Beijing directs state firms to ‘perform like normal enterprises’ after trade partners’ complaints

The new guidelines – coming after criticism of China’s ‘market distortions’ by the US, EU and Japan – depart from a policy of making state behemoths ‘bigger and stronger’

Beijing has set fresh guidelines for state-owned enterprises (SOEs), a target of recent complaints by China’s major trading partners, by advising the companies to operate like normal business entities and to continue to cut excessive steel and coal production capacity.

The directives mark a departure for the government from a previous policy of making the state behemoths “bigger and stronger” in favour of a softer tone, just weeks after trade ministers from the US, EU and Japan – in an obvious swipe at China – jointly blamed SOEs for market distortions.

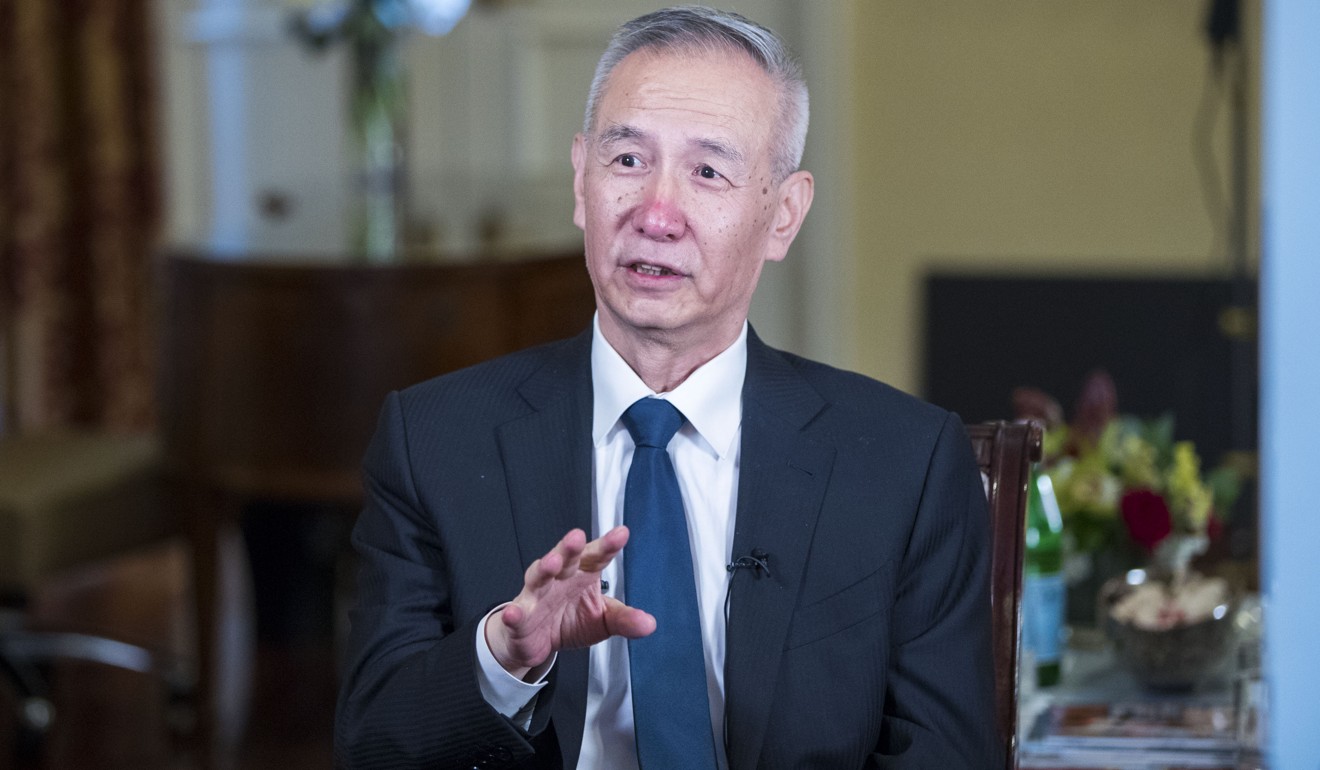

Vice-Premier Liu He, President Xi Jinping’s top economic aide, said at an SOE conference on Tuesday that it was “utterly important” to increase the vitality of state firms as “individual market players”.

In addition, the conference concluded it was necessary to respect the authority of SOEs’ boards of directors to make “significant decisions” pertaining to “personnel and compensation”.

The new guidelines do not directly challenge Beijing’s view that SOEs must play a vital role in the national economy and answer to the Communist Party.

However, new directives for SOEs governing their corporate governance structure, the protection of minority shareholder rights and management philosophy marked a shift by the government away from a policy of insisting that the Communist Party have a bigger role in running SOEs and that party loyalty be put ahead of profitability in SOE-related decision-making.

While Beijing sees SOEs as the backbone of the Chinese economy, Washington and many others view Beijing’s pouring of state resources into the firms as unfair to other countries vying for prominence in the global marketplace.

For that reason, US, EU and Japanese trade ministers last month said they agreed to work to secure “a level playing field”, given “the challenges posed by third parties developing SOEs into national champions”.

In particular, the ministers pledged to address the “market distorting behaviour of state enterprises and harmful subsidy practises”, an indirect reference to China’s SOE strategy.

Other groups outside China have criticised the country’s SOEs. Business 20, an advisory group affiliated with the Group of 20, the international forum that brings together the world's 20 leading industrialised and emerging economies, last week issued a communique calling for an end to state-related competitive distortions.

However, the China Council for the Promotion of International Trade, a semi-official Beijing-backed group, tried to block the communique from being submitted to G20 leaders next month at their meeting in Buenos Aires, Argentina, and demanded revisions to the communique’s SOE-related sections.

Derek Scissors, a resident scholar of the Washington-based American Enterprise Institute, said at a forum in Beijing on Monday that confrontations between Beijing and Washington tied to China’s SOEs would worsen if China did not change its stance.

“We have seen no movement from the Chinese side to allow greater foreign competition with central SOEs,” he said. “In fact, we see consolidation of central SOEs to make them less vulnerable to competition.”

Meanwhile, SOEs’ monopoly of the domestic marketplace and the state’s preferential treatment of the firms have raised questions in China about the extent to which SOEs are using up resources that could be employed more efficiently by the private sector.

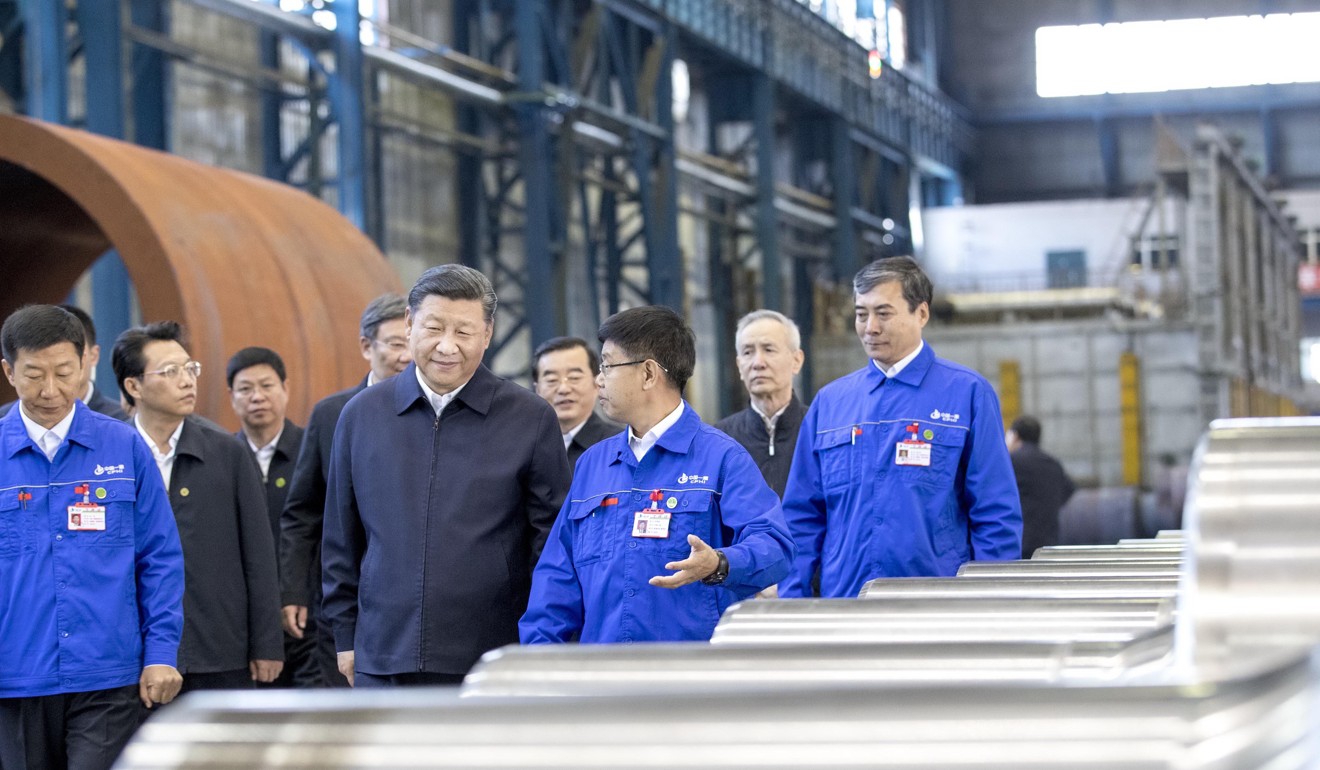

During a visit to China’s Manchuria region, a rust-belt zone with a preponderance of SOEs, China’s leader – known for his support of the state sector – told workers at state-owned factories that SOEs should continue to become “stronger, better and larger”.

“All statements and arguments saying we don’t need SOEs any more or we should diminish SOEs are wrong and one-sided,” President Xi said.

Although the conference at which Liu spoke stopped short of endorsing the president’s statements, it did not end with a resolution advocating that SOEs be allowed to develop advanced technologies, an action that would have transmitted a message of SOE support to China’s critics.

Instead, the takeaway was that China needed to become increasingly hands-off in how it managed SOEs and had to grant the firms greater operational autonomy.

The conference also urged SOEs to continue to cut excessive capacity in the production of steel, coal and coal power, another sore point for China’s trade partners, who have accused China of dumping cheaper products on the market to undercut their rivals.

The new guidelines also require SOEs to pare debt and reduce financial risk.

As of August 31, China’s state-owned industrial enterprises had assets valued at 174 trillion yuan (US$25.13 trillion), up 7.6 per cent, according to China’s Ministry of Finance.

The State-owned Asset Supervision and Administration Commission now directly controls 98 large industrial firms with total assets of more than 50 trillion yuan. Forty-eight of these state-run firms have made Fortune magazine’s list of the world’s top 500 companies by revenue.

Other Chinese state-owned enterprises are controlled by the country’s provincial and municipal governments.