Alliance with China Southern in Oneworld ‘could help Hong Kong’s Cathay Pacific’

- Mainland China’s biggest airline plans to leave Skyteam alliance, sparking speculation it will join Oneworld

- That would leave the Guangzhou-based carrier on the same side as its near neighbour in Hong Kong

China’s biggest airline’s potential move to the same industry alliance as Cathay Pacific Airways could help, rather than hinder, the Hong Kong carrier, experts have said.

And the fact that China Southern specialises in trips within mainland China, while Cathay Pacific flies further afield and is struggling against cheaper mainland carriers, could mean a boost for both if they teamed up, they said.

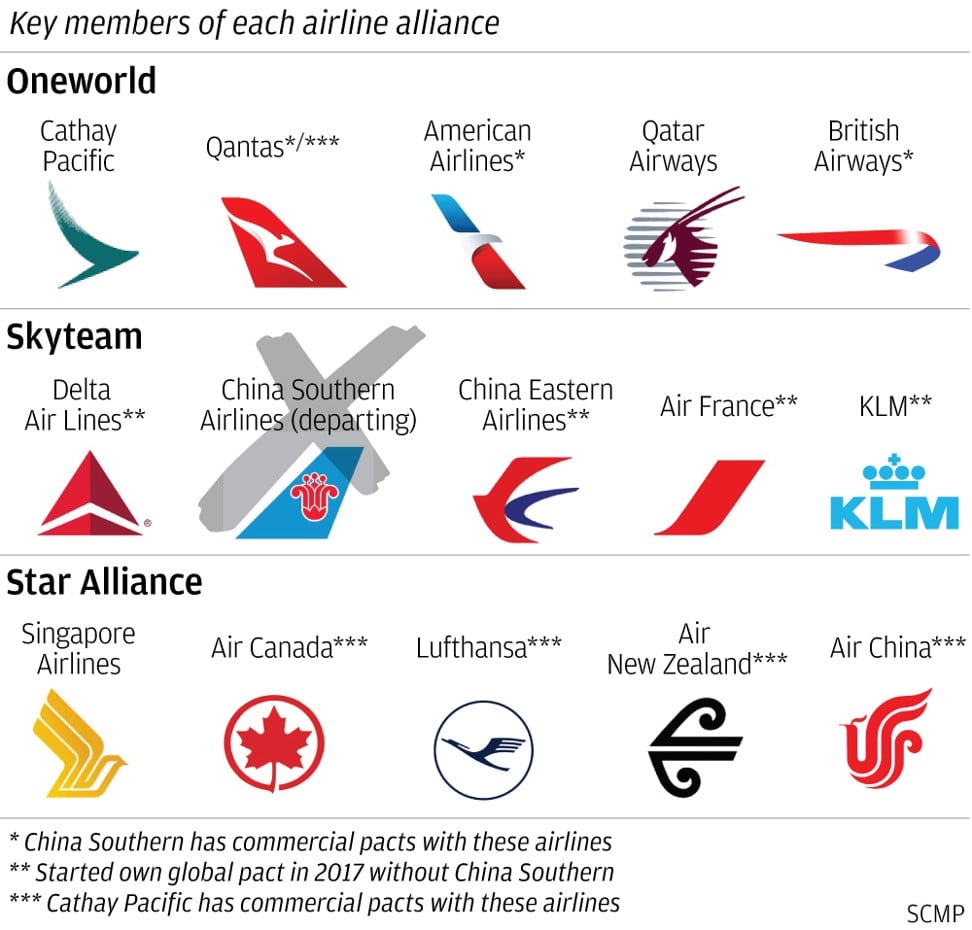

Major airlines are in one of three global airline clubs – Skyteam, Star Alliance and Oneworld, of which Cathay Pacific is a key member. Airlines’ frequent flier members can use points collected with one carrier across its alliance, and benefit from a wider variety of destinations on one booking. Code-share arrangements between the allies are common.

Junhao Kuang, editor of Guangzhou-based research group FATIII Aviation, said that – given each airline’s respective strengths – the pair were not really rivals at all, and both had more to offer each other, were they to cooperate.

“I don’t think China Southern wants to compete in the premium market with Cathay, Singapore Airlines and Qatar Airways,” Kuang said, adding that China Southern, while huge, did not focus on lucrative business travellers as Cathay did.

An example of cooperation between the two would be code-sharing stopover flights which marry a long Cathay Pacific flight with a shorter China Southern flight into mainland China, to open up more Chinese destinations to people in places like Europe and North America.

Dr Law Cheung-kwok, a Chinese University aviation policy expert, said both carriers recognised the pace of change in the region’s skies and Cathay Pacific would look to boost custom near its home city.

“From Cathay Pacific or Hong Kong airport’s point of view, they would like to expand this connectivity and catchment area in the region as much as possible,” he said.

A report by OAG, an aviation data consultancy, concluded the airports and airlines stood to win either way as the region prepared for an anticipated surge in outbound Chinese tourism.

“Ultimately this [would be] a win-win for both airlines. Whilst the issue of respective alliance membership will always be interesting, the fundamentals of strong markets with significant growth potential hold good for both airports and their respective airlines,” Mayur Patel, OAG’s Japan and Asia-Pacific sales director, said.

A review of both airlines’ routes from their respective hubs showed them overlapping on 61 per cent of destinations, according to OAG. Most of Cathay’s destinations which were not served by China Southern were long-haul ones like Dublin, Frankfurt, Boston, Milan, Tel Aviv and Madrid. Most of the China Southern routes not served by Cathay were to mainland Chinese destinations.

The view of Cathay Pacific – which can veto new Oneworld entrants – was less clear. The carrier declined to comment.

Chinese University’s Leung concluded China Southern had the upper hand. “I don’t think it will be in any urgent need to make a deal with Cathay Pacific at all for any collaborative arrangement. Cathay is not in a good position to offer a viable deal,” he said.

Industry experts have said Cathay could leave Oneworld in response and move to a different alliance.

But OAG’s Patel rejected this. He said: “Simply put, the two airlines serve different markets today and whilst that may change over time it certainly doesn’t mean that Cathay Pacific have to make a knee-jerk decision to change alliances.”