Bitcoin falls below US$5,000 for first time since October 2017, as cryptocurrencies are crushed again

- Bitcoin slumped as much as 9 per cent, while other cryptocurrencies such as Ether and Litecoin suffered even bigger falls

Cryptocurrencies resumed their slump on Monday, with bitcoin falling below the US$5,000 mark for the first time since October 2017, in the wake of increased regulatory scrutiny of initial coin offerings and the split of one of the largest tokens.

Bitcoin declined as much as 9 per cent to US$4,958, while so-called alternative coins slumped even more, with Ether tumbling as much as 12 per cent and Litecoin cratering as much as 13 per cent. XRP, the token associated with Ripple, was the lone gainer among major digital currencies. The Bloomberg Galaxy Crypto Index fell as much as 8.3 per cent to a one year-low on a closing basis.

Bitcoin cash split is tearing the crypto world apart

Bitcoin rebounded slightly to trade at US$5,035 at 1730 GMT.

Bitcoin opened trading at US$6,326, on a day that saw its market capitalisation fall to less than $100 billion for the first time in over a year.

“The sell-off is related to enforcement, which is almost certainly underway,” said Justin Litchfield, chief technology officer at ProChain Capital. “Projects are being made to return investor money, which, after having spent a tonne of money marketing their US$100 million ICO on a lavish party-filled roadshow that was the norm for this vintage of ICOs, will be tough.”

The sell-off is related to enforcement, which is almost certainly underway

The SEC announced its first civil penalties against two cryptocurrency companies that didn’t register their initial coin offerings as securities. Airfox and Paragon Coin Inc will each have to pay US$250,000 in penalties to compensate investors, and will also have to register their digital tokens as securities, the agency said in a news release on Friday.

The issuers were asked by the US Securities & Exchange Commission to provide refunds to investors, raising concern that other companies that used the proceeds from sales to finance projects could be forced to do the same.

Cryptocurrency miner Canaan lets Hong Kong IPO application lapse

Volatility has returned to cryptocurrencies, with the largest tokens shedding billions in market value since the hard fork of bitcoin Cash debuted last week. That came as two software-development factions failed to agree on a way to upgrade the offshoot of the original bitcoin, leading to a computing power arms race.

The cryptocurrency industry has now lost more than US$660 billion in value from a January peak, according to data from CoinMarketCap.com. Bitcoin is down more than 70 per cent from its December 2017 high, the data shows.

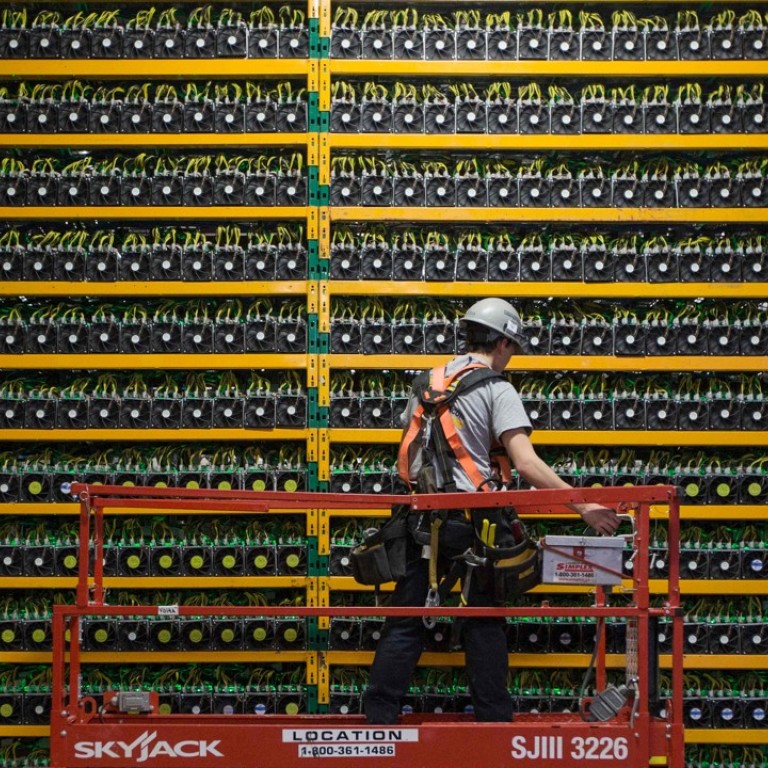

Thomas J. Lee, managing partner at Fundstrat Global Advisors and a long-time crypto bull, slashed his year-end price target for bitcoin to US$15,000 from US$25,000. The target is based on a fair value multiple of 2.2 times the break-even cost of mining, which the firm pegs at US$7,000, according to a report last week.

“Crypto-specific events have led to greater uncertainty in the crypto market, including the contentious hard fork for bitcoin Cash,” Lee said in the note Friday. Bitcoin’s break below US$6,000 “has led to a renewed wave of pessimism”, he said.

Bitcoin crashes below US$6,000 mark, as fellow cryptocurrencies join the slide

Bitcoin bulls may be able to take heart in some technical measures. Based on the GTI Global Strength Indicator, bitcoin is flashing oversold for the first time since August, and its most oversold level this year. In addition, it is testing its 23.6 per cent five-year look back Fibonacci level of US$4,727 as its next support.

Additional reporting by Agence France-Presse

.png?itok=arIb17P0)