Why yuan devaluation is not in China’s best interests and it’s time for Beijing to stop the free fall

- David Brown says an adverse midterm election for Trump could see him push for a weaker dollar, resulting in a currency war that further rattles markets

- A weaker yuan will intensify the Chinese economy’s focus on exports, in contrast to Beijing’s intention of concentrating on domestic consumption

The weak yuan has also given the economy the wrong signals by back-tracking on Beijing’s commitment to shift the focus away from export-led growth to domestic consumption. There are far better ways to revitalise domestic growth than the blunt force of yuan devaluation.

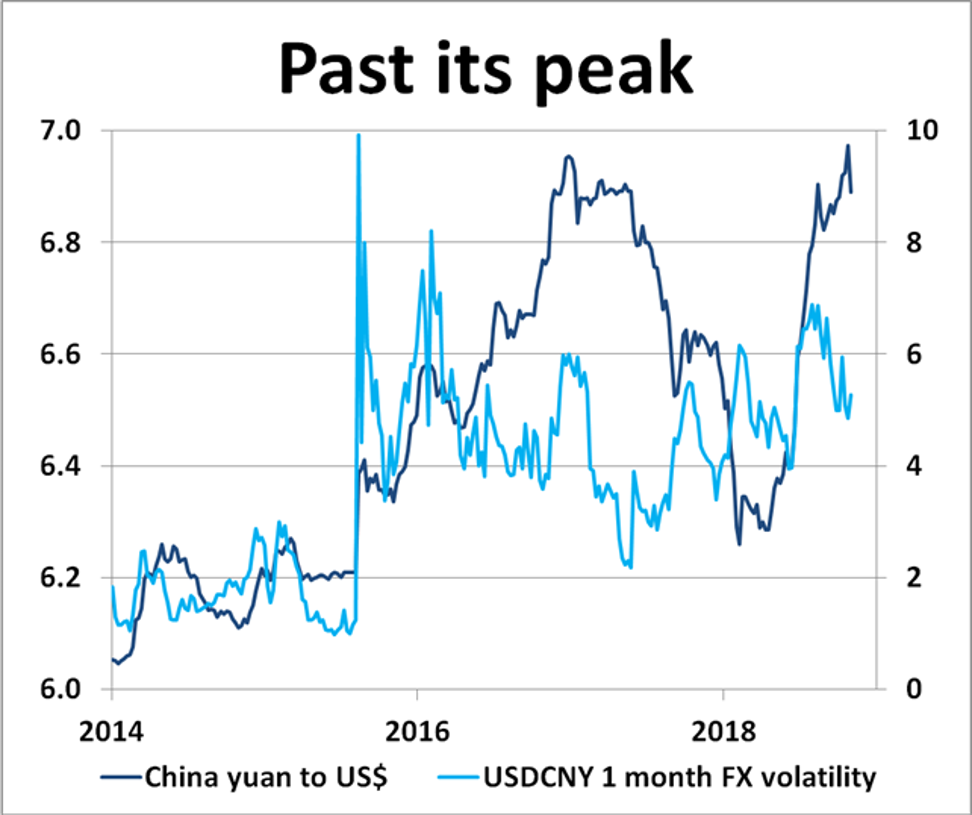

It is time for Beijing to take a moral lead and set a ceiling for the dollar/yuan exchange rate to go no higher than 7. Recent hints have suggested some stabilisation may be preferable now, so all Beijing needs to do is lean with the wind and give recent yuan appreciation some gentle endorsement to reinforce the move.

After all, what policymakers want for their currency, they generally get – if they push hard enough. Beijing just needs to be more explicit on its aims. Betting against currency speculators is one thing, but Beijing needs a credible forex policy fix for the future.

The market’s attitude has also been soured by Beijing’s apparent benign neglect towards its currency

The fact that the yuan staged its biggest two-day rally in a decade after Trump’s trade deal comments underlines how much dollar bulls may be overstretched, while China’s currency sell-off has gone too far. It is a prime opportunity for a yuan short squeeze.

There is nothing sacrosanct about a US dollar-Chinese yuan exchange rate of 7 as a barrier. After all, the market’s expectations for the currency over the next year are extremely wide, ranging from USD/CNY at 6.3 on the yuan’s upside to USD/CNY at 7.3 on the downside. The disparity is because the underlying fundamentals are so mixed.

If Beijing wants to build currency stability, it should not turn a blind eye to a break above USD/CNY 7. It would open up a box of trouble over the future and reinforce Washington’s notions that China is a currency manipulator.

If Beijing wishes to claim the moral high ground in the trade war, there is no better time to put a firm floor under the yuan and stake its case for some reasonable appreciation ahead. Stabilising the yuan into a 6.50 to 6.75 yuan range would still leave the currency competitive and provide much better price certainty for China’s embattled exporters.

From peak to trough this year, the yuan has depreciated by around 10 per cent. But this is misdirecting key resources towards exporters when Beijing should be channelling stronger stimulus into the domestic economy to boost consumption and investment. China’s economy is crying out for a much bigger fiscal spend.

The time for trade wars and currency instability should end and America and China should move on to better harmony and boosting global growth.

David Brown is chief executive of New View Economics