clothing maker China Outfitters Holdings, Zhang Yongli, recorded his first on-market trades since November 2017, with 6.15 million shares sold from May 8 to 10 at HK$0.29 to HK$0.24 each or an average of HK$0.253 each.

The trades, which accounted for 73 per cent of the stock’s trading volume, reduced Zhang’s holdings to 1.651 billion shares, or 47.93 per cent of the issued capital. The disposals were made after the stock fell by as much as 30 per cent from HK$0.345 in November 2017.

He had previously sold 6.1 million shares from June 2016 to November 2017 at an average of HK$0.34 each. Prior to that, Zhang had acquired 9 million shares from October 2012 to November 2013 at an average of HK$1.30 each. The stock closed at HK$0.242 on Friday.

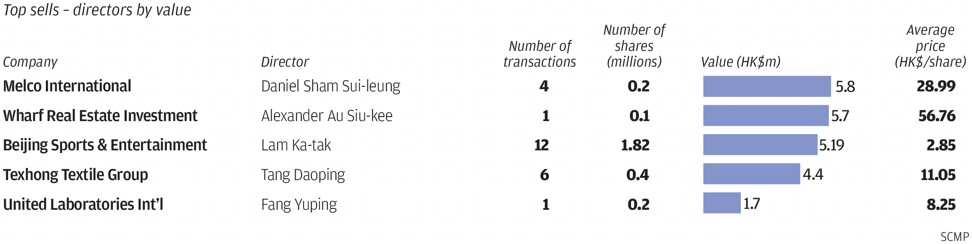

Meanwhile, COO Tang Daoping of Texhong Textile Group sold 400,000 shares between May 8 and 10 at HK$11.36 to HK$11.03 each, or an average of HK$11.05 each, after the stock rose by as much as 14 per cent from the price of his acquisition of shares last year.

The trades, which accounted for 14 per cent of the stock’s trading volume, reduced Tang’s holdings by 13 per cent to 2.8 million shares, or 0.31 per cent of the issued capital. He had previously acquired 200,000 shares from September to October 2017 at HK$10 to HK$10.80 each, or an average of HK$10.44 each.

Prior to those purchases, Tang sold 700,000 shares in November 2016 at HK$11.66 to HK$12.06 each, or an average of HK$11.78. He had also sold his entire holding of 200,000 shares in May 2013 at HK$9.04 each. Tang joined the group in 1998. The stock closed at HK$11.60 on Friday.

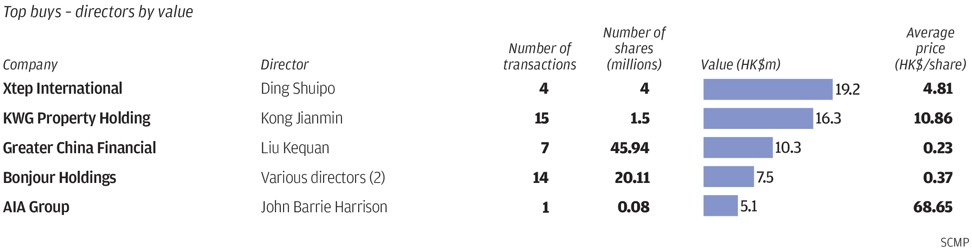

Among directors buying shares in their own firms in the week, the founder and chairman of personal care products maker Vinda International, Li Chaowang, and the company’s CEO, Johann Christoph Michalski, bought a combined 344,000 shares from May 4 to 7 at HK$13.08 to HK$13.50 each, or an average of HK$13.39 each.

The trades, which accounted for 46 per cent of the stock’s trading volume, were made after the stock fell by as much as 19 per cent from HK$16.24 in January.

Li recorded his first on-market trade since 2011 with 300,000 shares purchased on May 7 at HK$13.43 each. The trade increased his holdings to 273.64 million shares, or 22.91 per cent of the issued capital. He had previously acquired 2 million shares in January 2011 at HK$7.84 each and 12.3 million shares from September 2007 to September 2009 at HK$5.02 to HK$1.98 each, or an average of HK$3.10 each. Li was appointed chairman in April 2000.

Michalski recorded his first on-market trades since February 2016, with 44,000 shares purchased on May 4 at HK$13.08 each, boosting his stake by 17 per cent to 303,000 shares, or 0.03 per cent of the issued capital. He had previously acquired 39,000 shares in February 2016 at HK$12.58 each and 400,000 shares in November 2011 at HK$9.70 each.

Michalski was appointed in October 2015. The stock closed at HK$14.12 on Friday.

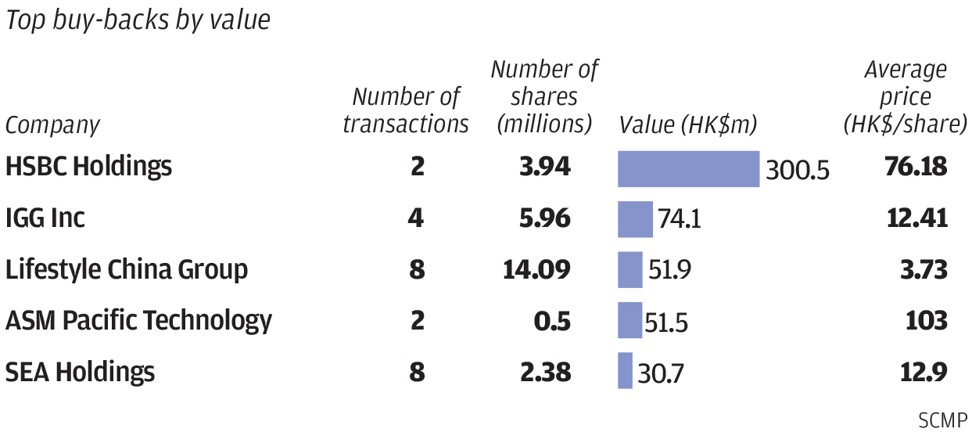

In company buy-backs, global banking giant HSBC Holdings bought back for the first time since November 2017, with 3.945 million shares purchased via the London Stock Exchange on May 9 at HK$76.18 each.

The trade was made on the back of an 11 per cent drop in the share price since January 24 from HK$85.85. The bank had previously acquired 326 million shares between February and November 2017 at HK$62.26 to HK$79.63 each, or an average of HK$71.24 each, and 325.27 million shares from August to December 2016 at HK$52.92 to HK$66.50 each, or an average of HK$59.63 each.

The repurchases since August 2016 are HSBC’s first buy-backs, based on filings on the exchange since 1992. The buy-backs are part of HSBC’s plan to repurchase HK$2 billion worth of shares this year. The stock closed at HK$77.55 on Friday.