Sigh of relief as second plot on Hong Kong’s Kai Tak runway fetches more than first

- The higher price reflects the new site’s superior views, not a recovery in land prices, says senior analyst

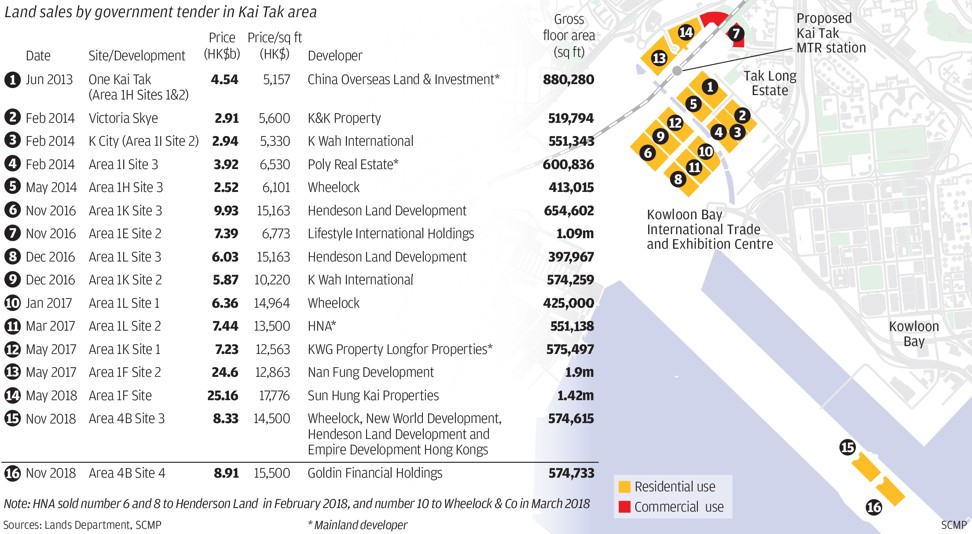

- Goldin Financial won the tender for the second residential site on the runway of Kai Tak airport for HK$8.9 billion (US$1.14 billion)

Hong Kong property observers breathed a sigh of relief on Wednesday when a piece of prime waterfront land at the city’s former airport fetched a higher price than a neighbouring plot a week earlier because of its superior sea views.

Goldin Financial Holdings won the tender for the second residential site on the runway of Kai Tak airport for HK$8.9 billion (US$1.14 billion), or HK$15,497 per square foot, the Lands Department said on Wednesday.

The price tag for the plot, known as Kai Tak Area 4B Site 4, is 6.9 per cent higher than the HK$14,500 per square foot paid at the last tender on November 7.

Many market watchers had expected the price to fall, or at best stay the same, as Hong Kong’s housing market enters a downturn, with demand dampened by a cluster of factors including rising interest rates and the US-China trade war. But the higher price per square foot reflected the new plot’s superior location rather than a recovery in the market, a senior property analyst said.

The first residential site on the runway, located adjacent to the second one and known as Kai Tak Area 4B Site 3, was won last week by a consortium comprising Wheelock Properties, New World Development, Henderson Land Development and Empire Development Hong Kong for HK$8.33 billion.

Wednesday’s tender for a 104,497 square-foot parcel of land was towards the higher end of market valuations of HK$8.3 billion to HK$9.2 billion.

“The fact the latest site sold for a higher price based on a per square foot does not mean a rebound in land value. It just reflects the fact this site captures a better sea view than the last one,” said Thomas Lam, executive director at Knight Frank.

He expects land values will decline a further 5 to 10 per cent in the next 12 months.

The winning bid has beaten six local property giants including CK Asset Holdings, K&K Property Holdings, Sun Hung Kai Properties (SHKP), China Overseas Land & Investment and a joint venture between Sino Land and K Wah International.

Forbes magazine estimates that Pan, who owns China’s biggest polo club in Tianjin, has a net worth of US$5.1 billion. He is building China’s tallest building, Goldin Finance 117, the centrepiece of his multibillion-dollar Goldin Metropolitan development in Tianjin.

The company said the tender price was “reasonable” It expects to invest about HK$14 billion in the project.

“The Kai Tak plot is an exclusive and prime piece of waterfront land. We participated in the tender of the last runway plot too and the plot this time has an even better view and location,” said a spokesman for Goldin Financial.

Analysts remain bearish on Hong Kong home prices.

“The city’s housing prices will drop 15 per cent by the end of 2019,” said Joseph Tsang, executive director of JLL. That could worsen to 25 per cent if the US-China trade war deteriorates and the stock market continues to dive, he said.

“Hong Kong’s almost 10 year housing market bull run looks like it is coming to an end.

“All of Hong Kong’s property sectors have become reliant on demand from the mainland to underpin growth in recent years,” said Tsang.

He added that the US-China trade war and slowing mainland economy would weigh heavily on Hong Kong’s economy and property market.

The prices of mass residential properties have tripled since the global financial crisis in 2009 and are now 63 per cent higher than their 1997 market peak. But growing uncertainty around the city’s economic outlook has seen prices drop 1.5 per cent over the last two months.

JLL also noted that China’s efforts to reduce debt levels in the economy is harming business confidence in the private sector and had contributed to a slump of more than 20 per cent in the Hang Seng Index since January.