Advertisement

Advertisement

Opinion

Macroscope

by David Brown

Macroscope

by David Brown

How China can avoid 2 per cent growth nightmare: cut interest rates, expand money supply and ramp up deficit spending

- David Brown says Beijing must start treating the unthinkable – economic growth slumping to just 2 per cent – as entirely possible and implement a huge stimulus programme to stop the rot

China’s growth slowdown is reaching crisis point. How bad could it be? Very bad, judging by the weaker signals coming out of China right now. Its 2019 GDP growth rate could end up well outside the consensus range of expectations, which has been between 5 and 7 per cent.

Negative forces are building and China could hit a brick wall very soon with economic expansion collapsing, sinking to as low as 2 per cent in the worst-case scenario. A hard landing on such a scale would be unprecedented, catastrophic and a game-changer for Beijing.

You don’t need to look very far to see where the trouble lies. Vulnerability is written all over the domestic economy – weak car sales, lacklustre property prices, listless consumer confidence, sagging money supply growth and acute stock market pain say it all. Weakness is rife throughout the international economy, too – trade wars, global policy tightening, Germany half way to recession, latent euro troubles, deflation worries in Japan, a political crisis in the United States, credit default risks and a hard Brexit in Britain are all adding up. It’s a mess with no apparent happy ending.

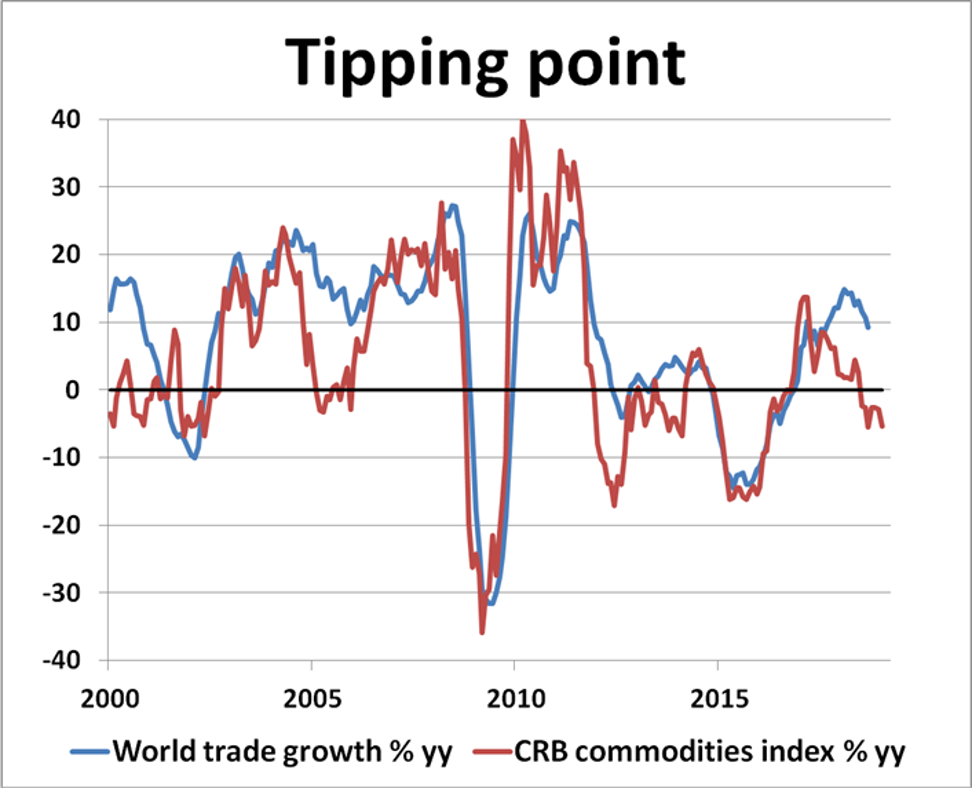

The world is in trouble and China will get sucked in as a bellwether for global trade conditions. Yet Beijing’s policy response so far has been to tinker at the margin, ending up behind the curve and possibly compromising the country’s recovery hopes for years. Conventional wisdom says China’s growth rate for 2019 should only experience a marginal slowdown from 6.5 per cent last year – but this grossly underestimates the scale of the problem. We are all getting sucked into complacency – Beijing included.

A positive result for China’s growth this year would be 5-6 per cent, but current trends suggest the economy will be lucky to come close to that. The trade war with the US is taking its toll – consumer confidence and business optimism both look precarious, casting a dark shadow over China’s domestic demand. The external sector is no better off, given the sudden downturn in global economic confidence and the damage being wrought on world trade flows.

It is hard to fathom why the World Bank and International Monetary Fund are still so relatively upbeat, expecting annual global GDP growth of between 2.8 and 3.7 per cent over the next few years.

The worry about China banking on a bigger boost from overseas markets is that its major trade partners are slowing down – and some very markedly. The omens are poor. Japan’s economy has slumped again, while US economic prospects are being dulled by the deepening political impasse in Washington and Federal Reserve tightening. Germany’s economy shrank in the third quarter and could easily flip back into recession again, dragging the rest of Europe with it. The withdrawal of monetary stimulus by the European Central Bank is not helping matters, either. A global crash is more than a remote possibility.

The concern for global markets is that a hard landing in China could be the greatest threat to global recovery. Investors believe robust growth in China is a talisman for better times ahead in the rest of the world, but if China is heading into the doldrums, then there is good reason to panic. The world is getting into a self-feeding, negative feedback loop which must be broken very soon.

In this new age of economic isolationism and the absence of any meaningful multilateral initiatives, self-help seems to the only way to go. The Group of Seven, the G20 and all the other bastions of global policy co-ordination are effectively dead in the water. China knows it has to go it alone with blockbuster macroeconomic policies necessary to turn the tide – domestically, regionally and globally.

Leaving micromanagement aside, China needs a huge stimulus programme to stave off a deeper meltdown. Beijing must stop strangling growth with restrictive monetary and fiscal policies. Interest rates must be cut again, money supply expanded dramatically and deficit spending ramped up.

China needs radical action in exceptional times. It must stop the rot soon or 2 per cent growth could become a nightmarish reality this year.

David Brown is chief executive of New View Economics

This article appeared in the South China Morning Post print edition as: For China, nightmarish 2pc growth is a possibility this year

Post