What is a hearable? Plus why they’re going to be the biggest wearable

- You’ve probably got one but didn’t realise it: products like Apple’s AirPods and Plantronics’ BackBeat FIT are set to dominate the wearables market

- Their uses will extend into hearing aids and medical devices

Are smartwatches just a fad? Absolutely not, a new report predicts, with falling prices meaning that sales of wearables devices – including smartwatches, wristbands and fitness trackers – will surge by a quarter in 2019.

However, by 2022, smartwatches will lose their place as the dominant wearable with the rise of a different product: the “hearable”.

Analysts at research company Gartner forecast that worldwide shipments of wearable devices will reach 225 million in 2019, an increase of 25.8 per cent on 2018. They also think that wearables will become a US$42 billion market next year, about a third of that from sales of smartwatches.

Seventy-four million smartwatches are expected to be sold in 2019, but for now it is a market dominated by the Apple Watch. “The smartwatch market is bolstered by the relatively stable and higher average selling price of the Apple Watch,” said Alan Antin, research director at Gartner.

However, there’s a price drop coming, albeit a small one. Antin predicts that the average price of smartwatches will slowly decline from US$221.99 in 2018 to US$210 in 2022, due to a growth in lower-priced competitors and higher volumes leading to reductions in manufacturing and component costs.

“Strong brands like Apple and traditional watch brands [will] try to keep pricing stable,” Antin said.

“Traditional watch brands such as Fossil and Casio will gain market share by offering more style and choice in their portfolio than the technology brands. We think that fashion and traditional watch brands are likely to account for up to 20 per cent of unit shipments by 2022.”

Apple Watch fitness challenge put to the test

Apple recently introduced the Apple Watch Series 4, which adds an electrocardiogram (ECG) sensor that measures the wearer’s heartbeat. That fits in with a new focus among wearable manufacturers on health care.

“The two largest smartwatch brands, Apple and Fitbit, continued to delve deeper into the health care market,” said Jitesh Ubrani, senior research analyst at IDC Mobile Device Trackers. “The health care market is quickly becoming the next frontier for wearables brands to conquer.”

The GPS version of the Apple Watch 4 sells in Hong Kong for HK$3,199, with a version with GPS and cellular connectivity priced at HK$3,999. IDC claims that the subsequent price reduction on the Apple Watch 3 after the 4’s launch accounted for most of Apple’s wearable shipments during the third quarter of 2018.

Though Apple dominates the smartwatch segment, it was reported this week that Chinese manufacturer Xiaomi sells more wearables than Apple. That’s largely down to its Mi Band 3 fitness tracker, which has been selling well in India, Europe, the Middle East and Africa.

Moving forward, advanced ear-worn devices can reduce smartphone use

In its report, IDC named the key products in the sector as Xiaomi’s Mi Band 3, Apple’s Apple Watch 3, Fitbit’s Versa, Charge 3 and the Ace, Huawei’s TalkBand B5, and the Samsung Galaxy Watch, Gear S3 and Gear Fit.

The next frontier for wearables makers, however, is hearables.

Defined as “ear-worn devices”, hearables will take over as the top wearables segment in 2022, according to Gartner, shipping 158 million units compared with 115 million smartwatches.

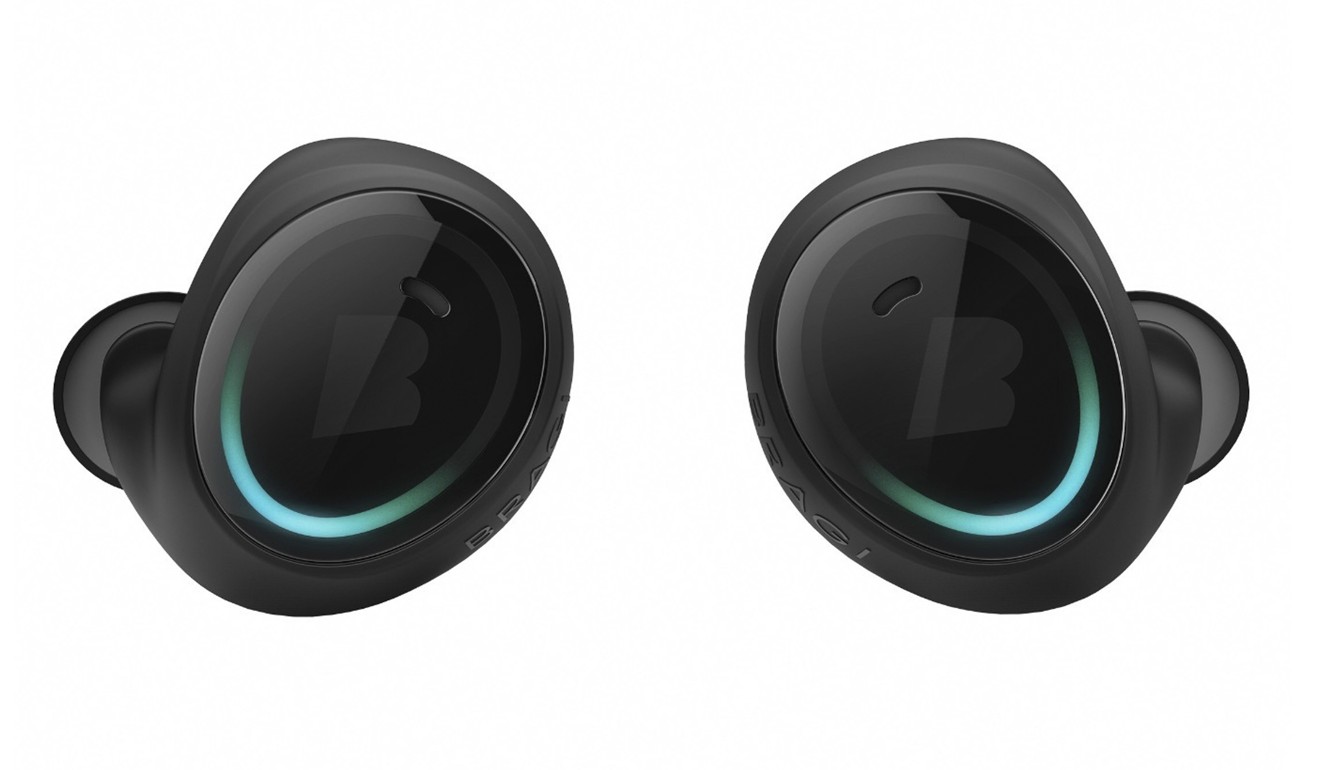

Key early hearables products include Apple AirPods, Samsung’s Gear IconX and Plantronics’ BackBeat FIT. Gartner predicts that those products and brands will account for more than 30 per cent of all shipped wearables in 2022.

Though the current main uses for hearables are communications, entertainment, fitness and health coaching, they also extend into hearing aids and medical devices. An example is the recently launched Bose Hearphones, a pair of conversation-enhancing headphones designed to improve the wearer’s hearing in loud environments.

It is expected that hearables, as well as many headphones and earphones, will soon get microphones that can discern “wake words” that allow easy interaction with virtual personal assistants such as Alexa, Siri and Google Assistant.

“Moving forward, advanced ear-worn devices can reduce smartphone use, as they will take over many tasks that users solve with the help of their smartphones today,” read the Gartner report “Forecast: Wearable Electronic Devices, Worldwide, 2018”.