Revealed: how Canada border agency tried to conceal Chinese immigration mega-fraud files from tax collectors

Tax and border chiefs have hailed their cooperation in the case of Xun ‘Sunny’ Wang – but a court ruling shows that auditors had to fight for access to files on his millionaire Chinese clients, that were seized by border agents in raids

Last year, Canadian tax collectors and border officers were hailing their cooperation on the biggest immigration fraud case in Canadian history – that of unlicensed consultant Xun “Sunny” Wang, who helped Chinese millionaires fabricate evidence needed to maintain residency and obtain citizenship in Canada.

“The CRA [Canada Revenue Agency] works closely with other law enforcement agencies and departments, including the CBSA [Canada Border Services Agency], to help maintain the integrity of the tax system,” said Elvis Dutra, Assistant Director of Criminal Investigations for the CRA, in a press release about the sentencing of Wang’s staff for their role in the scam. “Tax evasion costs all of us,” Dutra added.

Canada bans hundreds of rich Chinese, a scandal decades in the making

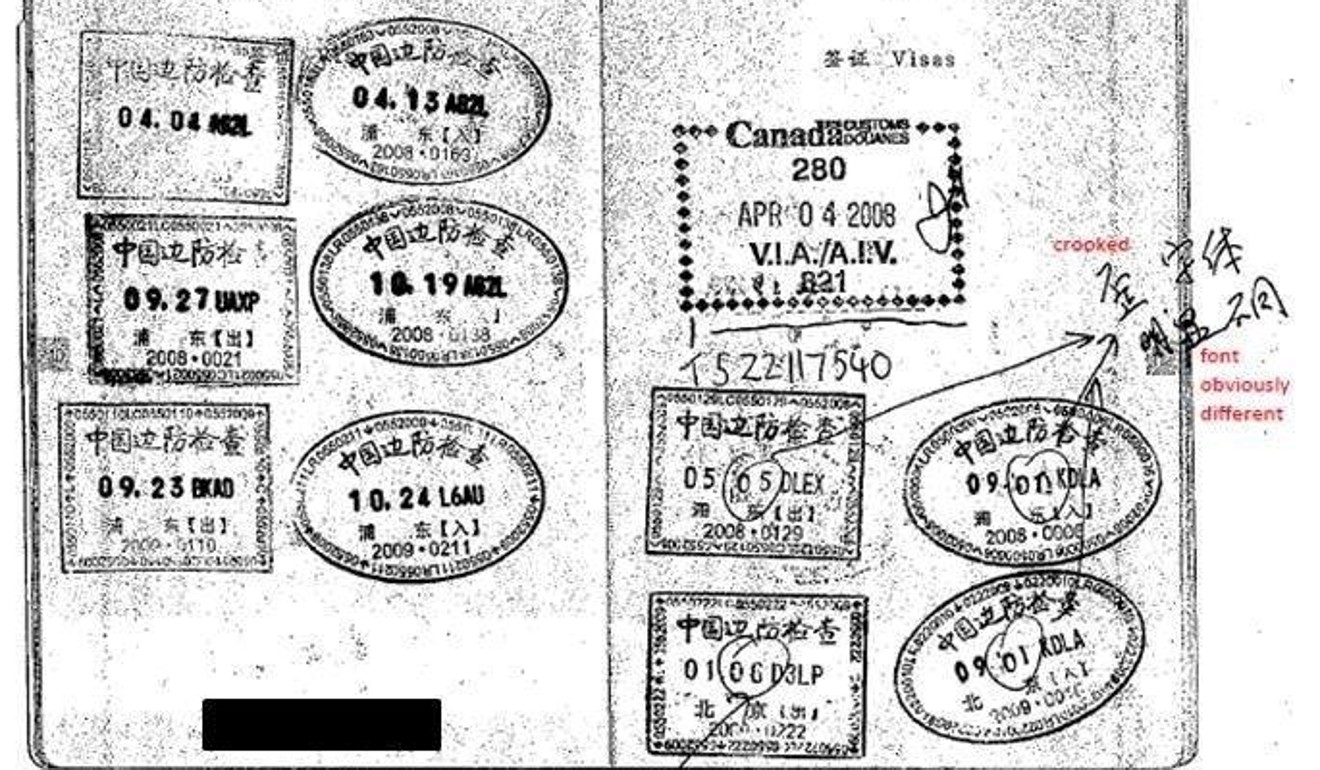

But in contrast to that depiction, a 2013 court ruling reveals how the CBSA resisted the CRA, and tried to conceal the vast haul of evidence about Wang and his wealthy clients, hundreds of whom have since been blacklisted from the country for fraudulent behaviour.

The failed effort to impede the tax collectors is described in a judgment by Associate Chief Justice Austin Cullen; listed as the applicant in pursuit of the files in the Supreme Court of British Columbia is the CRA, while the CBSA is listed as a respondent alongside Wang himself and his firm, New Can Consultants.

Cullen’s April 8, 2013, ruling describes the respondents attempting to withhold from the CRA 90 boxes of files and 18 computers that were seized from Wang by the CBSA in 2012 raids. The CRA’s demand for the material was an invasion of privacy, the respondents said, and the tax agents should be required to demonstrate probable grounds for suspicion of an offence – but not based on the contents of the actual documents being sought.

The respondents also offered an alternative argument – that handing over the files would amount to a breach of a sealing order imposed on “records pertaining to [the] search warrant”.

Cullen was dismissive.

“I conclude that the CRA is not obliged to demonstrate the existence of reasonable and probable grounds to be permitted to examine the materials seized by the CBSA pursuant to a valid warrant. Nor do I find that the provision of information from CBSA to CRA implicates a reasonable expectation of privacy on the part of the respondents in the circumstances.”

Case studies: the Chinese millionaires who Canadian immigration

Cullen also said the sealing order on the search warrant did not cover the actual material seized in the searches, which were conducted on Wang’s home and offices on April 17, 2012. “It is apparent from reading the sealing order that what it refers to is ‘the records’ comprising the basis for obtaining the search warrant and the search warrant itself, not the fruits of the search,” he said, as he ordered the CBSA and Wang to relinquish the files to the CRA within 14 days.

‘Protecting taxpayer information’

In response to questions lodged separately with the CRA and CBSA, the agencies issued a joint statement to the SCMP, saying that “the opposition of an action does not reflect on the level of cooperation between the two agencies.”

“Federal partners must exercise due diligence when exchanging information with each other, and ensure they do so in accordance with the legislation and policies in place,” the response said. “At times, requests for information exchanges will not be covered by these policies and as such, could be subject to specific rules or require that requests be made to the courts to support transparency and to protect taxpayer information.”

Who is Lil Tay? Behind the illusion of the foul-mouthed nine-year-old Asian rapper

It added: “In cases in which another Government Department or entity are seeking access to evidence seized through a warrant execution it must apply for a court order to obtain copies.”

In a response to a follow-up question, the CRA refused to describe what actions it was taking against Wang’s clients, saying “the CRA does not comment on other compliance actions related to this case that it may or may not be undertaking”.

However, a large number of possible tax offences are outlined in court cases and immigration hearings resulting from the demise of Wang’s scam (Wang was sentenced to seven years’ jail in 2015 but was freed late last year after serving a third of his time).

“In fact, 146 [of Wang’s] clients received a total of almost C$188,000 in Working Income Tax Benefits meant for working taxpayers with low incomes,” wrote immigration tribunal panellist Susy Kim in a November 2017 ruling, that imposed an exclusion order against Wang’s client Rui Zhang, husband Zhe Li and their minor son.

Other cases involving Wang’s clients feature immigration tribunalists loudly flagging a core problem – the clients’ failure to properly declare worldwide income.

One such client was Ying Wang, who was deemed “vague and evasive” about her millionaire husband Pi Long Sun’s business activities and earnings in China.

Sun’s “nominal income tax returns in Canada” did not represent his global income” and “he was evasive about his actual income,” wrote tribunalist Craig Costantino in a 2017 ruling that the couple be excluded from Canada for five years. “On a balance of probabilities, Mr Sun was not reporting his worldwide income to the Canada Revenue Agency,” Costantino added.

Another Wang client – whose exclusion order was overturned last year, and who the SCMP has therefore decided not to name – lived in a C$10million Vancouver mansion, on which he was paying a C$2 million mortgage on his son’s behalf. But he too was deemed to have filed “only nominal” tax returns in Canada.

“[These] I find do not represent his global income. I find that he was evasive about his actual income,” wrote the tribunalist. “I find that it is clear that his business activities in China generate significant income as nothing he or his family have done in Canada can account for the value of their properties in Canada, let alone the C$6 million worth of assets that the appellant stated he currently holds in China.”

Current and former CRA auditors have previously complained to the SCMP about a historical lack of cooperation from immigration officials. CBSA was carved off from the immigration department and other agencies in 2003.

In 2016, one former veteran auditor, who acted as a go-between for the SCMP and a current auditor, said “there was/is no cooperation between CRA and Citizenship and Immigration Canada [the former name of Immigration and Refugees Canada] that we are aware of.

“If there is, then a memorandum of understanding would have to exist. There may in fact be one – but no one I talked to knows of it,” the ex-auditor said. “And even if there is then you have to go through an intergovernmental affairs officer to get anything – red tape and time. There is no bulk data that we ever knew of, no database easily accessible by an auditor.”

Both the current and former auditor requested anonymity to discuss CRA matters without authorisation.

This month, the SCMP reported that 860 of Wang’s clients had already either lost immigration status – resulting in expulsion and five-year bans from entering the country – or been reported for inadmissibility. The CBC has separately reported that more than 200 others face the potential loss of their Canadian citizenship.

*

The Hongcouver blog is devoted to the hybrid culture of its namesake cities: Hong Kong and Vancouver. All story ideas and comments are welcome. Connect with me by email [email protected] or on Twitter, @ianjamesyoung70.