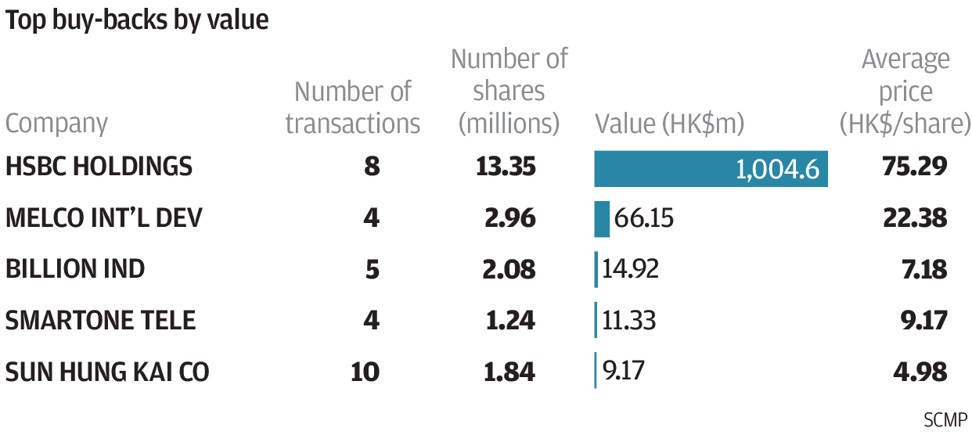

Gaming firm Melco International resumes buy-backs, snapping up 2.96 million shares

Buying rose for the second straight week with 43 companies recording 299 purchases worth HK$473 million from November 13 to 17

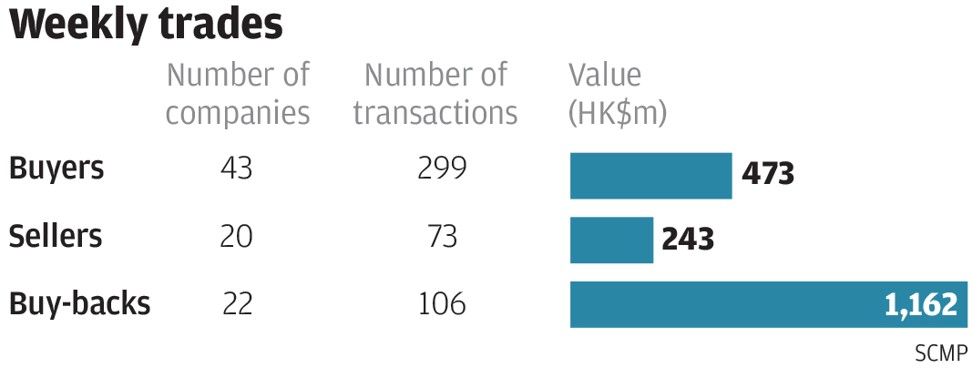

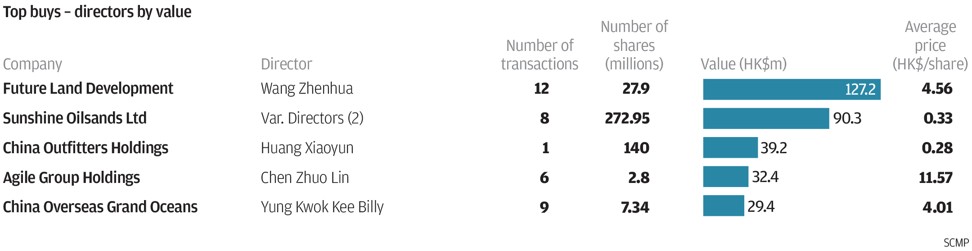

The buying rose for the second straight week with 43 companies that recorded 299 purchases worth HK$473 million based on filings on the Hong Kong stock exchange from November 13 to 17. The number of firms and trades were up from the previous week’s 39 companies and 259 purchases.

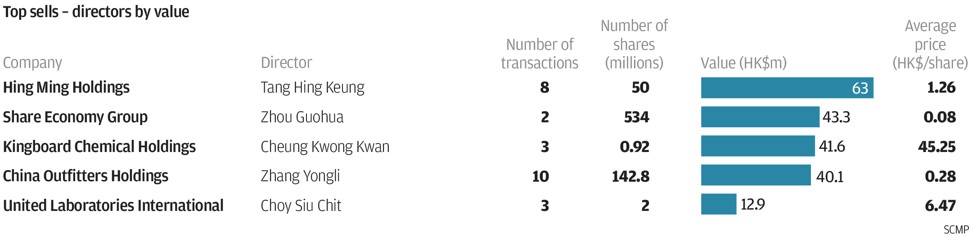

However, the buy value was down from the previous week’s acquisitions worth HK$673 million. Sales, on the other hand, rebounded sharply with 20 firms that recorded 73 disposals worth HK$243 million. The figures were up from the previous week’s three companies, 10 disposals and HK$7 million.

Meanwhile, the buy back activity rose after trading flat for two straight weeks with 22 companies that posted 106 repurchases worth HK$1.162 billion based on filings from November 10 to 16. The number of firms and trades were up from the previous 5-day totals of 17 companies and 76 trades. The value, however, was sharply down from the previous week’s turnover of HK$1.52 billion.

China XLX Fertiliser bought back 150,000 shares on November 16 at HK$2.70 each. It previously acquired 2.63 million shares from August 16 to September 22 at HK$2.01 to HK$2.45 each or an average of HK$2.11 each.

The company started its buy-back programme in August after the stock fell from HK$5.09 in June 2015. The buy-backs since August were made after the company announced a 129 per cent gain in first half profit to 186.6 million yuan (US$28.1 million). The stock closed at HK$2.60 on Friday.

Aside from the buy-backs since September, the company acquired 16.3 million shares from May 5 to 15 at an average of HK$17.26 each. Before the buy-backs this year, the company acquired three million shares in December 2016 at HK$10.93 each and 15.8 million shares from October to December 2014 at HK$21.00 to HK$16.62 each or an average of HK$18.88 each.

Investors should note that Southeastern Asset Management sold 136 million Melco shares from April 11 to October 4 at HK$14.93 to HK$22.95 each, which reduced its holdings by 60 per cent to 91.709 million shares or 5.98 per cent of the issued capital.

The repurchases since October 2014 are Melco’s first buy-backs based on filings on the exchange since 1992. The stock closed at HK$22.85 on Friday.

The recent buy-backs were made after the stock fell by as much as 31 per cent from HK$0.71 on August 24. The counter closed at HK$0.69 on Friday.

Robert Halili is managing director of Asia Insider