Why Facebook and Google’s China dream will cost more than it pays

Even if the tech giants succeed in gaining a toehold in the China market they will start at a disadvantage to local competitors, face labyrinthine regulation and leave themselves open to interference from Beijing

The old dream still burns. In the 19th century, British textile merchants used to fantasise about the vast fortunes they would make if only they could “add an inch of material to every Chinaman’s shirt tail”.

Ask Google? How to win in China … without being evil

They may succeed one day in establishing a toehold, but they will pay a heavy price to do so. And they are highly unlikely ever to make the great fortunes from China that they have long dreamt about.

Since then, the market has changed beyond all recognition. Today China boasts some 770 million internet users – more than the populations of western Europe and the United States combined – and Google and others want a slice of the pie.

This month it emerged that Google is developing a search engine app for smartphones that will comply with China’s strict censorship rules. Meanwhile Facebook has been attempting to set up a subsidiary in China.

With their “platform company” business model, in which additional scale offers vast network benefits at zero marginal cost, they hope to replicate in China the successes they have scored in international markets.

It will be tough. One of the reasons Beijing has kept the US internet giants out of China for so long has been to allow home-grown companies to establish near-unassailable positions in the domestic market. For example, while Google commands close to 90 per cent of the search market in the US and Europe, in Google’s absence, Baidu has captured three-quarters of all searches behind China’s great firewall.

What’s more, Beijing has an impressive array of regulatory instruments it can apply to ensure Chinese companies retain dominant positions in their own domestic market. For example, the authorities fully recognise the economic value of big data, and to make sure foreign players capture as little of that value as possible, all data generated in China must be managed inside the country, and only by Chinese-owned and operated companies.

On top of that, technology companies are subject to multiple layers of labyrinthine national security regulations, the almost total opacity of which, say critics, allows the authorities all the room they could possibly want to apply them for commercial rather than security purposes.

If a company is prepared to compromise its much-vaunted principles to operate inside China, it is no great stretch to imagine it might be prepared to make concessions on its international operations to further its ambitions for its new Chinese business.

Facebook is bent on friending China, but …

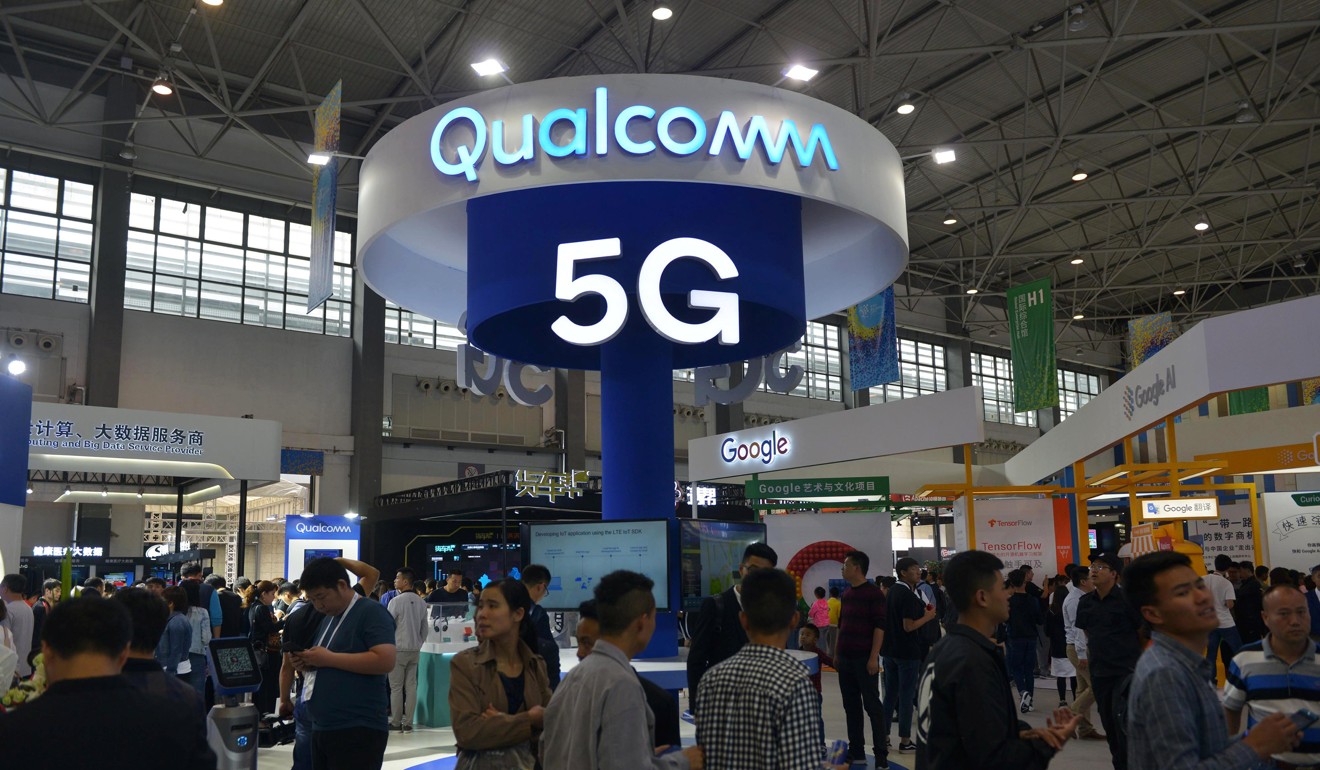

Consider the case of Qualcomm. In October 2016, the US chip maker announced its intention to merge with Dutch semiconductor company NXP. The US and European competition regulators both approved the deal. But because Chinese factories are major customers of each company, authorities in Beijing also got their say.

As recently as March, the Chinese Ministry of Commerce was signalling that it would approve the merger. Much of the rationale for the deal was to strengthen the merged company’s ability to develop chips for fifth generation “5G” mobile technology, an area where Chinese equipment-makers have major international ambitions. As a result, the deal was judged to be favourable to Chinese interests.

But as the US administration ramped up its economic cold war, proposing punitive measures aimed at Beijing’s mercantilist tech sector policies, China’s leaders revised their opinion.

As for the Chinese government attempting to exert influence over international search engines and social media news feeds, the prospect can surely surprise no one. Revelations over recent months have exposed the scale of Beijing’s efforts to silence critics around the world, and even to manipulate elections – most notoriously in Australia. After that, no one can doubt that the Chinese government would leap at the chance to influence international search engine results.

So at some point in the near future, international internet giants may well find themselves granted limited access to China’s domestic market. Rather than rushing in, they should consider carefully the price of admission they may be called on to pay. Rather than adding an inch to Chinese shirt tails, in ethical terms, they might end up losing their shirts. ■

Tom Holland is a former SCMP staffer who has been writing about Asian affairs for more than 20 years