Hong Kong director share buying falls, but property firms still top list of buy-backs

Insider buying and buy-backs are building up in the retail and consumer goods sectors

Hong Kong company directors may be experiencing buying fatigue after recording heavy purchases of their own companies’ shares in recent weeks, with activity falling for a second straight week, although property firms continued to stand out as major buyers of their own shares.

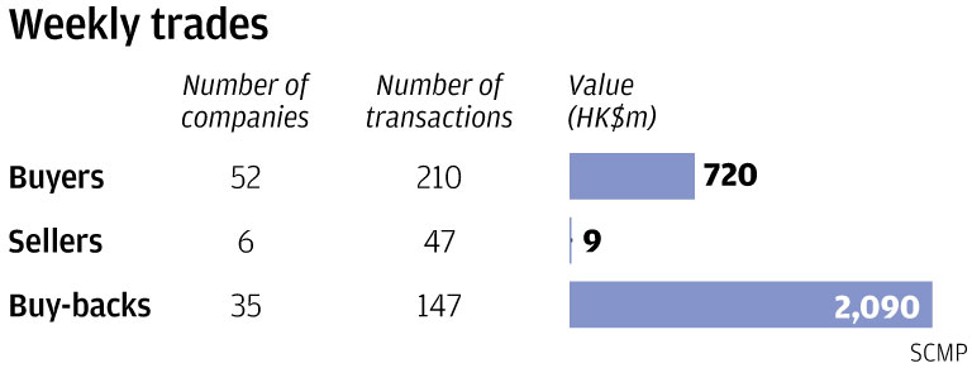

A total of 52 companies recorded 210 director purchases worth HK$720 million (US$91.8 million) based on filings to the stock exchange from July 23 to July 27. The figures were sharply down from the previous week’s 68 firms, 391 purchases and HK$1.278 billion.

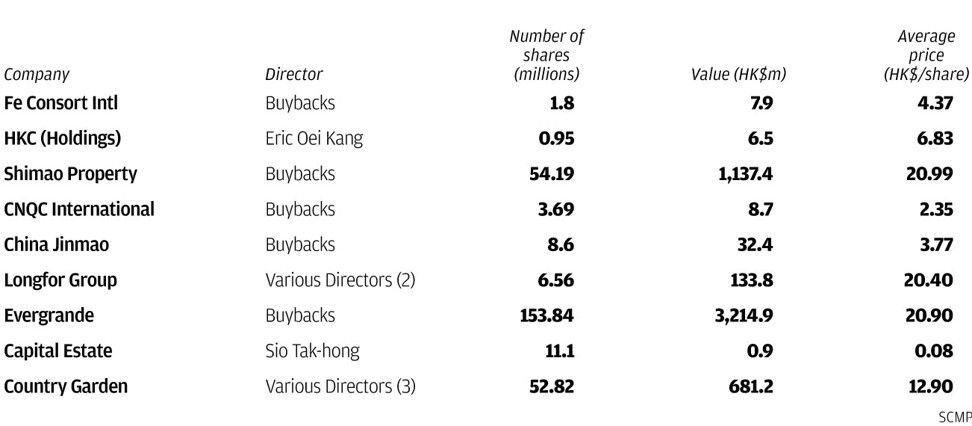

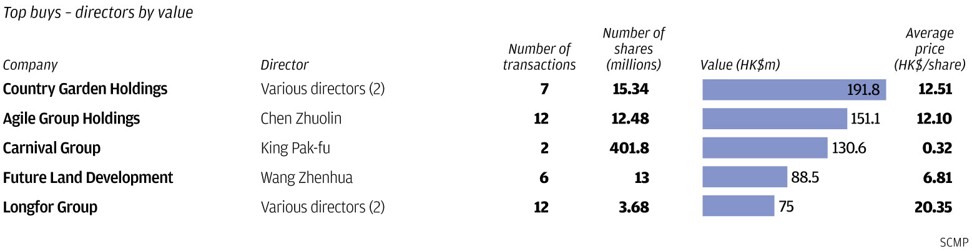

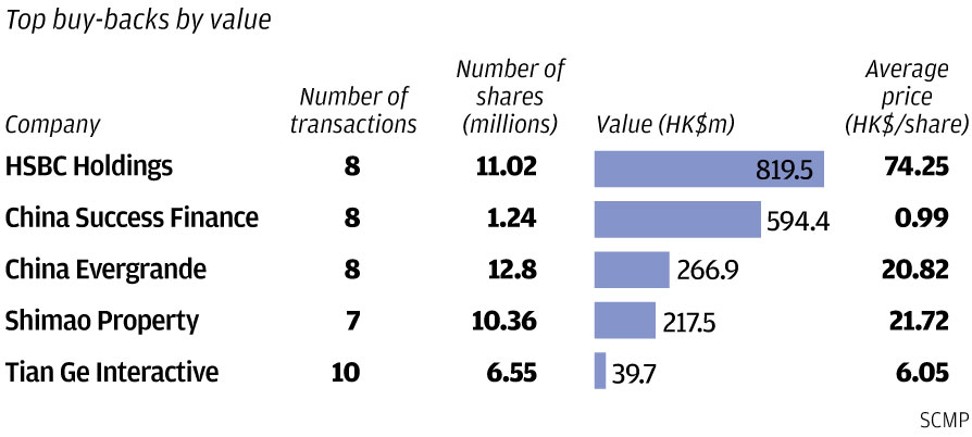

The property sector led all buyers for the sixth straight week, with huge insider purchases in Country Garden Holdings, Agile Group and Future Land Development and buy-backs in China Evergrande Holdings and Shimao Property.

Other lesser known property stocks that have provided the most consistent support this month are HKC Holdings, CNQC International, Longfor Properties and China Jinmao Holdings, with buys recorded in almost every trading day. The CEO of HKC Holdings, Eric Oei, for instance, recorded buys for 14 straight trading days from July 3 to July 20, with purchases that accounted for 43 per cent of the stock’s trading volume.

Although some of these property stocks have not risen, the high frequency of purchases by directors and companies have prevented their shares from falling further following the heavy correction the market in the past month.

However, while huge purchases by value are bullish indicators, investors should also look at how frequent directors and companies buy shares, particularly in this very volatile period where stocks can fall sharply on any given day. Frequent purchases provide more support and, if coupled with heavy volume, can stimulate a stock more than a few or one-off purchases.

While the property sector has garnered the most attention in the past month, insider buying and buy-backs are building up in the retail and consumer goods sectors, with purchases recorded in computer gaming and mobile phones manufacturer Razer Inc, car distributors Sparkle Roll Group and Dah Chong Hong Holdings and jewellery retailer Luk Fook Holdings, following sharp falls in their share prices.

The purchase in Razer is worth noting as its poor performance may further dampen investor enthusiasm for upcoming IPOs. The Hong Kong IPO last week for telecoms infrastructure firm China Tower, for instance, received a lukewarm response, despite the company having stable earnings and a planned high dividend payout. With the underwhelming IPO response, expect directors and companies to move in to provide support perhaps sooner if their share prices go south after listing.

Razer bought back for the first time since listing in November 2017, with 6.07 million shares purchased on July 23 at HK$1.74 each. The trade was made on the back of the 63 per cent drop in the share price since November 2017 from HK$4.69. The buy-back price was sharply lower than the IPO price of HK$3.88.

There were conflicting trades by Razer directors earlier this year. Non-executive director Lim Kaling purchased 4.7 million shares on May 15 at HK$2.45 each, which increased his holdings to 2.134 billion shares, or 23.65 per cent of the issued capital. Executive director Khaw Kheng Joo, on the other hand, picked up where he left off in April with 8.7 million shares sold on May 15 at HK$2.45 each, which reduced his stake by 10 per cent to 79.855 million shares or 0.89 per cent. He had previously sold 2.5 million shares from April 3 to April 9 at HK$2.82 to HK$2.74 each, or an average of HK$2.79 each.

The recent buy-back may have helped boost the stock, which closed 10 per cent up from the buy-back price at HK$1.92 on Friday.

Luxury goods and car distributor Sparkle Roll Group bought back for the first time since listing in 2002, with 76.1 million shares purchased from July 9 to July 25 at an average of HK$0.30 each. The trades, which accounted for 20 per cent of the stock’s trading volume, were made on the back of the 68 per cent drop in the share price since January from HK$0.94.

Another first-time buyer this year is independent non-executive director Thomas Lee Kang-bor, with 424,000 shares purchased on June 26 at HK$0.40 each. The trade increased his holdings by 34 per cent to 1.680 million shares, or 0.03 per cent of the issued capital. The stock closed at HK$0.30 on Friday.

CEO Lai Ni-hium of motor vehicle distributor and logistics services provider Dah Chong Hong Holdings picked up where he left off in March, with 21,000 shares purchased on July 18 at HK$3.96 each. The trade increased his holdings to 729,000 shares, or 0.04 per cent of the issued capital.

The trade was made on the back of a 12 per cent drop in the share price since May from HK$4.49. He previously acquired 150,000 shares on March 12 at HK$3.99 each. Prior to his trades this year, Lai had acquired 7,200 shares in October 2017 at HK$3.86 each, 100,000 shares in August 2017 at HK$3.93 each and 250,000 shares in March 2017 at HK$3.23 each. Prior to his trades since 2017, he had acquired an initial 200,000 shares in June 2016 at HK$3.67 each. Lai joined the group in June 2016. The stock closed at HK$3.66 on Friday.

Executive director Chan So-kuen recorded his first on-market trade in gold jewellery retailer and wholesaler Luk Fook Holdings since his appointment in August 2015, with 40,000 shares purchased on July 26 at HK$28.21 each. The trade increased his holdings by 47 per cent to 125,000 shares, or 0.02 per cent of the issued capital. The trade was made after the stock plunged by 23 per cent from HK$36.65 in the first week of June.

Although Chan bought shares following the sharp fall in the share price, his purchase was made at higher than his previous acquisition price. He had previously acquired an initial 85,000 shares at HK$22.27 each when he was appointed to his position in August 2015.

Three other Luk Fook directors have bought shares this year. Deputy chairman Tse Moon-chuen purchased 11,000 shares from March 23 to March 26 at an average of HK$26.49 each, which increased his holdings to 241.302 million shares or 41.1 per cent of the issued capital. He had previously acquired 10,000 shares in December 2015 at HK$16.04 each, 130,000 shares from August to September 2015 at HK$20.65 to HK$18.46 each, or an average of HK$20.14 each, and had sold 20,000 shares in February 2015 at HK$29.13 each.

Chairman Wong Wai-sheung, on the other hand, had purchased 1.17 million shares from January 18 to January 25 at an average of HK$28.20 each. The trades increased his holdings to 248 million shares, or 42.24 per cent of the issued capital. He had previously acquired 23,000 shares in January 2016 at HK$13.00 each and 20,000 shares in June 2014 at HK$23.13 each.

Lastly, executive director Nancy Wong Lan-sze had bought 100,000 shares from January 18 to January 19 at an average of HK$28.46 each. The trades increased her holdings by 5 per cent to 1.996 million shares, or 0.34 per cent of the issued capital. She had previously acquired 183,000 shares from January 2011 to June 2014 at an average of HK$22.67 each and 70,000 shares from October to November 2008 at an average of HK$1.94 each. The stock closed at HK$27.20 on Friday.