Apple warns on holiday sales, sending value below US$1 trillion

- Apple’s business in China grew 16 per cent to US$11.4 billion, the fifth quarter in a row the company has had double-digit growth in the market

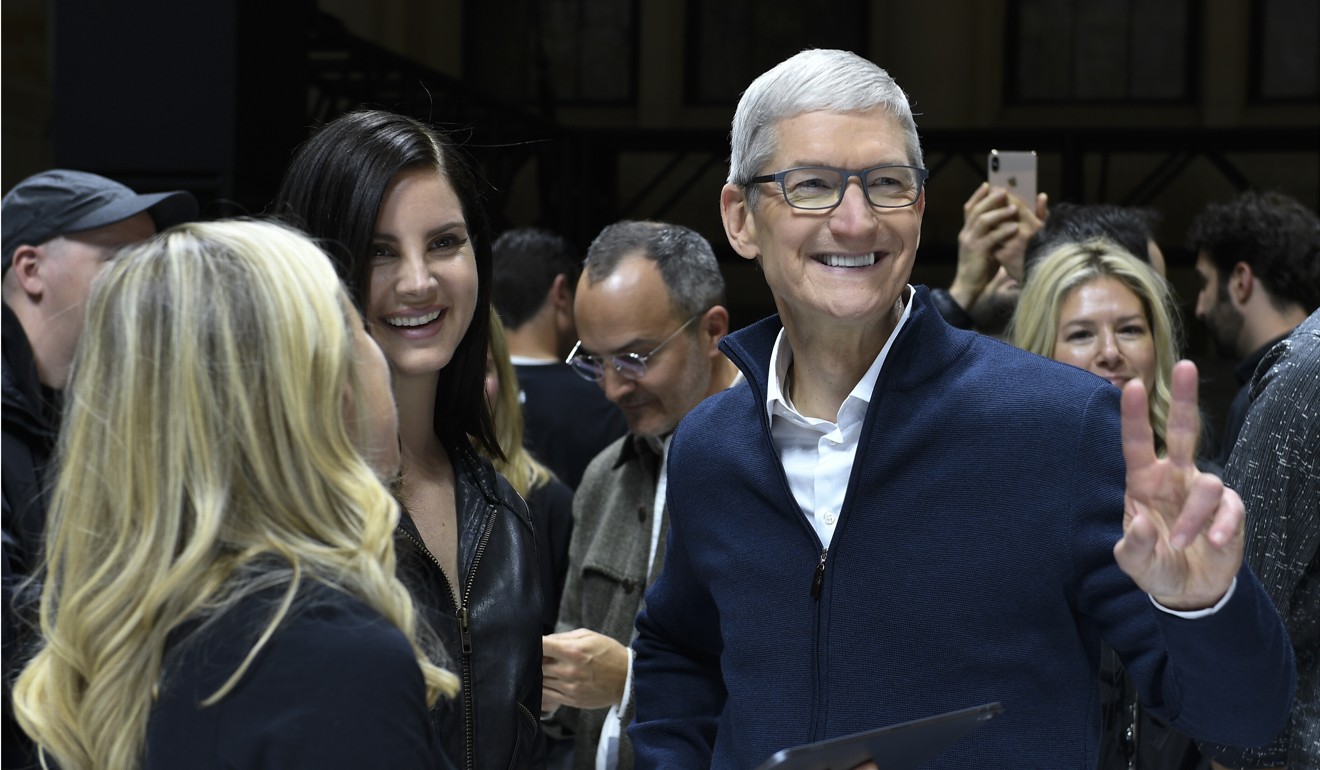

Apple on Thursday said sales for the crucial holiday quarter could miss Wall Street expectations, which chief executive Tim Cook blamed on weakness in emerging markets, foreign exchange costs and uncertainty whether the iPhone maker can keep up with demand for new products.

The disappointing forecast by the world’s most valuable technology company helped send shares down as much as 7 per cent, taking roughly US$70 billion off Apple’s market value and forcing that value below US$1 trillion. The forecast could also deepen concerns for technology companies that saw a sell-off after misses by Amazon.com and Google parent Alphabet.

Apple said it expects between US$89 billion and US$93 billion in revenue for its fiscal first quarter ending in December, while Wall Street on average expects US$93 billion, according to IBES data from Refinitiv.

Cook in an interview with Reuters said that Apple is “seeing some macroeconomic weakness in some of the emerging markets”. He later told investors on a conference call that weak markets included Brazil, India, Russia and Turkey. Sales were flat in the fourth quarter in India, Cook said.

“Obviously, we would like to see that be a huge growth,” Cook said on the call.

Executives said they also would quit giving the number of iPhones, iPads and Mac computers, leading to a further drop in the share price, since iPhone unit sales was long the key indicator of quarterly success.

Withholding that number will make it impossible to calculate the average selling price of phones, another key measure.

Apple executives said unit sales are becoming less relevant as customers buy bundled products that include subscription services like Apple Music.

Apple said it would start giving cost-of-sales data for its services business, an important metric for subscription businesses. But investors reacted negatively.

“Companies typically stop reporting metrics when the metrics are about to turn. This is not a good look for Apple,” said analyst Walter Piecyk from BTIG Research.

Apple sold 46.9 million iPhones in the fiscal fourth quarter, missing analyst expectations of 47.5 million iPhones, according to FactSet. But the average selling price of iPhones was US$793, well above analyst estimates of US$750.78, according to FactSet.

“Our worry is there must be a limit to Apple’s pricing power,” said George Salmon, an analyst at Hargreaves Lansdown. “The group is now charging close to US$800 per phone, and while that’s helping revenues climb despite flat sales volumes, one has to wonder how the strategy to shimmy up the price ladder fares in a downturn. If consumers start feeling the pinch, those price tags could put the punters off.”

In an interview with Reuters, Cook said some of the forecast was explained by Apple releasing its top-end iPhone models, the XS and XS Max, in the fiscal fourth quarter. Cook also said foreign exchange rates would have a US$2 billion negative impact on Apple’s sales forecast.

Apple was unsure whether it can make enough new iPhones, Apple Watches, iPads and Mac models it released in recent weeks, Cook told Reuters. Apple is widely expanding the use of its facial recognition unlocking system in iPhones and iPads, which uses special lasers that are produced by only a handful of suppliers.

Elazar Advisors analyst Chaim Siegel said that China trade issues could be making it difficult for Apple to get the supplies it needs. “As for emerging markets slowing, that’s also contagion from China. Both trade war issues coming to reality,” Siegel said.

But Cook stressed that Apple was happy with its performance in China, where revenue grew 16 per cent to US$11.4 billion – the fifth quarter in a row the company has had double-digit growth in the market.

Apple’s cautious forecast could accelerate investor fears that have in turn erased stock market gains for much of the year. At market close on Thursday, Apple shares were up more than 25 per cent for the year – supported by purchases by Warren Buffett and a US$100 billion share buy-back programme – while the Nasdaq Composite Index is nearly flat for the year.

Apple said revenue from services, which includes iCloud, the App Store and Apple Music, reached US$10 billion, in line with analyst estimates. Apple investors have been increasingly focused on growth in the company’s services business as growth in the global market for smartphones levels off in terms of unit sales.

Apple forecast a tax rate of 16.5 per cent for the December quarter, above analyst expectations of 15.9 per cent, according to data from Refinitiv.

“There’s going to be a minimum tax on foreign earnings coming from the new tax legislation” passed in the United States, Apple chief financial officer Luca Maestri told Reuters.

For its full fiscal 2018 ended in September, Apple reported revenue of US$265.6 billion and profits of US$11.91 per share, beating analyst estimates of US$264 billion and US$11.79 per share.