Exclusive | Bitmain seen posting Q2 loss in Hong Kong IPO filing as cryptocurrency slump erodes mining rig demand

The world's biggest bitcoin miner probably racked up a US$395 million loss in the April-to-June quarter, based on calculations made by the South China Morning Post comparing the first and second-quarter numbers of the Chinese company

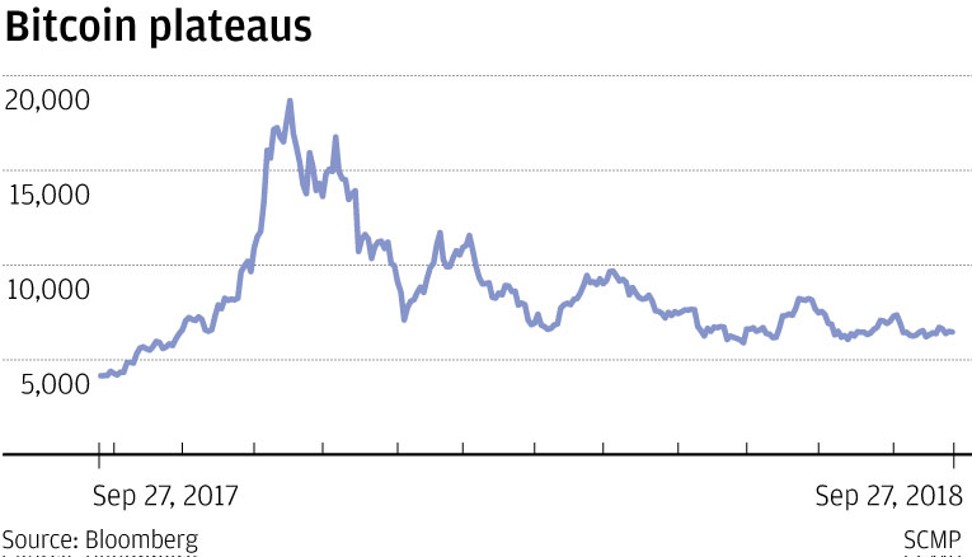

The 70 per cent crash in bitcoin prices from its peak in December last year has affected demand for the specialist equipment used to produce new digital currencies.

That is showing up in the accounts of Bitmain Technologies, the world’s biggest supplier of so-called cryptocurrency mining rigs. The Beijing-based company, founded by Wu Jihan and Micree Zhan Ketuan, is going for a highly anticipated initial public offering in Hong Kong, having filed its pre-IPO prospectus late on Wednesday with the stock exchange.

Bitmain probably racked up a loss in the April-to-June quarter, based on calculations made by the South China Morning Post comparing the first and second-quarter numbers of the Chinese company.

In the first three months of this year, Bitmain made a US$1.1 billion profit, according to a person with direct knowledge of the matter. Its reported first-half profit of US$742.7 million suggested that the company had a US$395 million loss in the three months ended June, a calculation that the person familiar agreed with.

A spokesman for Bitmain declined to comment when asked to confirm the estimated second-quarter loss.

Bitcoin and other cryptocurrencies have ridden a wave of speculation to reach a peak of US$829 billion in total value on January 7, only to shed more than US$600 billion in the past eight months, according to data from CoinMarketCap. That has shaken the confidence of many retail investors, although institutional investors such as asset management giant BlackRock remain bullish.

Chinese companies like Bitmain, Canaan Creative and Ebang International Holdings depend on widespread adoption and rising value of cryptocurrencies to sustain demand for their mining equipment. These rigs are designed to solve complex maths problems to verify transactions in return for new digital assets, such as bitcoin and ethereum.

“Bitmain’s loss in the second quarter exposed lots of problems,” said Katt Gu, an adviser for cryptocurrency market research firm Strategic Coin. “The most obvious one is that its revenues are vulnerable to the rise and fall of the cryptocurrency market.”

Bitmain had anticipated a bull run in cryptocurrency mining rigs, so it placed a large order with production partners early this year, according to its regulatory filing in Hong Kong.

“However, there had been significant market volatility in the market price of cryptocurrencies in the first half of 2018,” the company said. “As a result of such volatility, the expected economic return from cryptocurrency mining had been adversely affected and the sales of our mining hardware slowed down.”

The filing showed a US$391 million inventory writedown by Bitmain in the first half of this year, which was about three times larger than its total writedown in 2017.

The company reported selling 2.5 million sets of cryptocurrency mining gear in the first half, about 1.6 times more than what it sold in 2017. The average selling price, however, declined to US$992 from US$1,333 last year.

Founded in 2013, Bitmain accounted for a 75 per cent share of the global market for cryptocurrency mining machines last year, according to data from Frost & Sullivan cited in the firm’s regulatory filing in Hong Kong.

The company also operates the world’s two biggest bitcoin mining pools, AntPool and BTC.com, which collectively account for about 37 per cent of all the processing power on the bitcoin network. Miners combine their computing resources together in these pools to increase the odds of receiving new cryptocurrency as reward.

Bitmain operates 11 mining farms in China, located in the southwestern provinces of Sichuan and Guizhou, as well as Inner Mongolia in the north. These have a combined capacity of about 200,000 cryptocurrency mining machines.

Overseas, Bitmain has three mining farms under construction in the US. It also plans to build facilities in Canada’s Quebec province to tap into the area’s cheap hydropower.

It reported a total customer base of 80,000, with 52 per cent of its total sales generated from outside China last year.

“One quarter of losses should not be a significant concern to long-term investors, especially in a volatile business like cryptocurrency mining,” the research unit of cryptocurrency exchange BitMex said in an online post on Thursday.

But with cryptocurrency mining machine prices remaining low, the BitMex research unit said it expected the third quarter to remain a loss-making period for Bitmain. “Moving back in the black may be challenging,” it said. “Bitmain may need to raise prices to return to profitability.”