US-China trade war: worst yet to come for Chinese economy, say analysts

- Latest Chinese data shows economy is not collapsing, but raises questions about the outlook for consumer spending

- Data suggests government’s stimulus efforts are starting to bear fruit

Chinese consumers reined in their spending in October on increasing uncertainty amid the trade war with the United States, government data released on Wednesday shows.

But growth in fixed-asset investment and industrial production both accelerated during the first month of the fourth quarter, indicating that while the economy may be slowing, it is not collapsing under the weight of trade war uncertainty.

China says strong US economy shores up its exporters

Analysts, however, said the worst was yet to come for the Chinese economy, as the impact of the trade war is expected to weigh on growth at least until the middle of next year. Many expected the government to enact more stimulus measures in the coming months to offset the affects of the trade conflict.

In October, overall investment growth accelerated to 5.7 per cent in the January to October period, above an expected 5.5 per cent gain and the January to September rise of 5.4 per cent.

The data suggests the government’s programme of infrastructure investment was starting to bear fruit, offsetting declines in manufacturing and property investment growth during October. But analysts said the rebound in investment seen last month may be short-lived.

“The recovery in infrastructure spending will be difficult to sustain without a broader easing of fiscal policy – local government bond issuance has already dropped back in recent weeks in response to budget limits. And home sales, which continued to weaken last month, point to a coming slowdown in property construction,” said Julian Evans-Pritchard, senior China economist at Capital Economics.

Industrial production grew 5.9 per cent in October compared with a year ago, higher than the median of 5.8 per cent and September’s 5.8 per cent outturn. Industrial output was most probably buoyed by the “front loading” of export orders for early next year to this year to avoid increases in US tariffs that go into effect on January 1, with growth in industrial sales for export rising from 11.7 per cent in September to 14.7 per cent in October, according to Capital Economics.

In addition, “a significant easing of the anti-pollution campaign which closed production in many sectors last winter in 28 cities” is likely to have helped October’s production figures, Nomura Global Markets Research said in a note.

China’s latest financial data paints a bleak economic outlook amid trade war

Elsewhere, growth in Chinese retail sales slowed to 8.6 per cent in October compared with a year earlier, the weakest growth rate since May and well below the forecast of a 9.2 per cent gain. Retail sales rose 9.2 per cent in September.

Beijing had hoped the recent cut in personal income taxes would help boost consumer spending and help offset the impact of the trade war on the export sector. But the data adds to other evidence that consumers are becoming more cautious in their discretionary spending – a “consumption downgrade” – because of worries about the trade war’s impact on the overall economic outlook and how that might affect their jobs and income. In particular, sales of big ticket items have been affected, with cars sales falling 6.4 per cent year on year in October.

In addition, rising costs for housing, food and energy have also caused some consumers to seek to economise on their daily spending.

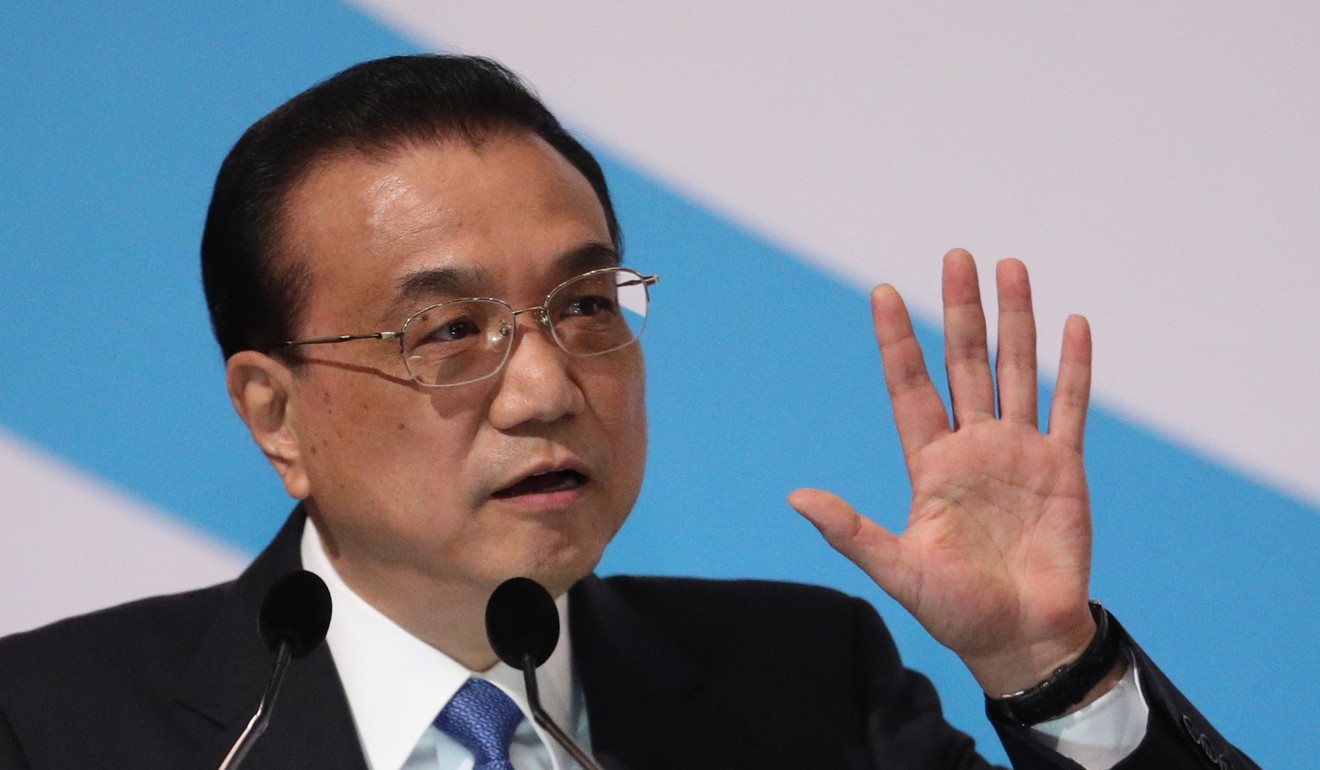

Premier Li Keqiang said on Tuesday the Chinese government had no plans to resort to a “massive stimulus” similar to that of 2008 as a way of managing its slowing economy amid the trade war with the US.

Instead, Beijing will focus its policies on “energising the market, in particular market entities” and on creating “fair and equal regulations” to maintain momentum in the world’s second-biggest economy, Li said in a speech before the annual summit of the Association for Southeast Asian Nations in Singapore.

“Despite the downward pressure, we will not resort to massive stimulus,” said Li.

Asian mega free-trade deal stalls despite China’s push

His comments came as the People’s Bank of China released data showing bank lending slowed sharply in October to a level well below expectations, suggesting businesses were reluctant to proceed with investment given the economic uncertainty created by the trade war with the US.

Chinese banks extended 697 billion yuan (US$100.2 billion) in net new loans in October, just about half of the 1.38 trillion yuan in the month before and below a median forecast for lending of 862 billion yuan in a Reuters survey of economists, according to central bank figures released on Tuesday. Nationwide fiscal revenues in October fell 3.1 per cent from the same month last year, limiting the government’s scope for increased spending.

China’s top trade negotiator aims to kick start new round of talks

“We remain bearish on the consumption outlook due to high household leverage, sluggish income outlook and underperforming financial markets,” Nomura Global Markets Research said.

“We believe the worse is yet to come, with growth slowing faster into spring 2019” because of the front loading of exports will be over by then, and the direct impact of a trade war with the US should start to hit export growth, said Nomura. In addition, even though the government has eased its debt reduction campaign, the difficulty that businesses are having gaining access to credit – as shown by the weak October lending data – will continue into next spring because of rising pressure to repay existing debt and rising interest rates from new loans for companies without implicit government guarantees.

Taken together, the October data paints a picture of an economy slowing gradually, with the risk that it could slow faster if the trade war were to escalate.

In the third quarter, China’s economic growth rate decelerated to 6.5 per cent, its slowest since the first quarter of 2009.

All eyes will be on the meeting between Chinese President Xi Jinping and US President Donald Trump at the G20 summit in Buenos Aires, and what progress, if any, they can make towards resolving the trade war.