Cryptocurrency entrepreneurs now among China’s richest, despite bear market

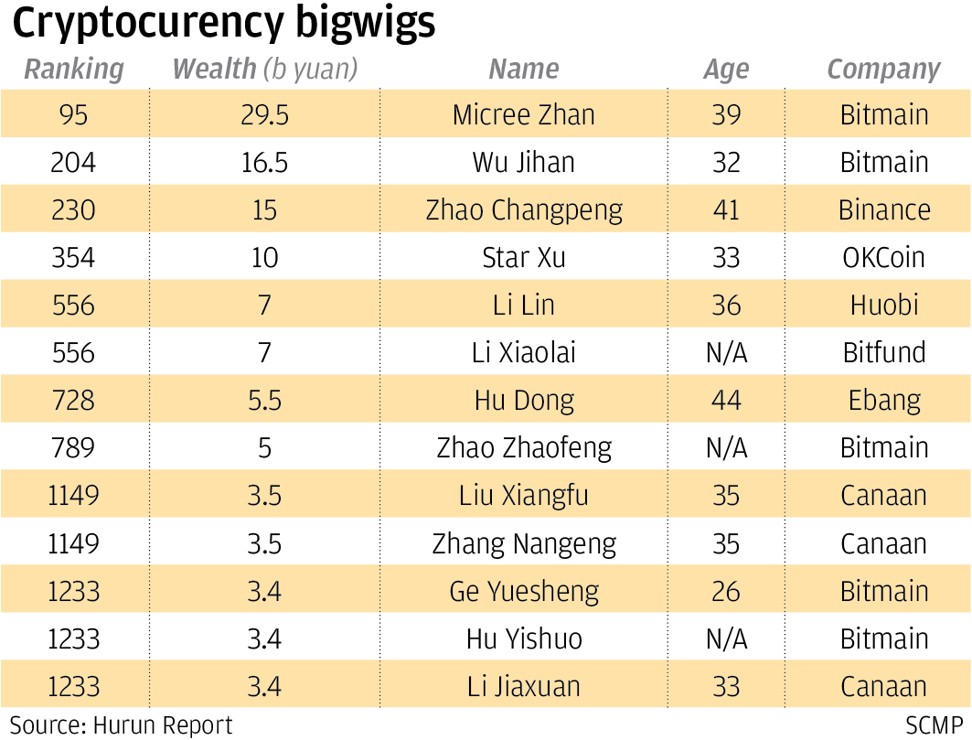

At least 13 cryptocurrency bigwigs, with businesses that range from bitcoin mining and virtual currency trading to venture capital funding, made their debut in the latest ranking of China’s wealthiest people

Cryptocurrency bigwigs made it to the list of China’s wealthiest people for the first time, despite the crash in digital currency prices and the government’s crackdown on trading of these assets.

At least 13 cryptocurrency entrepreneurs, with businesses that range from bitcoin mining and virtual currency trading to venture capital funding, are now among the wealthiest individuals in the country, according to the latest ranking compiled in the annual Hurun Report. Those in the list have a personal net worth of at least 2 billion yuan (US$289 million).

Micree Zhan Ketuan, the 39-year-old co-founder of Bitmain Technologies, was the only one among his industry peers to rank in the report’s top 100 richest people in China, with an estimated wealth of 29.5 billion yuan.

Bitmain co-founder Wu Jihan, 32, was the next highest-ranked cryptocurrency tycoon in 204th place, with a personal wealth of 16.5 billion yuan.

Beijing-based Bitmain, the world’s biggest supplier of so-called cryptocurrency mining rigs, along with rivals Canaan Creative and Ebang International Holdings have each applied to go public in Hong Kong, which would put their secretive bosses under public scrutiny for the first time.

A total of nine individuals from the three companies made it to the Hurun list, including Canaan founder Zhang Nangeng and Ebang founder Hu Dong.

The leaders of the world’s top cryptocurrency exchanges were also featured in the list. Zhao Changpeng, 41, founder of Binance, the world’s biggest digital currency exchange by trading volume, was the third highest ranked industry mogul at 230th place, with an estimated wealth of 15 billion yuan.

He was followed by fellow Chinese exchange founders Star Xu of OKCoin and Li Lin of Huobi.

English teacher-turned venture capitalist Li Xiaolai, who is often described as China’s richest bitcoin billionaire, was listed with an estimated wealth of 7 billion yuan at 556th place in the Hurun report.

Li, the founder of Beijing-headquartered venture capital firm BitFund, recently announced on social media that he will no longer invest in any blockchain-related projects, without specifying a reason.

The growing affluence of China’s cryptocurrency entrepreneurs has withstood the volatility in cryptocurrency prices this year.

Bitcoin and other cryptocurrencies have ridden a wave of speculation to reach a peak of US$829 billion in total value on January 7, only to shed more than US$600 billion in the past eight months, according to data from CoinMarketCap. That has shaken the confidence of many retail investors, although institutional investors such as asset management giant BlackRock remain bullish.

While China is ratcheting up its efforts to adopt blockchain, the underlying technology behind cryptocurrencies, the government has made clear that it does not want everyday investors to participate in trading involving the digital assets, amid concerns of financial instability.

Following Beijing’s crackdown on cryptocurrency trading in September last year, many Chinese cryptocurrency exchange operators and blockchain projects have migrated their operations overseas by establishing regional offices in friendlier jurisdictions like Singapore. Neither Binance, Huobi nor OKCoin serves customers based in mainland China.

Increased regulation of the cryptocurrency industry also looms. While Binance and its peers have been operating with little to no oversight to date, regulators around the world are gearing up to introduce some order to digital-asset trading platforms amid growing concern over computer hacking, market manipulation and money laundering among other things.